Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1560.3 Million |

| 2030 Forecast | USD 2490.4 Million |

| Growth Rate(CAGR) | 8.1% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12672

Get a Comprehensive Overview of the Implantable Loop Recorders Market Report Prepared by P&S Intelligence, Segmented by Indication (Cardiac Syncope, Stroke, Heart Failure, Cardiac Arrhythmia, Bundle Branch Block), End User (Hospitals, Cardiac Centers, Ambulatory Surgical Centers), Distribution Channel (Direct, Indirect), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 1560.3 Million |

| 2030 Forecast | USD 2490.4 Million |

| Growth Rate(CAGR) | 8.1% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

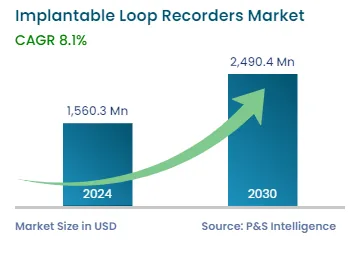

The implantable loop recorders market size stood at USD 1560.3 million in 2024, and it is projected to rise at a compound annual growth rate of 8.1% during 2024–2030, to reach USD 2,490.4 million by 2030. This is attributed to the increasing prevalence of heart diseases, the growing aging population across all regions, the surging healthcare spending, the emerging new fields of clinical research, and the rising governments’ support for creating better healthcare infrastructure.

Additionally, the growing variations in lifestyle, lack of nutritional diet, and rising trend of junk food consumption are the major reasons behind the increasing cases of chronic health conditions in both the younger and older populations. Also, these ill health habits are the root cause of the surging incidences of CVDs and other chronic ailments. In addition, the growing mortality incidents of people suffering from chronic cardiac diseases have led to the rising adoption of implantable loop recorders (ILRs) for better information and treatment of existing heart patients.

Moreover, novel technical advancements in cardiac care, augmented demand for remote patient monitoring, and the growth and development of various heart disease treatment devices and therapies are driving the implantable loop recorders market.

The cardiac arrhythmia category is expected to witness considerable growth in the coming years, due to the rising CVD incidences, the increasing adoption and usage of remote patient monitoring devices, and the growing incidence of Atrial fibrillation (AFib or AF), which is one of the sub-types of cardiac arrhythmia. For instance, nearly 33.5 million patients are suffering from AFib worldwide and it causes more than 150,000 deaths every year in the U.S.

Similarly, as per an article published on a European government website, AF is the most common heart rhythm disorder and accounts for approximately 3% of healthcare expenditure in European countries. Further, patients having AF are prone to have a five-time higher risk of stroke, and more than 20% of strokes are caused by this form of cardiac arrhythmia. Also, such strokes are more fatal than strokes caused by other reasons. Thus, this factor drives the demand for self-monitoring cardiac devices, which, in turn, is bolstering the market growth.

Moreover, remote patient monitoring is gaining traction for people having heart failure for the record of patients’ heart conditions. Heart failure is a common chronic life-threatening illness. To better define the probable risk of deteriorating heart failure and as a life-saving step, several approaches have been conjectured to track the patient’s condition without the need for frequent hospitalizations. Further, for patients having heart failure, the ICM monitoring is suitable when they reach a clinical status and may avoid indications for other types of cardiac implantable electronic devices (CIEDs).

In addition to the intensive care of arrhythmias, implantable systems have the capability to utilize parameters such as an upsurge in respiratory rate and pulse rate to predict a worsening medical condition of patients that may lead to hospitalizations. Such kind of prior monitoring serves early remedial involvement and thus provides outpatient and home management without frequent hospital visits, which, in turn, reduces economic costs. Also, the use of such devices positively impacts the patient’s quality of life, along with minimizing the chances of hostile events such as infection caused by frequent hospitalizations. Therefore, such incidences of heart failure, cardiac arrhythmia, and strokes are expected to fuel the demand for implantable loop recorders.

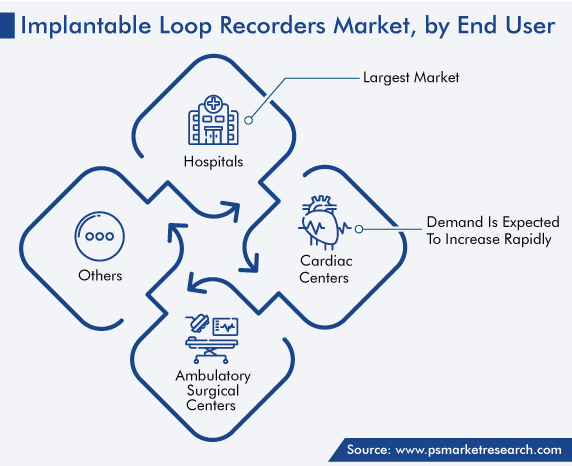

Based on the distribution channel segment, the distribution of ILRs is dominated by the direct purchase of cardiac rhythm monitoring devices by end users like hospitals, ambulatory surgery centers, cardiac centers, and others. Thus, in 2022, the direct category captured a larger revenue share of 90%. This is also ascribed to the rising CVD patient population in both developed and emerging nations, the escalated number of hospital visits for diagnosis, and the increasing number of cardiac implantable electronic device procedures.

The rising advancements in cardiac solutions and services and advanced product launches are key reasons for the augmented growth of the implanted loop recorders market. For instance, in February 2023, Medtronic plc announced the successful results of recent clinical data from the STROKE AF clinical study. It presented that the company’s Reveal LINQ insertable cardiac monitor detects 10-fold more in AF detection of patients suffering from large vessel diseases and microvascular dysfunction stroke patients. It is an automatic, wireless, and patient-responsive intravenous ECG monitoring device.

Similarly, in 2021, RhythMedix, a medical device manufacturer, launched the next-generation RhythmStar, a wearable cardiac monitoring device with integral 4G cellular connectivity. It is worn for extended remote monitoring with no requirement for smartphones or any other communication device. The technology aids in quick ECG studies, reports heartbeat irregularities, and alerts doctors if any risk related to arrhythmia is detected.

Likewise, in 2020, Biotronik SE & Co. KG launched an ICM BIOMONITOR III. It is intended to help patients with irregular heart rhythms by describing unexplained syncope with amplified precision. It aims at providing the accuracy of arrhythmia detection and analysis, and it proposes enhanced signal quality. The product can be implanted under the skin with a quick injectable procedure following a small incision.

Furthermore, with the benefits such as automatic pairing, ease of data transmission, and no active patient involvement, the adoption of cardiac monitors is increasing. Also, the feature of intelligent memory management averts the double recording of medically relevant events so that no relevant evidence is missed. These devices are also used as monitoring equipment for patients with unexplained episodes of palpitations. Thus, these factors drive the growth of the market.

Drive strategic growth with comprehensive market analysis

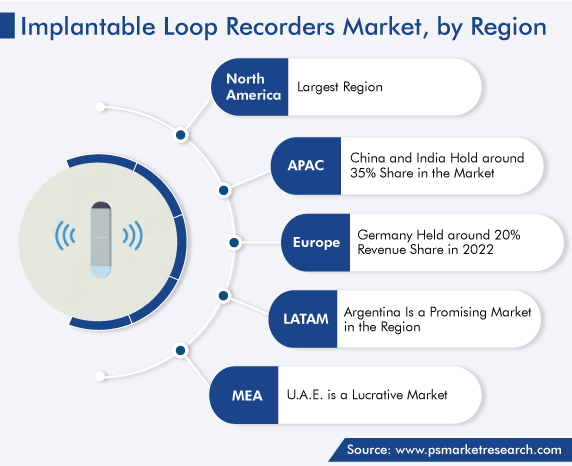

Due to the presence of well-developed healthcare infrastructure and facilities, the rising CVD incidences, the growing healthcare expenditure, high disposable income, and the augmented demand for remote patient monitoring devices in the region, the North American implantable loop recorders market accounted for the highest revenue share, of 40%, in 2022, and it is projected to grow at a CAGR of 7% during the forecast period.

Moreover, the rising heart disease and stroke statistics show an alarming rate of deaths in the U.S., and hence largely supporting the regional market growth. For instance, around 700,000 people die of heart disease in the country every year. Amongst these, around 150,000 people die from stroke every year. Additionally, the growing elderly population is more likely to develop heart diseases and necessitates unceasing cardiac activity monitoring and the wide availability of technologically advanced products are bolstering the demand for ILR devices in the region.

Furthermore, the European market is expected to witness significant growth in the coming years. This can be ascribed to the presence of established healthcare infrastructure and substantial healthcare investment. For instance, countries like Germany, the U.K., France, and Switzerland have a developed healthcare sector, owing to which new technology and diagnostic procedures are more frequently used. Further, the rapid increase in the proportion of the aging population and the rising CVD cases are creating a lucrative demand for ILRs.

In addition, in Europe, CVD causes more than three million deaths every year and accounts for around 45% of all deaths in the EU and thereby expected to bolster the need for enhanced heart care solutions to treat the patient population. Thus, this factor drives the regional market growth.

This fully customizable report gives a detailed analysis of the implantable loop recorders industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Indication

Based on End User

Based on Distribution Channel

Geographical Analysis

The implantable loop recorders market size stood at USD 1,560.3 million in 2024.

During 2024–2030, the growth rate of the implantable loop recorders market will be 8.1%.

Hospital is the largest end user in the implantable loop recorders market.

The major drivers of the implantable loop recorders market include the rising death frequencies caused by CVD worldwide, enhancing living standards and awareness of healthcare devices and procedures, consistent innovation in ILR devices by industry players, increasing government support for health infrastructure, and surging healthcare spending.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages