Report Code: 10575 | Available Format: PDF | Pages: 136

Car Rental Market Research Report: By Vehicle Type (Economy, Executive, Luxury), Channel (Online, Offline), Purpose (Business, Personal), Usage (Local, Airport, Outstation), Geographical Outlook (U.S., Canada, Germany, U.K., France, Italy, Spain, Netherlands, China, Japan, India, Australia, U.A.E, Brazil) - Global Industry Analysis and Forecast to 2024

- Report Code: 10575

- Available Format: PDF

- Pages: 136

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

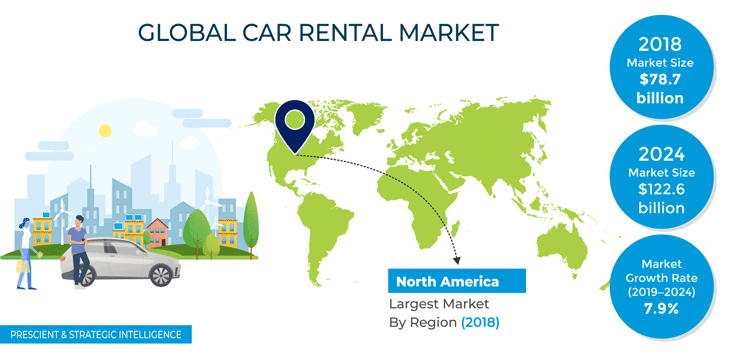

The car rental market revenue stood at $78.7 billion in 2018, and it is projected to reach $122.6 billion by 2024, witnessing a CAGR of 7.9% during 2019–2024.

North America generated the highest revenue between 2014 and 2018 and accounted for an over 43.3% share in 2018. This was due to the wide adoption of such services in the U.S. and introduction of numerous initiatives by the industry players to optimize their services.

Market Dynamics

The surging adoption of electric vehicles (EVs) by service providers is a key market trend in the car rental industry. Governments of numerous countries are implementing policies and regulations to support the deployment of EVs for car rental services. Additionally, the companies are taking initiatives to incorporate these new-energy vehicles into their fleet. For instance, Sixt SE provides electric cars, such as Tesla Model X, Tesla Model S, BMW i3, and BMW i8, for renting purposes.

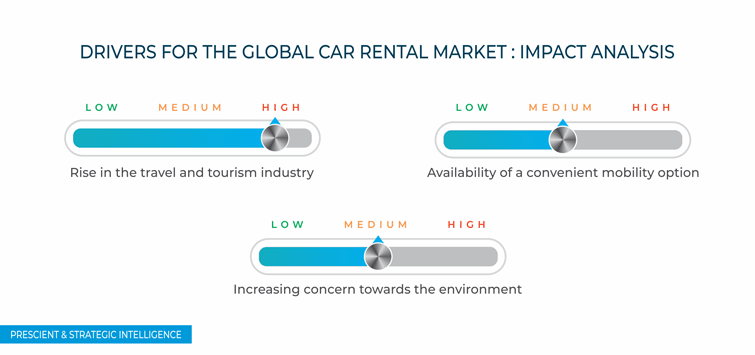

The growing travel and tourism industry has become a vital catalyst for the growth of the market worldwide. The World Travel and Tourism Council (WTTC) states that in 2018, the global travel and tourism sector observed a growth of 3.9% from 2017, which was greater than the global gross domestic product (GDP) growth rate of 3.2% in the corresponding year.

The car rental market is highly fragmented with the presence of a large number of organized and unorganized players. However, the growing necessity to switch from the unorganized to the organized sector has led to the emergence of the digital or online car rental system, which is further expanding the growth opportunities for the emerging and existing players in the market.

Segmentation Analysis

The economy category, under the vehicle type segment, dominated the market for car rental services during 2014–2018 and accounted for a 54.5% market share in 2018. The low environmental impact and high fuel efficiency of economy cars encourage their deployment by fleet operators and usage by individuals for rental services.

The online category, within the channel segment, generated the highest revenue in the market, accounting for an over 52.0% share, in 2018. This can be owed to the high smartphone penetration, better convenience offered by online platforms, and rapid advancements in the internet of things (IoT) technology. Online platforms offer easy access to the services, as customers can book a car of their choice through the website or mobile app of service providers.

In 2018, the personal category, under the purpose segment, generated revenue in the car rental market, of $48.6 billion due to the growing disposable income of people across the world. As a result, they are making frequent trips for shorter distances for leisure purposes. Most of the customers opt for car rental services for such short trips to reduce the burden of driving their own cars.

The airport category held the largest share in 2018, of 54.9%, within the usage segment, and it is expected to hold an around 56.1% share in 2024. This can be owed to the increasing usage of airport car rental services by business professionals. Besides, the surging frequency of air travel, increasing disposable income, and growing volume of international and domestic tourist activities in emerging economies will boost the growth of this category in the coming years.

Geographical Analysis

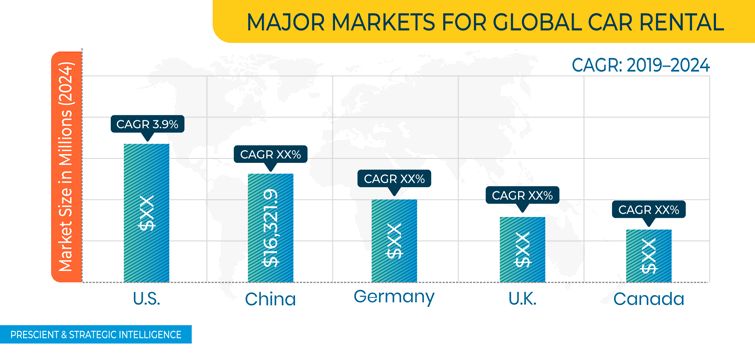

The North American market for car rental services will generate the highest revenue in the foreseeable future. Of the two North American countries, the U.S. remains the larger user of these services. In 2018, several cities adopted these services owing to the initiatives of the service operators. For example, Uber Technologies Inc. has incorporated mobile technologies and other devices to meet personal transportation requirements efficiently.

Competitive Landscape

The car rental market is consolidated in nature with just three companies accounting for over half of the market share. Enterprise Holdings Inc. was the market leader in the global car rental market, with 30.6% share in 2018. The company is presently operating in over 100 countries across North America, Central America, South America, Europe, the Caribbean and parts of Middle East and APAC. The other two dominant players in the global car rental market are Hertz Global Holdings Inc., and Avis Budget Group Inc.

The other major players operating in the market includes Europcar Mobility Group S.A., Sixt SE, and Localiza Rent a Car SA.

Recent Strategic Developments of Major Car Rental Market Players

In recent years, major players in the car rental market have taken several strategic measures such as new service launches and partnerships to gain a competitive edge in the industry. For instance, in April 2019, Enterprise Holdings Inc. announced to launch its own car subscription service. Under this service, the customers are required to pay monthly fees to select from six different vehicle classes — small and mid-sized Sports Utility Vehicle (SUVs), full-size and premium sedans, and small and medium-sized trucks.

In March 2019, Avis Budget Group signed a deal with Etihad Aviation Group to be its exclusive car rental service provider. This deal will provide Etihad Airways Group’s guests a greater travel experience.

Key Questions Addressed/Answered in the Report

- What is the current scenario of the global car rental market?

- What are the emerging services/technologies in the rental market?

- What is the historical and the present size of the market segments and their future growth potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key geographies from investment perspective?

- What are the strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws