Cardiac Monitoring Market Future Prospects

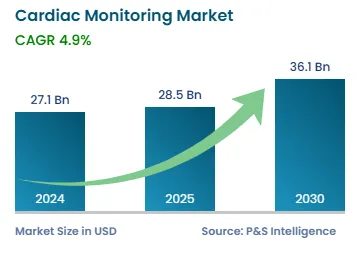

The global cardiac monitoring market will generate revenue of USD 27.1 billion in 2024, and it is projected to expand at a rate of 4.9% from 2025 to 2030, reaching USD 36.1 billion by 2030. This is ascribed to the rising prevalence of CVDs, which, as per WHO, are the leading cause of death around the world, with a mortality of 17.9 million every year.

Factors that directly affect heart health include high tobacco use, high cholesterol levels, obesity, physical inactivity, diabetes, poor diet, and alcohol use. Due to the changes in lifestyle, continuous monitoring of cardiac health is required; therefore, medical technology companies are launching various products. For instance, Apple Watch Series 4 and newer models come with an ECG app and sensors with advanced heart rate that can detect potential signs of irregular heart rhythm and atrial fibrillation (A-fib).

Pre-monitoring and pre-diagnosis can prevent the majority of CVDs. A-fib is the most-common arrhythmia diagnosed in clinical practice. The prevalence of A-fib is projected to increase to 12.1 million cases in 2030. Arrhythmias can be prevented with early detection; consequently, the demand for cardiac monitoring and cardiac rhythm management devices is rising, as they save the lives of patients who are at a high risk of cardiac arrest.

The economic burden of heart diseases will be more than USD 1.0 billion by 2030, which emphasizes the need for effective heart monitoring.

With new developments in heart monitoring devices, notably mobile cardiac telemetry (MCT) systems, cardiac monitoring practices have substantially improved.

Moreover, the rising adoption of digital health services intensifies the cardiac monitoring market growth. For instance, Amazon acquired One Medical, known for its integrated in-office and virtual care, on-site labs, and comprehensive health programs.

Moreover, in February 2022, AliveCor Inc. announced the launch of the KardiaMobile Card, a slim and convenient personal ECG device. The size of a credit card, it performs a single-lead ECG in 30 seconds. It pairs with a smartphone using Bluetooth technology, to detect six of the most common arrhythmias.