Report Code: 12844 | Available Format: PDF | Pages: 310

EV Charging Cables Market Size and Share Analysis by Application (Private Charging, Public Charging), Type (Normal, High-Power, Liquid-Cooled High-Power), Charging Level (Level 1, Level 2, Level 3), Connector (Type 1, Type 2, CCS1, CCS2, CHAdeMO, GB/T, NACS/TESLA Connectors), Diameter (<10 mm, 10-20 mm, >20 mm), Jacket Material (All Rubber, TPE, PVC), Length (2-5 Meters, 6-10 Meters, >10 Meters), Mode (Mode 1 & 2, Mode 3, Mode 4), Power Supply (AC, DC), Shape (Straight, Coiled) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12844

- Available Format: PDF

- Pages: 310

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

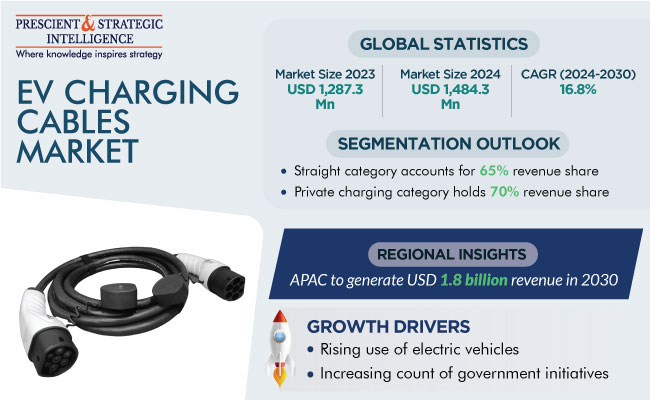

The EV charging cables market size has been estimated at USD 1,287.3 million in 2023, and it is expected to grow at a CAGR of 16.8% during 2024–2030, to reach USD 3,775.6 million by 2030.

The growth can be primarily ascribed to the rising use of electric vehicles because of the increasing number of government initiatives to ensure their adoption. Moreover, the growing pace of technological advancements, which are enabling higher driving ranges and speeds, are contributing toward the growth of the market.

Charging cables are being separated from electric vehicles as this approach results in more compactness and lower weight due to the absence of an electronics box for holding them. The adapter is connected to the cables so that the required plug can be chosen for the available charging ports and EVs can be charged at home with a wall charger or standard household electrical outlet.

The growing adoption of EVs, along with the increasing count of government initiatives for minimizing the carbon footprint, and the increasing requirement for connections that help in fast charging, are contributing toward the growth of the market.

The existing logistical approaches in urban areas have become inadequate in efficiency and scale as cities stretch beyond limit and the population becomes denser than they can handle. Moreover, to cater to the demand for same-day deliveries, distribution centers are moving closer to urban areas. Meanwhile, a double-digit growth rate is being observed in online retail for parcel service providers.

Hence, as larger logistics fleets mean more pollution, many countries are introducing electrification in the associated vehicles. For instance, FREVUE, a project funded by the European Union, was initiated to discover how fully electric vehicles can be viable substitutes to diesel ones for commercial logistics operations in cities. During the project, in the eight largest cities of Europe, 10 urban logistics operators tested over 80 electric vehicles, ranging from 18-ton electric trucks to small-car-derived electric vans. The project proved that the electric propulsion technology is mature enough to be included in commercial vehicle fleets for urban logistics operations.

Based on Shape, Straight Cables Dominate Market

Straight cables dominate the market with a share of around 65%, attributed to the fact that most public charging stations use them cables because of their low maintenance requirements, ease of installation, and low purchase cost.

Moreover, the coiled category is expected to grow over the coming few years, because these variants aid in the prevention of a tripping hazard as they do not lie across the surface. Moreover, less storage space is required for them, and they are also considered long-lasting. In addition, the price of coiled cables is less than the straight ones, which is further fueling their usage.

On Basis of Application, Private Charging Category Dominates Market

On the basis of application, private charging dominates the market with a share of around 70%, as most EVs are charged at owners’ homes. The majority of the private EVSE is slow-charging variants, to which the vehicle can be plugged to charge through the night.

The public charging bifurcation is rapidly growing because of the rapid installation of EVSE at airports, shopping malls, parking lots, hotels, government offices, highways, and taxi stands. Moreover, most public chargers take less time to replenish the EV battery, accomplishing the task at high voltages. In the coming years, the rising demand for EVs to cover longer distances on a single charge, which is of special significance to delivery and public transportation firms, will drive the adoption of fast public chargers and their associated high-voltage cables

| Report Attribute | Details |

Market Size in 2023 |

USD 1,287.3 Million |

Market Size in 2024 |

USD 1,484.3 Million |

Revenue Forecast in 2030 |

USD 3,775.6 Million |

Growth Rate |

16.8% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Application; By Type; By Charging Level; By Connector; By Diameter; By Jacket Material; By Length; By Mode; By Power Supply; By Shape; By Region |

Explore more about this report - Request free sample

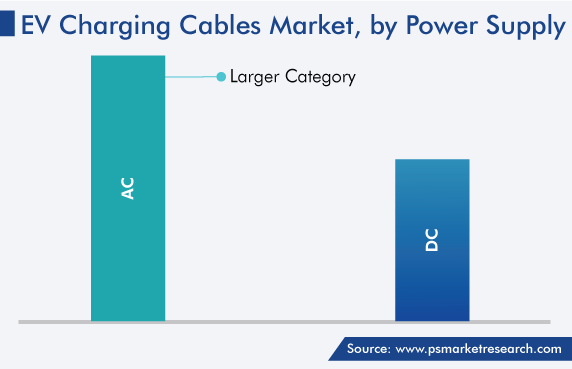

AC Power Supply Holds Larger Share

The AC category holds the larger share of around 60%, as AC supplies 120 V of power and a charging speed of 22 kW. Slow AC chargers are widely used in residential and semi-commercial areas and, thus far, outnumber fast DC variants because of their low cost of installation. Along with this, more preference is given to wall-mounted EV chargers than floor-mounted ones because of the lower cost of underground electrification entailed by the former.

The DC bifurcation is expected to grow at a CAGR of 17.0%, primarily due to the advancements in public charging stations. Since DC chargers take less time to charge the vehicle, they offer operational flexibility to fleet owners and those traveling long distances on their own EVs. As per the U.S. Department of Transportation, DC fast chargers can replenish 80% of the EV battery charge in around an hour.

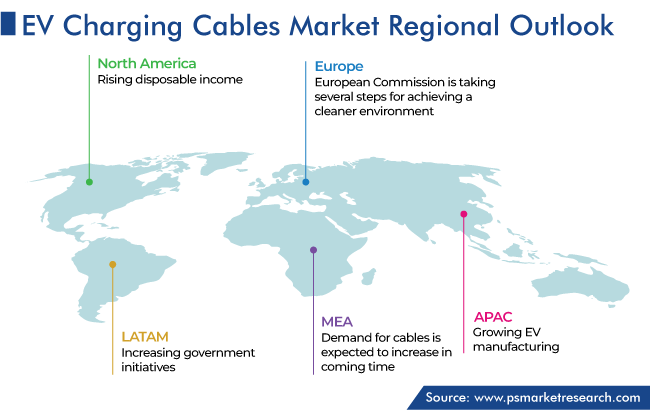

APAC Makes Largest Contribution to Global Revenue Generation

APAC has the leading position in the EV cables market, and it will hold the same position till 2030, with a value of around USD 1.8 billion. This is majorly attributed to the rising disposable income and the presence of key players.

In APAC, China holds the leading position, and it will grow at a CAGR of 17.2% during the forecast period. This is because of the easy availability of EVs, charging stations, and charging cables and the continuous advancements in automotive technologies.

The market is also growing in South Korea, Japan, and India because of the rapid adoption of electric vehicles. This is because their governments are taking several initiatives to encourage the adoption of electric vehicles and the development of infrastructure for their charging. For example, the Chinese government offers subsidies on their purchase, and the Indian government has announced plans to mandate their use in certain industries.

The Indian government has also set an overall target of having 30% of all vehicles be electric by 2030. The domestic demand for electric vehicles in China is, similarly, driven by the substantial government subsidies, national gasoline/diesel vehicle replacement targets, and municipal air quality mandates. Therefore, the increasing number charging stations is expected to fuel the growth of the market across the region.

The electric vehicles market in other regions is still in its nascent phase and depends largely on government policies. The comparatively higher upfront costs, underdeveloped value chain, and presence of few EV manufacturers have limited sales in these regions. However, OEMs in are investing heavily in the development and sale of electric vehicles, which is expected to boost the market growth during the forecast period.

Low Operating and Maintenance Cost of Electric Vehicles Boost Market Advance

Apart from polluting the air, fossil-fuel-based vehicles possess higher maintenance and operating costs than electric vehicles. This is because they need changes in oil, spark plug replacements, emission checks, fuel filter retrofitting, and various other efforts. On the other hand, EVs do not have many of these components, which makes their operations cost-effective. Moreover, many of them use regenerative braking, which aids in reducing the wear and tear on brakes, as well as in saving energy.

Along with this, the cost of fuel forms around 35% of the total operational expenses of automobiles with an internal combustion engine. And, since BEVs do not need fuel, their operation becomes even more cost-effective, which ultimately boosts the demand for charging cables.

Stringent Emission Norms and Declining Prices of EV Batteries also Drive Market

In the past few years, the support for BEVs has grown significantly as a means to limiting the emission of greenhouse gases and their effect on the environment. The European Commission is taking several steps for achieving a cleaner environment, setting various air quality and EV sales targets for member nations. The targets call for a 55% reduction in overall GHG emissions from the levels recorded in 1990 by 2050; a 20% reduction had already been achieved in 2020.

Since the public transportation system is an integral part of the daily life in developing countries, it is a large contributor to the rising pollution levels here. To curb this problem, governments are actively investing in clean-energy transportation systems, thereby offering lucrative opportunities to electric vehicle and EV component manufacturers, as well as EVSE installers and operators. For instance, in India, the government provides incentives for the in-house R&D and manufacturing of electric vehicles, in order to make them cost-effective for people.

Key Players in EV Charging Cables Market Are:

- Leoni AG

- Chengdu Khons Technology Co. Ltd.

- Phoenix Contact

- Aptiv Plc

- BESEN-Group

- General Cable Technologies Corporation

- Dyden Corporation

- TE Connectivity Ltd.

Report Breakdown

The study uncovers the biggest trends and opportunities in the EV charging cables market, along with offering segmentation analysis at the granular level for the period 2017 to 2030.

Applications of EV Charging Cables

- Private Charging

- Public Charging

Types of Cables

- Normal

- High-Power

- Liquid-Cooled High-Power

Charging Level

- Level 1

- Level 2

- Level 3

Connector Types

- Type 1

- Type 2

- CCS1

- CCS2

- CHAdeMO

- GB/T

- NACS/TESLA Connectors

Diameter of Cables

- <10 mm

- 10–20 mm

- >20 mm

Jacket Material

- All Rubber

- Thermoplastic Elastomer (TPE)

- Polyvinyl Chloride (PVC)

Length of Cables

- 2–5 Meters

- 6–10 Meters

- >10 Meters

Charging Mode

- Mode 1 & 2

- Mode 3

- Mode 4

Power Supply

- AC

- DC

Shapes of Cables

- Straight

- Coiled

Regions/Countries Analyzed

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

The market for EV cables will reach USD 3,775.6 million by 2030.

The EV cables industry future CAGR is 16.8%.

The rising EV sales are propelling the market for EV cables.

Straight variants sell more in the EV cables industry.

Private charging dominates the market for EV cables.

Players in the EV cables industry are launching new products.

APAC is the largest market for EV cables in 2023.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws