India Shared Mobility Market Analysis

The India shared mobility market size was USD 1,683.4 million in 2023, which is expected to witness a CAGR of 65.3% during the forecast period 2024–2030, to reach USD 56,397.9 million in 2030. It is attributed to the convenient and cost effectiveness provide by shared mobility service providers is the prime factor supporting to the growth of the market. In addition, further expenses, include, maintenance, as fuel, insurance, and parking, are taken care by the companies, which reduces the economic burden on customer.

Owning a private vehicle demands a high investment, which mainly comprises vehicle cost, fuel cost, parking expense, maintenance charge, and insurance cost. In this way, shared mobility provide consumer to having a personal vehicle, without having actual one. The users can make the payments on the basis of their usage only.

Besides, additional expenses, such as costs related to fuel, maintenance, insurance, and parking, are taken care by the mobility service providers. Moreover, shared mobility is extremely convenient for general public, primarily daily commuters, as they can enjoy driving to their required destination without having the hassles of owning and maintaining their own vehicles.

Additionally, most of the services are available round the clock, throughout the year, assuring the users for the easy availability of vehicles as and when required. Besides, the users can easily access to the services by booking the vehicles, directly through the companies’ mobile applications. The applications provide every necessary detail and assistance to the users to guarantee them a convenient experience. Thus, the convenience and the cost effectiveness of shared mobility act as a driving factor for the growth of the market.

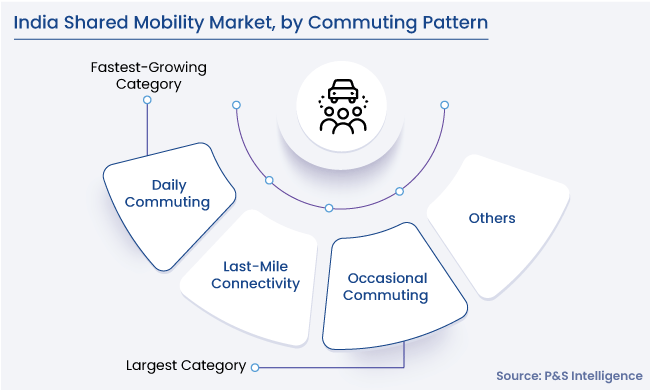

Rising population in major cities across India has led to an increased number of daily commuters, creating significant road congestion, especially in peak hours. Different companies are looking to introduce alternative mobility options in order to combat this problem. This scenario acts as a major driver for the shared mobility market in India.

Most of the urban cities in the country, especially in metro areas such as Delhi & NCR region, Mumbai, and Bengaluru, are taking initiatives to encourage the daily commuters to avail sharing mobility services, with the intension of reducing the number of vehicles on road. This program has a major contribution in reducing traffic congestion, which serves as a major driver for the growth of the market.