India CAD Software Market Analysis

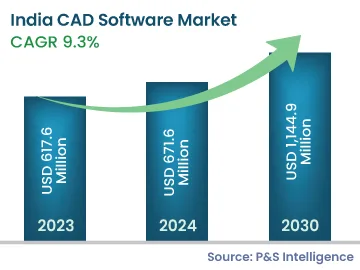

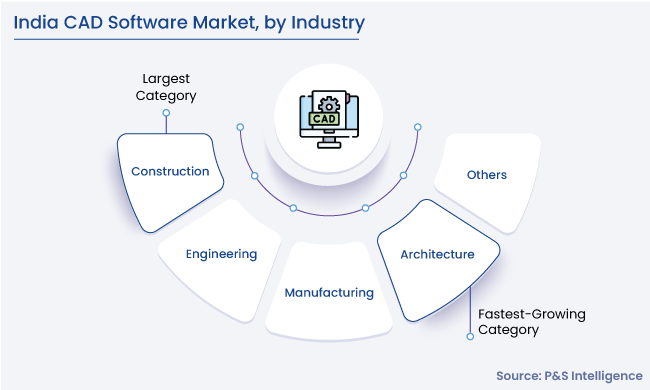

The Indian CAD software market generated USD 617.6 million revenue in 2023, and it is projected to witness a CAGR of 9.3% during 2025–2030, reaching USD 1,144.9 million by 2030. The major factors supporting the growth of the market include the surging utilization of CAD software by the construction sector, the rising focus on smart manufacturing, the growing need for fast production of goods, and the surging demand for accurate and improved-quality designs.

The rising number of initiatives by state governments is one of the major factors contributing to the growth of the Indian CAD software market. State initiatives focused on infrastructure development are resulting in heavy investments in several sectors, such as automotive, construction, aerospace, and healthcare, and increasing requirements for high-quality, customized industrial goods. As a result, several states in India are focusing on new industrial policies, which are expected to result in the rising demand for CAD software.

Additionally, another factor is the increasing usage of CAD software in the manufacturing and automotive industries. Packaging machines are increasingly becoming complex, especially with the rise in the focus on efficiency, due to which designers and engineers are deploying CAD software to meet mechatronic engineering challenges.