Report Code: 11641 | Available Format: PDF | Pages: 185

Healthcare Insurance Market by Coverage Type (Term, Lifetime), by Insurance Type (Medical, Disease, Income Protection), by Service Provider (Public, Private), by Insurance Network (Exclusive Provider Organization, Preferred Provider Organization, Point of Service, Health Maintenance Organization), by Insured Type (Adults, Senior Citizens, Minors), by Distribution Channel (Agents/Brokers, Direct Marketing, Bancassurance), by Geography (U.S., Canada, Germany, France, U.K., Italy Spain, Russia, Switzerland, Sweden, Belgium, Poland, Norway, China, India, Japan, Australia, Singapore, Malaysia, Brazil, Mexico, Argentina, Chile, Colombia, U.A.E., Israel, South Africa, Saudi Arabia) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2014-2024

- Report Code: 11641

- Available Format: PDF

- Pages: 185

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

The healthcare insurance market revenue was $1.7 trillion in 2018, and the market is predicted to grow at a CAGR of 4.3% from 2019 to 2024. The market is being mainly driven by the surging geriatric population, increasing incidence of chronic diseases, and soaring gross domestic product (GDP) and healthcare spending across the world.

Health insurance covers the surgical and medical expenses incurred during a person’s treatment. It can either reimburse the expenses incurred during the treatment of injuries or diseases to the patient or pay the healthcare provider directly for the treatment. The customer pays a tax-free premium annually or monthly for this service.

The term coverage category, under the coverage type segment, generated the higher revenue, of $1.3 trillion, in 2018. In addition, it is predicted to progress at a CAGR of 4.7% from 2019 to 2024. This is credited to the increasing public preference for term coverage over lifetime coverage insurance.

The medical insurance category is predicted to hold the largest share and exhibit the fastest growth, with a CAGR of 4.8%, within the insurance type segment of the healthcare insurance market in the forthcoming years. This is ascribed to the large pool of empaneled hospitals providing medical services.

However, insurance coverage for disease treatment is restricted to a specific set of diseases defined by the insurance firm, which primarily includes chronic illnesses, such as diabetes, cardiovascular diseases, and hypertension. On the other hand, the income protection category is generating the lowest revenue presently, and it is predicted to progress at a CAGR of 2.4% in the coming years.

The exclusive provider organization (EPO) category is predicted to lead the market for healthcare insurance in the coming years, with expected revenue of $0.9 trillion in 2024, within the insurance network segment. This is attributed to the low cost of premiums and consultations and existence of a large pool of physicians covered under this type of insurance network. The preferred provider organization (PPO) category is predicted to exhibit the fastest growth in the market in the coming years, mainly because it allows patients to choose physicians both inside and outside the network.

The adults category, under the insured type segment, is predicted to contribute the highest revenue to the market in the forthcoming years. The revenue generated by this healthcare insurance market category is projected to rise from $0.9 trillion in 2018 to $1.2 trillion by 2024. The minor category will exhibit sluggish growth, with a CAGR of 2.9%, during 2019–2024. This will be mainly because minors are considered dependent on adults and, thus, they are generally covered in the insurance plans bought by the adults in their families.

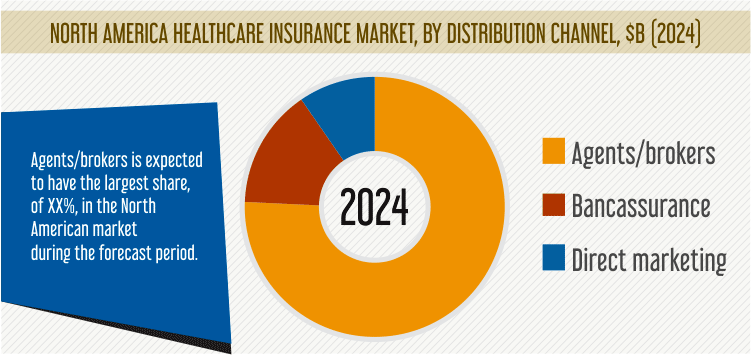

The agents/brokers category is predicted to dominate the healthcare insurance industry, under the distribution channel segment, in the upcoming years. This category is set to advance at a CAGR of 4.8% from 2019 to 2024 and generate revenue of $1.6 trillion by 2024. In this segment, the bancassurance category is the second largest, with revenue of $0.3 trillion in 2018 and a CAGR of 3.0% between 2014 and 2018.

Market Dynamics

The surging healthcare expenditure and GDP around the world, mushrooming population of geriatric people, and increasing incidence of chronic diseases are some of the major factors driving the advance of the market.

As per the World Population Prospects report published by the United Nations in 2017, the global geriatric population is predicted to register a faster growth than the younger population in the coming years. This will positively impact the growth of the healthcare insurance market. The report stated that the global population of people in the age bracket of 60 years and above will rise from 962 million in 2017 to 1.4 billion, 2.1 billion, and 3.1 billion by 2030, 2050, and 2100, respectively.

The growing incidence of chronic diseases is another major growth driver for the market for healthcare insurance. According to the World Health Organization (WHO), chronic diseases are the leading cause of disability and death globally. The organization also predicts that chronic illnesses will account for 43.0% of the burden of all diseases by 2020. This is augmenting the healthcare spending of people, which is, in turn, propelling the requirement for health insurance. Essentially, in order to reduce their out-of-pocket spending on healthcare, a large number of people are buying health insurance.

Additionally, the increasing healthcare expenditure of many countries is creating immense growth opportunities for the players operating in the market. According to the International Monetary Fund (IMF), developing countries, such as India, Brazil, and China, will perform better than developed economies, such as Germany, France, Canada, and the U.S., in terms of GDP by 2020. This will consequently augment the healthcare spending in the developing countries.

The surging investments in the healthcare industry in these countries are also supporting the healthcare insurance market expansion, as having health insurance is rapidly becoming necessary for people. Furthermore, with the increasing per capita GDP in several countries, the spending on health insurance is predicted to grow massively in the coming years.

Competitive Landscape

Ongoing product launches in healthcare insurance market is expected to increase shares of existing key players. For instance, in September 2018, Apollo Munich Health Insurance Company Limited launched a new insurance plan called, “iCan”, specific for cancer patients. The company through this plan offers coverage for hospitalization (inpatient and daycare), conventional treatments like chemotherapy and radiotherapy, and follow up and post treatment under this plan.

Besides, collaborations and acquisitions among the existing key players are expected to boost the healthcare insurance market. For instance, in July 2018, AIA Group Limited completed the acquisition of Commonwealth Bank of Australia’s life insurance business in New Zealand. This partnership will last for 20 years. The company will sell its solutions and services through bancassurance.

Some of the key players in the global healthcare insurance market are Allianz Group, Anthem Inc., Centene Corporation, Kaiser Permanente, Cigna Corporation, Gulf Insurance Group, International Medical Group Inc., Zurich Insurance Group, and Aetna Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws