Report Code: 12832 | Available Format: PDF | Pages: 290

Gastrointestinal Stent Market Size and Share Analysis by Product (Biliary, Duodenal, Colonic, Pancreatic, Esophageal), Application (Biliary Diseases, Colorectal Cancer, Stomach Cancer, Esophageal Cancer, Pancreatic Cancer, Duodenum Cancer), Material (SEMSs, SEPSs, Semirigid), Type (Bare-Metal Stents, Drug-Eluting Stents), End User (Hospitals and Clinics, Ambulatory Surgical Centers) - Global Industry Demand Forecast to 2030

- Report Code: 12832

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Gastrointestinal Stent Market Overview

The global gastrointestinal stent market generated revenue of USD 525.5 million in 2023, which is expected to witness a CAGR of 6.0% during 2024–2030, to reach USD 781.9 million by 2030. This is attributed to the rising prevalence of gastrointestinal cancers and other digestive problems and the growing elderly population with gastrointestinal diseases including diverticulosis and bowel ailments.

Additionally, the growing preference of patients toward minimally invasive surgical procedures is driving the market, as these procedures are becoming favorite for the treatment of gastrointestinal diseases, as compared to traditional open surgical procedures, in terms of low risk of infections, shorter hospital stay, minimal loss of blood, and quick recovery period.

Moreover, the surging technological advancements, such as nitinol material-based and bio-adsorbable stents providing a high degree of kink-resistance and flexibility and having reduced complications, for the treatment of gastrointestinal diseases, and the rising advent of various innovations and research in the field of healthcare to develop advanced technology to reduce the surgical burden from patients are further augmenting the growth of the industry.

Furthermore, stents are widely used in the treatment of patients with digestive tract obstructions, which include the esophagus, small bowel, stomach, and colon. Also, recent technological advancements have improved stent patency and reduced stent-induced complications, resulting in a higher quality of life.

Rising Prevalence of GI Cancer and Digestive Problems

One of the main causes of death globally is gastrointestinal cancer. There has been an increase in mortality and morbidity from chronic illnesses, including colorectal cancer, esophageal cancer, and GI-related critical diseases, in the past few years. As per a new study published in July 2020, by the International Agency for Research on Cancer (IARC), gastrointestinal cancer accounted for 35% of all cancer-related deaths and 26% of cancer incidences globally, and in 2018, there were an estimated 4.8 million new cases and 3.4 million related deaths worldwide.

Moreover, the rising prevalence of Crohn’s disease in all categories of the population is also a significant factor for the market growth. According to the Crohn’s & Colitis Foundation, in 2020, around three-quarters of patients with Crohn’s disease had one or more procedures in their lifetime. It shows that for the treatment of this disease, surgery is essential, which needs GI stents. Thus, with the surging incidence of chronic diseases, the market will witness strong growth in the coming years.

Biliary Stent Category Dominates the Market

Based on product, the biliary stent category accounted for the largest revenue share, of 35%, and it is further expected to maintain its dominance in the future. This is due to the rising incidence of obstructive jaundice, a common condition that may result from malignant or benign disease. Also, the biliary stent is used to treat obstructions that occur in the biliary tree or to treat biliary leaks. Further, nowadays, minimally invasive endoscopic stent placement is the most effective treatment option for serious benign bile duct structures.

Moreover, the rising prevalence of bile duct cancer and primary biliary cholangitis, previously called primary biliary cirrhosis, and chronic liver diseases, and the increasing need for surgical procedures for the treatment of these diseases are boosting the utilization of stents to reduce the burden of convention surgical procedures.

On the other hand, the esophageal stent category is projected to witness the highest CAGR during the analysis period. This can be due to its importance for relaxing inoperable esophageal hostilities, the rising prevalence of esophageal cancer and Crohn’s disease, and the advancement in esophageal stents such as launches of biodegradable stents for the treatment of such diseases.

SEMSs Held the Largest Share

Based on material, the self-expanding metal stent category accounted for the largest revenue share, of 40%, in the market, and it is further expected to maintain its dominance in the future. This is ascribed to its advantages such as high efficacy, longer potency, ease of insertion, and low possibility of migration or dislodgment. Also, it is used for the management of benign gastrointestinal leaks and perforations. Moreover, metal stents are generally made of nitinol, stainless steel, and cobalt-chromium, and these stents perform as a support to keep open the GI tract and offer relief from unobstructed drainage of water and food.

On the other hand, the self-expandable plastic stent category is expected to show significant growth in the coming years. This can be because these stents are widely used in the pancreas and the biliary tree. Moreover, they are usually made of polyethylene and are cost-effective.

| Report Attribute | Details |

Market Size in 2023 |

USD 525.5 Million |

Market Size in 2024 |

USD 550.6 Million |

Revenue Forecast in 2030 |

USD 781.9 Million |

Growth Rate |

6.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Application; By Material; By Type; By End User; By Region |

Explore more about this report - Request free sample

Drug-Eluting Stent Accounts for a Larger Share

The drug-eluting stent category held a larger revenue share in the gastrointestinal stent market in 2023, and it is further expected to maintain its dominance in the future. This is due to its advantages, such as reduced target-vessel revascularization, the potential to decrease the risk of any other related disease, the efficiency to slow release of medication, and the advancements in such stents such as biodegradability.

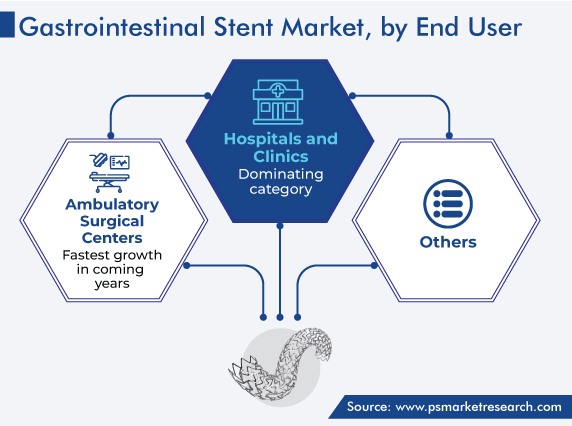

Hospitals & Clinics Lead the Market

On the basis of end user, the hospitals & clinics category held the largest market share, of 45%, in 2023, and it will further maintain its dominance in the future. This is because in both developed and developing nations, hospitals handle the majority of surgical procedures, as these have resources needed for such complex procedures; and a large number of percutaneous transhepatic cholangiography and endoscopic retrograde cholangiopancreatography procedures are performed in the hospitals for various disease indications.

Moreover, advantageous repayment scenarios, surging government initiatives to offer advanced treatment for GI diseases, increasing costs of healthcare facilities, people being more inclined toward healthcare insurance, and the availability of advanced healthcare services in hospitals are driving the market in this category.

Whereas, the ambulatory surgical centers category is expected to witness the fastest growth in the coming years. This can be ascribed to the rising preference of patients toward outpatient surgical procedures and the surging need for IT solutions including telehealth, mhealth, and remote patient monitoring, for better treatment of diseases. Also, these facilities provide same-day surgical care, including diagnostic and preventive procedures.

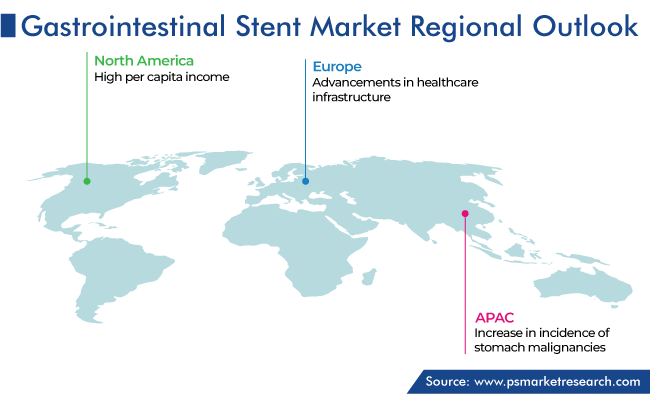

North America Is Prime Revenue Contributor

Geographically, the North American market held the largest revenue share, of around 50%, in 2023, and it is also expected to grow at a robust CAGR during the review period. This is due to the high per capita income and healthcare expenditure, the vast population of the elderly suffering from gastrointestinal diseases and other digestive-related problems, the high adoption of minimally invasive surgeries, and the accessibility of tools for performing minimally invasive surgeries, in the region. Additionally, the availability of favorable reimbursement scenarios and a high rate of new GI cases are some other factors driving the regional market.

Moreover, key players in the region are focusing on taking several steps, such as strategic approaches, to cater to the demand for stents. For instance, Boston Scientific Corporation received 510(k) approval from the USFDA and got the approval of CE Mark to market its WallFlex fully covered esophageal stent, in November 2020, for the management of malignant esophageal strictures. Similarly, Olympus Corporation introduced HANAROSTENT esophagus TTS self-expanding metal stents in October 2020.

In the region, the Canadian market is showing significant growth, due to its advancing healthcare infrastructure, the rising number of government initiatives for gastrointestinal procedures and reimbursement scenarios, and the surging preference toward minimally invasive surgeries, in the country.

Furthermore, the European market will show significant growth in the coming years. This can be ascribed to the advancements in healthcare infrastructure, the rising incidence of chronic diseases such as cancer, and favorable policies for reimbursement in the region.

In Germany, due to an increase in the prevalence of gastrointestinal cancer, IBD, and other digestive problems, the adoption of gastrointestinal stents is rising swiftly, to avoid conventional surgical methods. Moreover, strategic developments adopted by key players in the country are boosting the market’s profitability.

Top Manufacturers of Gastrointestinal Stents Are:

- Boston Scientific Corporation

- Medtronic plc

- Becton, Dickinson and Company

- CONMED Corporation

- Olympus Corporation

- Cook Group Incorporated

- HOBBS MEDICAL INC.

- Merit Medical Systems

- W. L. Gore & Associates Inc.

Market Size Breakdown by Segment

This report offers deep insights into the gastrointestinal stent market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

- Biliary

- Duodenal

- Colonic

- Pancreatic

- Esophageal

Based on Application

- Biliary Diseases

- Colorectal Cancer

- Stomach Cancer

- Esophageal Cancer

- Pancreatic Cancer

- Duodenum Cancer

Based on Material

- Self-Expanding Metal Stents (SEMSs)

- Stainless steel stents

- Nitinol stents

- Self-Expanding Plastic stents (SEPSs)

- Semirigid

Based on Type

- Bare-Metal Stents

- Drug-Eluting Stents

Based on End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The gastrointestinal stent market size stood at USD 525.5 million in 2023.

During 2024–2030, the growth rate of the gastrointestinal stent market will be around 6.0%.

Biliary diseases is the largest application area in the gastrointestinal stent market.

The major drivers of the gastrointestinal stent market include the rising incidence of gastrointestinal cancer, the growing elderly population susceptible to GI diseases and other digestive problems, the improving healthcare infrastructure, and the development of biodegradable and drug-eluting stents.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws