Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,571.1 Million |

| 2030 Forecast | USD 3,393.4 Million |

| Growth Rate(CAGR) | 4.7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 11564

Get a Comprehensive Overview of the Interventional Radiology Market Report Prepared by P&S Intelligence, Segmented by Product (MRI Systems, CT Systems, Ultrasound Systems, Angiography Systems), Procedure (Angioplasty, Biopsy and Drainage, Embolization, Catheter-Directed Thrombolysis, Vertebroplasty, Nephrostomy), Application (Cardiology, Oncology, Urology and Nephrology, Gastroenterology, Obstetrics and Gynecology), End User (Hospitals, Ambulatory Surgical Centers), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 2,571.1 Million |

| 2030 Forecast | USD 3,393.4 Million |

| Growth Rate(CAGR) | 4.7% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

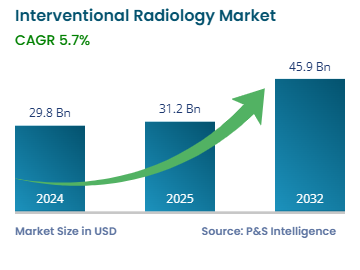

The interventional radiology market revenue is estimated to have stood at USD 2,571.1 million in 2024, advancing at a CAGR of 4.7% during 2024–2030, to reach USD 3,393.4 million by 2030. This is due to the escalating geriatric patients/population, growing incidence of chronic disorders/illnesses, surging awareness of less invasive alternatives, and increasing adoption of new scientific methods.

For instance, according to the WHO, the population over 60 years of age will nearly double from 12% to 22% between 2015 and 2050. The geriatric population is at a greater risk of developing diseases, due to weakened immune systems, which, in turn, require regular health checkups and follow-ups. Thus, with the increase in population rate, the radiology requirements will rise.

Additionally, the unhealthy quality of life gives rise to the initiation of acute disease conditions, which require immediate assistance, which, in turn, the demand for imaging diagnostics increases. Scanning techniques like the MRI system, CT system, ultrasound system, angiography, and others are used for the detection of abnormalities.

Another factor driving the demand for interventional radiology is the expanding popularity of minimally invasive treatments like ultrasound-guided procedures, X-ray vision, and early diagnosis. According to National Cancer Institute (NCI), with the advancements in cancer detection and diagnosis via radiology, there has been decreased death rate due to cancer and the number of cancer survivors increased from 7 million in 1992 to more than 15 million in 2016, which is further assumed to grow to beyond 26 million by 2040, resulting in longer and healthier lives.

Increasing Prevalence of Chronic Diseases Drives the Demand

The cases of chronic diseases such as cancer and cardiovascular are increasing. This drives the need for cardiological procedures like transcatheter aortic valve replacement (TAVR), percutaneous coronary interventions (PCI), and transcatheter aortic valve implantations (TAVI), which, in turn, propel the demand for interventional radiology. Furthermore, with the surging public awareness about chronic illnesses, the importance of early detection and diagnosis of such diseases and the need for tumor ablation procedures due to the uprising incidence of cancer are rising. For instance, according to the WHO, in 2020, approximately 10 million deaths were caused due to cancer.

Based on product, the magnetic resonance imaging (MRI) category dominates the market and is projected to grow at a CAGR of 4.5% from 2024 and 2030. This is due to the advancements in technologies and the surging demand for MRI systems. Moreover, it captures an image by using a magnetic field and radiofrequency around a patient, resulting in clear and detailed images of soft tissues. The MRI machine is broadly divided into two types: closed-bore MRI and open MRI.

In addition, a CT scanning machine uses X-ray to produce images of internal organs of the body and has the ability to view slices in succession and rotate the 3D image in space, making it easier to find the exact locations of a problem. For example, iodine-based contrast is injected into the circulatory system and the blocked/obstructed blood vessel becomes visible, which helps in making diagnoses.

Based on the procedure segment, the angioplasty category dominates the market, owing to the increasing number of cardiovascular diseases. To guide procedures and treat vascular disorders, angiography is widely used, as it is a minimally invasive procedure. This procedure is also adopted by various hospitals and healthcare providers for cardiovascular and peripheral vascular imaging.

Another procedure is a biopsy, which is generally performed after an imagining scan, where tissue is extracted from the body and examined by a pathologist for the confirmation of the disease. The imagining scan can only show a mass/lump in the body but the biopsy can identify the kind of mass/lump shown on an imagining radiology. The two types of biopsy needles are fine needle aspiration (FNA)/fine needle biopsy and core needle biopsy (CNB). The former is a thin, hollow needle connected to a syringe that can withdraw a small piece of a tumor. The latter is slightly larger than FNA, and it collects a small core of the tissue and requires local anesthesia before a biopsy.

Based on application, diagnostic and interventional radiography is used in the healthcare sector like cardiology, oncology, urology and nephrology, gastroenterology, obstetrics and gynecology, and others. Under this segment, cardiology holds the largest share because of the large-scale usage of radiography equipment in this field. Cardiology uses CT coronary angiography (CTCA), coronary artery calcium scoring, and cardiac MRI, along with others.

In addition, due to the sedentary lifestyle, cardiovascular issues are emerging. In case of a blocked artery in the heart, an angiogram is performed followed by stent (stent + angioplasty) insertion. According to the assessment by the WHO, in 2019, 17.9 million people died from CVDs, representing 32% of all deaths worldwide. Among these deaths, heart attack and stroke accounted for the largest number of deaths, of around 85%.

Whereas, the oncology category is expected to grow at a CAGR of 4.5% during the forecast period, owing to the high usage of radiology in cancer treatment. The radiology techniques have fewer side effects and decreased discomfort than open surgeries, which have significant risks. To diagnose, stage, and treat cancer, 3D detection is carried out by CT, MRI, single-photon emission computed tomography (SPECT), and positron emission tomography (PET) techniques.

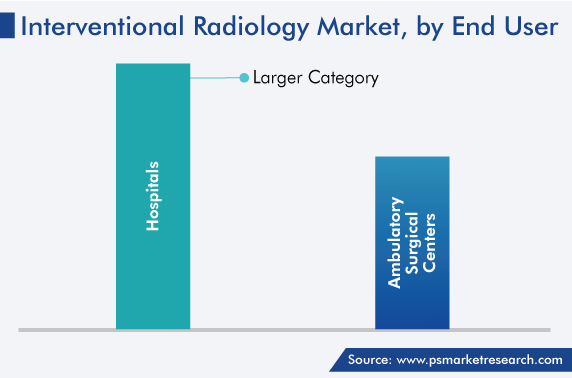

Based on end user, the hospitals category is dominating the interventional radiology market, due to the availability of expert healthcare professionals and a widespread patient count in these healthcare facilities. Also, with the increase in population and hence patients, the need for cancer screening and imagining increases, which results in increased diagnoses and treatments for patients. Thus, this factor helps the industry to expand.

Furthermore, hospitals attend a large influx of in-patients with coronary heart disease, atherosclerosis, and general surgeries than ambulatory surgical centers (ACSs), due to which they gather large funds that assist in installing advanced radiology instruments. Moreover, hospitals that are active in conducting R&D have great resources and utilization of instruments, which serve for the betterment of society, hence patients. They also help government and non-government units by promoting awareness about chronic diseases and their diagnosis through radiology.

Drive strategic growth with comprehensive market analysis

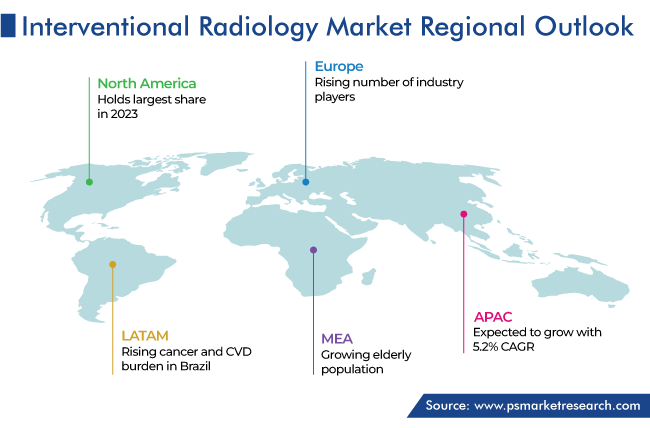

North America leads the global interventional radiology market. This is possible due to the increasing cases of chronic illnesses, the growing geriatric population, the availability of minimally invasive methods, the high disposable income of people, the well-established healthcare infrastructure, advancements in technologies, and the development of new products in the region. For instance, in March 2022, the United States Food and Drug Administration (USFDA) approved a Stellarex 0.035” OTW drug-coated angioplasty balloon by Philips Image Guided Therapy Corporation. The drug-coated balloon is used to re-open narrowed or blocked arteries in the knee and thigh, due to peripheral artery disease (PAD).

Moreover, according to the American College of Roentgenology, interventional radiology is a need for rural patients. Adequate care is not provided to rural patients without such services. Recruitment and retention of interventional radiologists is increasing for rural hospitals and radiology practices, the full magnitude of this is yet unclear.

Whereas, the APAC market is expected to witness the fastest growth in the coming years. This can be ascribed to the surging progression in healthcare infrastructure, the rising medical tourism sector, the growing geriatric population, and the dedication of medical professionals in terms of learning and upskilling themselves in the region. In addition, the most common interventional radiological procedure is cerebral angiography in China, followed by percutaneous transhepatic cholangiography, cerebral aneurysm interventions, percutaneous transluminal angioplasty, and transcatheter arterial chemoembolization. Additionally, developing countries, rural areas, and under-developed healthcare facilities provide immense opportunities to investors/players in the APAC interventional radiology sector.

Moreover, constant growth is expected in the European market during 2024–2030, due to the increasing requirement for radiological imaging technology, surging healthcare expenses, and rising number of industry players. Another reason for the market growth is the active involvement of regional governments along with emerging players to provide cost-operative advanced interventional procedures in Europe.

This fully customizable report gives a detailed analysis of the interventional radiology industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Product

Based on Procedure

Based on Application

Based on End User

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages