Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 5,001.9 Million |

| 2030 Forecast | USD 6,334.7 Million |

| Growth Rate(CAGR) | 4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 10861

Get a Comprehensive Overview of the Gas Engines Market Report Prepared by P&S Intelligence, Segmented by Product (Natural Gas, Special Gas), Power Output (1-2 MW,3-5 MW,6-15 MW, Above 15 MW), Application (Power Generation, Mechanical Drives, Cogeneration), End User (Utilities, Oil and Gas, Manufacturing, Marine), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 5,001.9 Million |

| 2030 Forecast | USD 6,334.7 Million |

| Growth Rate(CAGR) | 4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

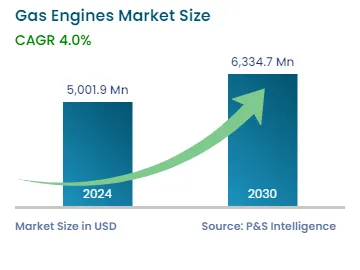

The gas engines market size stood at USD 5001.9 million in 2024, and it is expected to witness a compound annual growth rate of 4.0% during 2024–2030, to reach USD 6,334.7 million by 2030.

A gas engine is an internal combustion engine that runs on gaseous fuels, such as natural gas, propane, and methane. In terms of efficiency and emissions, these engines typically perform better than gasoline and diesel engines. They are widely used in generators, pumps, and a lot of other pieces of off-road and on-road machinery.

The rising demand for power from various industries is the major factor propelling the global market. Moreover, the increase in the efficiency of gas engines as the technology advances and the rise in the population are the major factors supporting the market growth.

The COVID-19 pandemic had a negative effect on the global market for gas engines because industrial facilities around the world used less energy. As a result of the global lockdowns, a number of industries were temporarily shut down, thus decreasing the demand for these systems in most regions. Further, a significant order backlog was created as a result of the delays in the production of gas-based engines, thereby slowing the growth of the market. However, following vaccination drives, the government of several nations took steps to increase investments in power generation, particularly gas-fired systems. This made it easier for the market to recover steadily after the pandemic.

Based on fuel, the market is classified into different gases, such as natural, special, and others (coal, producer, and propane). Among these, the natural gas category is predicted to hold the largest revenue share over the projection timeframe. Power plants using natural gas can be commissioned quickly, which is why they are ideal for tackling grid demand fluctuations and the limited renewable energy production.

Further, this is the cleanest fossil fuel, with minimal emissions of CO2 and other particulates and lower water consumption in comparison to coal- and diesel-powered power plants. In assisting in the transition to a world powered by clean energy, the production of electricity from natural gas is becoming increasingly significant. Gas power plants are also more mechanically efficient than steam-driven plants.

Additionally, natural-gas-fired plants have emerged as an eco-friendlier option for the generation of baseload power, in response to the growing environmental concerns due to the high carbon emissions from coal-based power plants. According to the United States Energy Information Administration, these plants were to generate 38% of the country's electricity in 2022. In addition, the primary driver for the market in a few of the world's key tech-savvy nations is the policies that encourage the use of natural gas for energy production.

Utilities are the most-common users of engines powered by these gases. When it comes to cogeneration, both commercial and industrial settings typically make use of natural gas engines. As the U.S., Russia, the U.K., France, and other countries improve their natural gas distribution networks, there will be an increase in the demand for these engines.

According to the EIA, U.S. natural gas exports set a new record in 2021, of an average of 10.5 billion cubic feet per day (Bcf/d). This record volume was driven by the rising LNG exports to Asia and Europe.

As economies shift toward renewable energy and other conventional yet clean energy solutions, natural gas is being widely used as a transitional fuel, to meet energy demands. Power plants driven by natural gas are inexpensive and simple to construct. In comparison to oil- and coal-fired plants, they produce negligible amounts of carbon monoxide (CO), carbon dioxide (CO2), sulfur dioxide (SO2), and nitrogen oxides (NOx). Hence, when natural gas is used in place of coal, the quality of the air tends to improve. Additionally, these facilities have higher thermodynamic efficiencies.

As a result, the demand for all kinds of gaseous fuels, such as biogas, landfill gas, and natural gas, has increased. Essentially, the rising demand for electricity in both residential and commercial settings is expected to drive the gas engines market during the forecast period.

Based on power output, the market is classified into 1–2 MW, 3–5 MW, 6–15 MW, and above 15 MW. Among these, the above 15 MW category is predicted to expand at the highest rate, of around 5%, over the projection timeframe. Utilities and the marine industry use above-15-MW engines. By providing a dependable and relatively cleaner alternative to engines powered by diesel and coal, those that consume natural gas play a crucial role in assisting major global economies in developing an energy system that is more environment-friendly.

In cruise and merchant vessels, submarines, and warships, gas engines with a high output serve as the primary source of propulsive power. The use of these variants to power the global shipping fleet is further encouraged by the stringent maritime regulations that limit the emission of sulfur and other pollutants.

Further, the market will benefit from the rising demand for warships to protect the coastline of both developed and developing nations. The market is expanding because gas engines offer a number of advantages over conventional engines, when used as a drive source for submarines. In addition, the market expansion is fueled by an increase in the stringency of fuel efficiency norms and the investments by the major players in the design of these machines.

Based on application, the market is classified into power generation, mechanical drive, cogeneration, and others. Among these, the mechanical drive category is predicted to expand at the highest rate, of around 4%, over the projection timeframe. Gas engines as prime movers are used to directly run mechanical equipment, such as pumps, compressors, blowers, chillers, and other rotating equipment. This why the oil & gas and manufacturing sectors make extensive use of gas engines. Within the oil & gas industry, particularly in LNG plants, gas engines primarily drive the compressors during the gathering, processing, and transmission of the gas.

An oil well's water injection and irrigation pumps can also be driven by gas engines. In contrast to the lean-burn engines used for power generation, gas engines for prime moving applications are designed to handle variable loads. In consideration of all these factors, during the forecast period, the demand for gas engines will eventually be driven by an increase in the demand for prime movers as a result of the expansion of the industrial sector.

The Food and Agriculture Organization of the United Nations predicts that global agricultural production will rise by an average of 1.5% annually over this decade. Hence, irrigation pumps will play a crucial role in this market's expansion, due to their importance in farming.

The power generation category dominates the global gas engine market. Gas-based engines play an important role in power generation, as CNG, LPG, and biogas are increasingly being used to power turbines. The exponential rise in the electricity demand due to the increasing population and load shedding is driving the growth of the gas engine market in the power generation category. Moreover, the increasing investment by governments in power generation with a focus on the expansion of the related infrastructure is driving the demand for such energy conversion systems.

Drive strategic growth with comprehensive market analysis

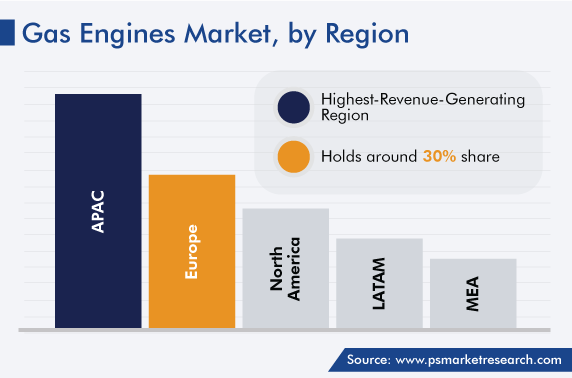

The conversion of coal-based plants to gas-based ones, as part of the initiatives taken for the replacement of the aging power generation infrastructure, and the rising demand for clean and efficient fuels are driving the expansion of the Asia-Pacific market.

Over 4 billion people live in more than 60 countries in the Asia-Pacific region. Additionally, the region contributes more than half the world's emission of greenhouse gases. Extreme weather (reflected in the rising temperatures) and water scarcity are just a few of the climate change's effects on Central Asia. Thus, carbon-intensive energy systems must be phased out of the region's energy sector, which is a major emitter of greenhouse gases.

While the oil capacity is expected to decrease by 15% by 2035, natural gas capacity is expected to increase by approximately 44%. This is because of the growing demand for fuels with lower carbon emissions, particularly natural gas.

Europe is expected to grow at the highest rate in the market, propelled by the high demand for gas-based engines in industrial spaces. Moreover, Europe is a leading biogas producer, which is why the technological advancements in gas engines will lead to new opportunities in the region.

This report offers deep insights into the gas engines industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

Based on Power Output

Based on Application

Based on End User

Geographical Analysis

The market for gas engines valued USD 5001.9 million in 2024.

Power generation is the largest application in the gas engines industry, while mechanical drives will have the highest CAGR.

The market for gas engines is propelled by the shift for power plants and ships using natural gas.

The fastest gas engines industry growth is predicted in the utilities category.

APAC has the largest share of the market for gas engines.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages