Report Code: 12023 | Available Format: PDF

CBD Oil Market Size and Share Analysis by Source (Hemp, Marijuana), Sales (B2B, B2C), End-Use (Medical, Personal Use, Pharmaceutical, Wellness) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12023

- Available Format: PDF

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

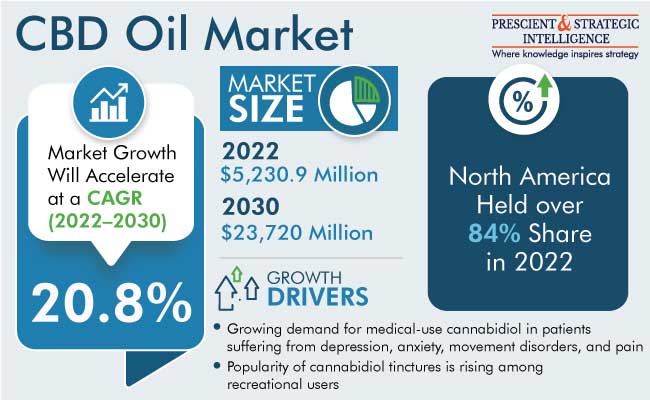

The global CBD oil market is estimated to generate $5,230.9 million in 2022, and it is expected to advance at a compound annual growth rate of 20.8% during 2022–2030, to reach $23,720 million by 2030.

CBD, also known as cannabidiol, is a chemical found in the Cannabis sativa plant and extracted from hemp or cannabis. Hemp is the preferred feedstock, as it has a high CBD content. Due to its therapeutic properties, the demand for CBD in the health and wellness sector is increasing. In addition, the rising usage of CBD-rich products due to the government approvals for medical, recreational, and research purposes is a major factor expected to boost their production.

Furthermore, according to the Alcohol and Drug Foundation (ADF), the cannabis plant produces between 80 and 100 cannabinoids such as delta-9-tetrahydrocannabinol (THC) and CBD; and nearly 300 non-cannabinoid chemicals. Each of them has a significant impact on the body.

Moreover, the demand for medical-use cannabidiol is growing among patients suffering from depression, anxiety, movement disorders, and pain. Moreover, the popularity of cannabidiol tinctures is rising among recreational users, whose number is expected to burgeon in the coming years.

Additionally, the promotion of cannabidiol-containing products by companies as having wellness advantages will drive the market expansion. Major skincare companies are using cannabidiol oil in products to treat pimples, crumples, and other conditions. Moreover, many countries governments and key players are widely investing in research and development activities. For instance, ItsHemp has developed Hemp Heros Full Spectrum CBD Capsules and Endoca Raw Hemp Oil Capsules.

Marijuana To Continue Being Preferred Source

The marijuana category is expected to grow at a CAGR of 22% and maintain its dominance throughout the projection period. The increasing adoption of purified CBD products and the growing legalization of marijuana and marijuana-derived products for several medical and research purposes are the key driving factors for the category. For instance, ancient Indian Ayurvedic practices utilized cannabis as an active ingredient in medicine, to improve digestion and blood pressure. Medical marijuana is a widely used drug for various purposes, and after its legalization, it has grabbed the attention of many growers, manufacturers, and researchers.

Hemp Is Expected To Witness Significant Growth

The hemp category is expected to witness steady growth during the forecast period. This growth is mainly ascribed to the mushrooming demand for hemp in the pharmaceutical industry and surging awareness among consumers of health and fitness, along with the increasing consumer income and legalization of cannabis. Moreover, industrial hemp seeds contain protein, calories, and other nutrients. People use it mainly for diet purposes, eczema, constipation, and other purposes. Many industries, such as personal care & cosmetics and food & beverages, are using these seeds to develop products for fitness, health, and wellness.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

$5,230.9 Million |

Revenue Forecast in 2030 |

$23,720 Million |

Growth Rate |

20.8% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Source; By End Use; By Sales; By Region |

Explore more about this report - Request free sample

B2B Holds Largest Share

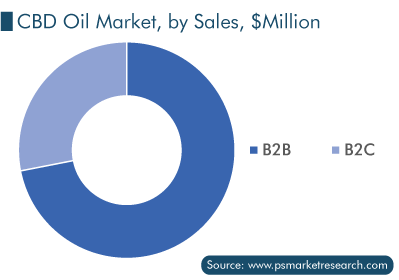

The business-to-business category dominated the market, with a revenue share of 52%, in 2022, and the situation is predicted to remain the same during the forecast period. This is due to the rising number of wholesalers, investors, and manufacturers of CBD oil products. The demand is also increasing because cannabidiol products need are growing in several sectors, such as food and additives, cosmetics sectors, and health and wellness, and the pharmaceuticals sector has increased the demand for businesses to procure cannabidiol raw material or precursor material for their item in bulk.

Moreover, two-thirds of the U.S. states have legalized such seeds for medical purposes, and others are considered doing the same. Moreover, many key players in the medical sector are directly working with big farmers for these products.

Pharmaceuticals Are Set To Hold Largest Market Share

The pharmaceuticals category is expected to dominate the market during the forecast period. Many pharmaceutical companies are performing trials to examine the effect of cannabidiol oil on certain health conditions and its pros and cons on the human body. In addition, companies are making CBD tinctures, gummies, capsules, and other products, for numerous conditions.

Moreover, the rapid change in the usage of cannabidiol from herbal preparations to pharmaceutical drugs is also propelling the growth of the market, along with the increasing awareness on the medical benefits of this oil, including its healing properties. This is driving the demand for products containing this ingredient in the pharmaceutical industry.

North America Is Pioneer in CBD Oil R&D

North America is expected to hold the largest market share, of over 84%, and remain the largest during the forecast period. This is because of the legalization of cannabidiol for medical and research purposes in the continent. The status of the product as a natural phytocompound, its strong promotion by firms as a wellness and lifestyle product, the launch of cannabidiol-based pharmaceuticals, including Epidiolex and Sativex, and the wide availability of various products containing this compound are further expected to propel the sale of cannabidiol oil in the region in the coming years.

Investments Are Increasing across CBD Value Chain

The growing deregulation of this ingredient and hemp across countries has garnered interest among CBD market players. This has led to a surge in market activities, including licensing, hemp and marijuana production, investment in R&D, and downstream product distribution. Various companies are trying to ensure supply chain certainties, enter newer geographies, and even ramp up the production of a differentiated array of CBD products. These steps are aimed at developing a loyal customer base, expansion of the supply chain, and generating brand equity in the nascent stage of the market.

Legalization of CBD for Research, Medical, and Recreational Usage

The legalization of CBD across the U.S. and Canada has caused a cascading effect, leading to several countries joining the bandwagon of decriminalizing to even deregulating cannabis and CBD-based products. Countries in Europe, APAC, and LATAM, such as the U.K., Norway, Spain, Japan, South Korea, Thailand, Mexico, Brazil, and South Africa, have legalized complete or partial sales of CBD-infused products. While regulations are varied across geographies, the countries have increased the production of hemp and downstream hemp-based CBD products. This has also helped national and state governments generate additional jobs and increase revenue from the sales of the products and licensing fees. Other potential upsides include income from recreational and medical tourism and sales of paraphernalia.

Furthermore, with stakeholders, such as government agencies, expediting regulatory approvals for the products, investing in research for mass-commercialization and manufacturing, and improvising supply chain logistics, the CBD oil market is expected to witness significant growth during the forecast period.

Key Players in CBD Oil Market Are:

- Aphria Inc.

- CV Sciences Inc.

- Endoca BV

- Isodiol International Inc.

- Aurora Cannabis Inc.

- Canopy Growth Corporation

- Tilray Inc.

- Folium Biosciences

- Gaia Botanicals LLC

- CBDfx

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the market, to offer accurate market estimations for 2017–2030.

Based on Source

- Hemp

- Marijuana

Based on Sales

- B2B

- By End-use

- Pharmaceuticals

- Wellness

- Food & Beverages

- Personal Care & Cosmetics

- Nutraceuticals

- By End-use

- B2C

- By Sales Channel

-

- Hospital Pharmacies

- Online

- Retail Stores

-

- By End-use

- Medical

- Chronic Pain

- Mental Disorders

- Cancer

- Personal Use

- Medical

- By Sales Channel

Based on End-use

- Medical

- Chronic Pain

- Mental Disorders

- Cancer

- Personal Use

- Pharmaceutical

- Wellness

- Food & Beverages

- Personal Care & Cosmetics

- Nutraceuticals

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E

During 2022–2030, the CBD oil market will witness a growth of 20.8%.

The government approval in several countries for the use of CBD for research and medicinal purposes is the major factor behind the growth of the CBD oil industry.

The sales of tinctures in the CBD oil market are driven by their popularity among recreational users and anxiety, depression, pain, and movement disorder patients.

North America is expected to hold the largest market share in the coming years.

Countries with laws favorable for the CBD oil market growth include the U.S., the U.K., Norway, Spain, Japan, South Korea, Thailand, Mexico, Brazil, and South Africa.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws