Green and Bio-Solvents Market Future Prospects

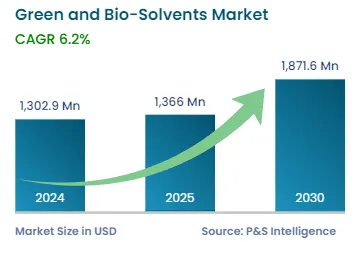

The global green and bio-solvents market will generate an estimated revenue of USD 1,302.9 million in 2024, and it is projected to grow at a CAGR of 6.2% from 2024 to 2030, reaching USD 1,871.6 million by 2030. The growth of the industry is attributed to the health and environmental concerns associated with synthetic solvents.

Green and bio-solvents are an environmentally benign substitute for traditional petrochemical-based solvents because they are made from renewable resources, including plant and animal waste.

The usage of green and bio-solvents is growing in sectors such as paints and coatings, cosmetics, and pharmaceuticals because of their low toxicity, biodegradability, and eco-friendliness. In applications including industrial cleaning, food processing, and agriculture, they are essential in lowering VOC emissions, guaranteeing safer goods, and promoting sustainable practices.

Furthermore, the necessity for sustainable industrial practices, evolving environmental legislation, and consumer awareness are the main factors driving the need for green and bio-solvents.