Industrial Hemp Market Future Prospects

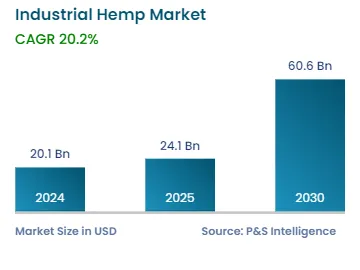

In 2024, the global industrial hemp market size is estimated at USD 20.1 billion, and it is projected to progress at a CAGR of 20.2% during 2024–2030, reaching USD 60.6 billion by 2030.

The major growth drivers for the market are the increase in the availability of raw materials with the legalization of hemp cultivation in more countries, surging demand for textiles, ropes, building materials, and other products made from hemp fibers, advancing cultivation technology leading to higher productivity and lower resource wastage, surging interest in hemp cultivation owing to its lower water requirement, and burgeoning usage of hemp oil and seeds in the food & beverage industry.

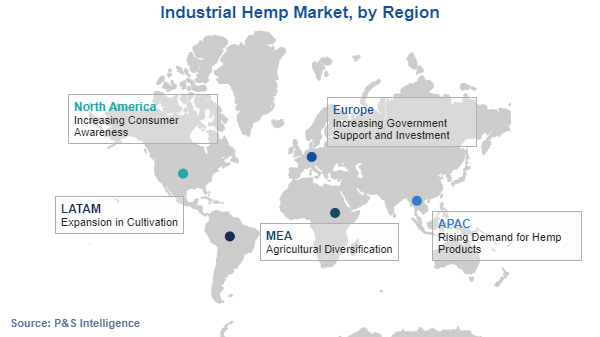

Globally, over 45 countries permit hemp cultivation, and there is an increasing bast fiber demand for the production of high-quality textiles. In the past, Canada concentrated on hemp cultivation for the production of seeds for the food and cosmetics industries. The country has recently begun to grow this crop for fibers, which will be used in bio-composites, insulation, and building materials. Furthermore, an increasing number of states in the U.S. are legalizing hemp farming, indicating that the country would experience a burgeoning hemp demand for its fibers and seeds.

Moreover, in terms of fiber hemp cultivation, China is the most-important country. For export to Europe and Northern America, the country produces both traditional long fibers and enzymatic cottonized hemp fibers.

Developed countries, such as the U.S., the U.K., and France, are seeking for ways to grow crops with a low environmental impact, such as cereals, which are produced in excess. Hemp is a potentially profitable crop, fitting into sustainable farming systems. Interest in "new" fiber crops is growing as a means of finding alternatives to high-input crops, such as cotton, or reducing the paper industry's impact on forests. It has prospective uses in the paper, textile, composite, biofuel, and food industries, as well as novel uses as renewable raw materials for seed oils and essential oils.

In Europe, the area allocated to hemp farming has increased by more than 70%, from roughly 20,000 hectares in 2015 to 35,000 hectares in 2019. Moreover, hemp production increased by roughly 65% during the same period, from around 95,000 tonnes to 155,000 tonnes. THC levels in hemp harvests have also been raised from 0.2% to 0.3%, allowing European farmers access to more than 500 hemp varieties.