India Shared Mobility Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024-2030)

Get a Comprehensive Overview of the India Shared Mobility Market Report Prepared by P&S Intelligence, Segmented by Service Type (Two-Wheeler Sharing, Ride Sharing, Ride Hailing, Car Rental, Carsharing, Bus/Shuttle Service), Vehicle Type (Two-Wheelers, Cars, Buses/Vans), Commuting Pattern (Daily Commuting, Last-Mile Connectivity, Occasional Commuting), End Use (Personal, Business), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

India Shared Mobility Market Data

Market Statistics

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 1,683.4 Million |

| 2024 Market Size | USD 2,765.8 Million |

| 2030 Forecast | USD 56,397.9 Million |

| Growth Rate (CAGR) | 65.3% |

| Largest Region | South India |

| Fastest Growing Region | North India |

| Nature of the Market | Consolidated |

| Largest End User | Personal |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

India Shared Mobility Market Analysis

The India shared mobility market size was USD 1,683.4 million in 2023, which is expected to witness a CAGR of 65.3% during the forecast period 2024–2030, to reach USD 56,397.9 million in 2030. It is attributed to the convenient and cost effectiveness provide by shared mobility service providers is the prime factor supporting to the growth of the market. In addition, further expenses, include, maintenance, as fuel, insurance, and parking, are taken care by the companies, which reduces the economic burden on customer.

Owning a private vehicle demands a high investment, which mainly comprises vehicle cost, fuel cost, parking expense, maintenance charge, and insurance cost. In this way, shared mobility provide consumer to having a personal vehicle, without having actual one. The users can make the payments on the basis of their usage only.

Besides, additional expenses, such as costs related to fuel, maintenance, insurance, and parking, are taken care by the mobility service providers. Moreover, shared mobility is extremely convenient for general public, primarily daily commuters, as they can enjoy driving to their required destination without having the hassles of owning and maintaining their own vehicles.

Additionally, most of the services are available round the clock, throughout the year, assuring the users for the easy availability of vehicles as and when required. Besides, the users can easily access to the services by booking the vehicles, directly through the companies’ mobile applications. The applications provide every necessary detail and assistance to the users to guarantee them a convenient experience. Thus, the convenience and the cost effectiveness of shared mobility act as a driving factor for the growth of the market.

Rising population in major cities across India has led to an increased number of daily commuters, creating significant road congestion, especially in peak hours. Different companies are looking to introduce alternative mobility options in order to combat this problem. This scenario acts as a major driver for the shared mobility market in India.

Most of the urban cities in the country, especially in metro areas such as Delhi & NCR region, Mumbai, and Bengaluru, are taking initiatives to encourage the daily commuters to avail sharing mobility services, with the intension of reducing the number of vehicles on road. This program has a major contribution in reducing traffic congestion, which serves as a major driver for the growth of the market.

India Shared Mobility Market Trends & Drivers

Ongoing Technological Development

- Technological progression has been a catalyst for the growth of the shared mobility market in India. All the shared mobility services, such as ride hailing, shuttle, car rental, ride sharing, carsharing, and two-wheeler sharing, are based on mobile applications, where providers and users connect with each other for the purpose of booking rides and making related payments.

- In other word, shared mobility is a wholly technology-dependent platform that offers mobility services round the clock, at the time of need. Constant innovations in technologies have led to the launches of various solutions that provide simplified access to the services. One such innovation is cloud sharing that provide computing services related to software, network, storage, analytics and database to the consumer at a minimum cost.

- The shared mobility market is also significantly benefitted from cloud computing models like platform-as-a-service (PaaS) and software-as-a-service (SaaS). Through PaaS, companies can develop their own mobile applications that enable them to run their services online. Whereas, SaaS helps the service providers to adopt software to carry out their business activities.

- Additionally, the usage of IoT in fleet management offers a plethora of advantages to mobility service companies. IoT device helps in optimization process by enabling efficient process of tracing and monitoring vehicles, handling routes, and identify potential problems from a remote location.

Government Initiatives Smooth the Way for the Adoption of Shared Mobility Services

- The government of India is playing an active role in emphasizing adoption of shared mobility model over vehicle ownership to minimize traffic congestion and environmental pollution. Increasing concern toward environmental protection, primarily due to the accelerated rate of environmental degradation caused by increasing amount of exhaust fumes from vehicles, is compelling the government to formulate regulatory policies as well as offer financial benefits, in order to encourage the adoption of shared mobility services.

- For instance, under the FAME II scheme, the Government of India designated incentive plans for the purchase of electric vehicles for commercial usage. This will result in a rapid boost of electric vehicles adoption by shared mobility service providers, which in turn, will drive the growth of the shared mobility market.

- Moreover, other than the national government, various city and state authorities are also taking initiatives to accelerate the adoption of these services locally.

Improper Infrastructure for Deployment of Shared Mobility

- In order to gain traction nationally, shared mobility services need to be backed by a strong infrastructural support. Many cities lack an integrated transportation system and adequate infrastructure, which are pivotal for these services to take a functional form. Also, in order to introduce emission-free electric vehicles in public sharing fleets, there is a need to first establish charging stations for re-charging of the vehicles.

- Additionally, public mobility services require specific areas designated for parking of vehicles; hence, it is necessary to dedicate enough parking space to ensure smooth operations. Many cities do not have excess area required for parking, which restrains the development of shared mobility in those cities to some extent.

- Furthermore, insufficient internet penetration can affect the market because shared mobility services are completely dependent on the internet, where all activities, from booking a vehicle to making payment, are done over mobile applications.

- However, around 55% of the Indian population is still deprived of the internet. This acts as a major factor restraining the growth of the Indian shared mobility market. Additionally, the potential for this market in rural areas is quite low, considering the lack of internet access to the people. Most of the rural areas in India, do not have adequate broadband infrastructure, which further reduces the possibility of introducing shared mobility services in those areas.

India Shared Mobility Industry Outlook

Service Type Insights

- Based on service type, the ride hailing category held the largest share in 2023 in the Indian shared mobility market. It is also expected to progress with the highest CAGR during the forecast period. This can be attributed to the shift in preference of millennials toward ride hailing services from conventional mobility solutions. The innovation, such as cloud sharing that delivers computing services related to network, software, storage, database, and analytics to users at low cost, is attracting new customer base, which, in turn, is benefitting the market in this category.

Services Type covered in the report include:

- Two-Wheeler Sharing

- Ride Sharing

- Ride Hailing (Largest and Fastest-Growing Category)

- Car Rental

- Carsharing

- Bus/Shuttle Service

Vehicle Type Insights

- Based on vehicle type, cars category held the largest share in the market during the historical period. The early introduction of car rental and hailing services is the primary factor for the market domination of this category. In addition, factors such as developed value chain and regulatory support have supported the market growth in this category.

- During the forecast period, the market is expected to witness the fastest growth in the buses/vans category. The category has reported double-digit growth (albeit on a smaller base) in recent years, on account of the expanding operations of market players in cities and the increasing acceptance of bike taxis in the national capital region (NCR) and Hyderabad. Further, two-wheeler is gaining attention in view of the fact that two-wheelers are more affordable, available, and convenient.

The following vehicle type are included in the report:

- Two-Wheelers

- Cars (Largest Category)

- Buses/Vans (Fastest-Growing Category)

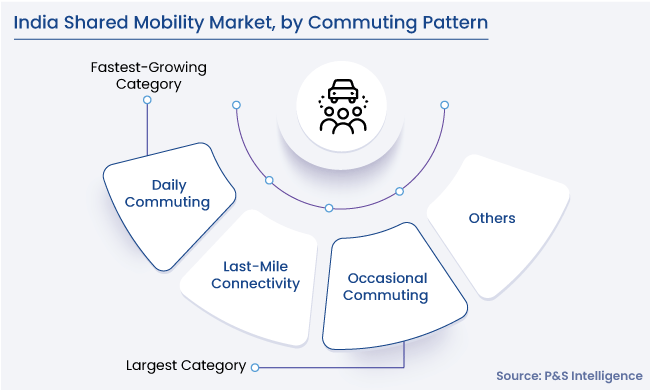

Commuting Pattern Insights

- By commuting pattern, occasional commuting held the largest share in the market in 2023 and daily commuting is expected to be the fastest-growing category during the forecast period. The market growth in the daily commuting category can be mainly attributed to the increasing demand for shared mobility services among the young population in the country, such as students and young professionals, for meeting daily commutation needs.

- Additionally, several initiatives aimed at reducing the usage of private vehicles on roads are expected to encourage the use of shared mobility transport among people in the country.

Commuting pattern covered in the report are:

- Daily Commuting (Fastest-Growing Category)

- Last-Mile Connectivity

- Occasional Commuting (Largest Category)

- Others

End Use Insights

- Under this segment, shared mobility services utilized for personal use account for the larger share in the market. It is due to majority of the customers in India use these services for personal work, which may include going to the workplace, running errands such as grocery shopping, and undertaking short trips such as escorting someone to the airport.

- During the forecast period, the market is expected to witness faster growth in the business category, with 65.5% CAGR. Business firms are increasingly tying-up with ride hailing service providers to offer transportation services to their employees, which, in turn, is boosting the market growth in this category.

It is further classified as:

- Personal (Largest Category)

- Business (Fastest-Growing Category)

Geographical Analysis

- Geographically, the south region dominates the regional market, contributed around 40% share to the market in 2023. Moreover, the market in this region is expected to advance with a CAGR of 65.6% during the forecast period, primarily driven by the fact that the majority of shared mobility providers are exist in region of south India, including Bengaluru, Hyderabad, Chennai and Visakhapatnam. In addition, the increasing demand for rental services and car hailing is propelling the growth of market in the region.

- The north region is the second largest revenue generator in the Indian shared mobility market in 2023. This can be attributed to the high demand for shared mobility services among people in the north region, primarily for meeting daily commuting and outstation travel needs.

- Furthermore, during the forecast period, the market is expected to witness the fastest growth in the east region, with 65.8% CAGR. This can be ascribed to the fact that shared mobility service providers are now exploring the market potential in the east region on account of the growing demand for these services in states such as West Bengal, Assam, and Odisha.

Further, regions analyzed for this report include:

- East

- West

- North (Fastest-Growing Region)

- South (Largest Region)

Competitive Analysis

The shared mobility market in India is highly consolidated in nature and majorly dominated by ride hailing service providers. The market is characterized by numerous strategic developments implemented by different market players, majorly for investment. strategic developments undertaken by the market players comprise over investment-related developments, product launch, partnerships and collaborations, service launches, and remaining related to other developments.

India Shared Mobility Service Providing Companies:

- Uber Technologies Inc.

- ANI Technologies Pvt. Ltd. (Ola Bike)

- Comuto SA (BlaBlaCar)

- Zoomcar Ltd.

- Roppen Transportation Services Pvt. Ltd. (Rapido)

- Mahindra Logistics Ltd.

- Yulu Bikes Pvt. Ltd.

- Carzonrent India Pvt. Ltd.

- Bashar Technologies Pvt. Ltd. (Wheelstreet)

- Royalbison Autorentals India Pvt. Ltd. (Royal Brothers)

- Motocruizer Technologies India Pvt. Ltd. (Onn Bikes)

India Shared Mobility Companies News

- In January 2024, Ola, a ride-hailing platform, launched its e-Bike service in Delhi and Hyderabad, with the aim to deploy more than 10,000 electric vehicles over the next 2 months across these cities.

- In December 2023, Uber Technologies Inc., announced a partnership with the Indian Coast Guard, as it provides mobility solution for daily commute. The aim of this collaboration is to provide dependable, efficient and secure transportation solutions for staff of Indian Coast Guard.

Frequently Asked Questions About This Report

The India shared mobility market is expected to reach a value of USD 2,765.8 million in 2024.

During the forecast period (2024-2030), the shared mobility market in India will grow at a CAGR of 65.3%.

The south region is leading the shared mobility industry in India, with a share of approximately 40%.

The India shared mobility industry will reach a value of USD 56,397.9 million in 2030.

The shared mobility industry in India is very consolidated and largely dominated by ride-hailing service providers.

The cost-effectiveness as well as convenience offered by shared mobility service providers are the major drivers for the shared mobility market in India.

Shared mobility services for personal use is the major end-use area in the shared mobility industry in India.

Request the Free Sample Pages

Want a report tailored exactly to your business need?

Request CustomizationWe are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws