Central Europe Heavy Ground Transportation Vehicles Market Future Prospects

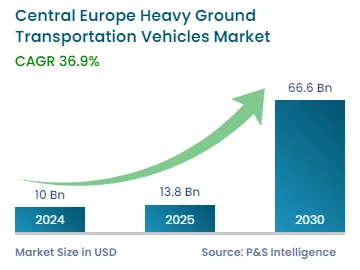

The Central European heavy ground transportation vehicles market, which includes trucks and buses, is estimated to have stood at USD 10.0 billion in 2024, which is expected to reach USD 66.6 billion by 2030, advancing at a CAGR of 36.9% during 2024–2030.

The key factors driving the industry include an increase in trade activities and the rise in urbanization, which drive the demand for road freight transportation and logistics, along with innovations in technologies. Trade requires efficient goods transportation solutions, which further boosts the growth of the market in Central Europe.

Moreover, the industry is boosted by several trade agreements between neighboring countries. For instance, Austria exports specialized industrial machinery, pharmaceuticals, glassware, power machinery, and food products mainly to Germany, Italy, Switzerland, and France by means of ground transportation, thereby supporting the growth of the industry.