Report Code: 11679 | Available Format: PDF | Pages: 220

Electric Bus Charging Station Market Size and Share Analysis by Type (Depot Charging, Opportunity Charging, Inductive charging), Power (<50 kW, 50-150 kW, 151-450 kW, >450 kW), Charger (Off-Board, On-Board) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 11679

- Available Format: PDF

- Pages: 220

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Electric Bus Charging Station Market Statistics

| 2023 Market Size | 2024 Market Size | 2030 Market Size | 2024-2030 CAGR | Nature of Market |

| USD 3,116.6 Mn | USD 4,035.3 Mn | USD 19,906.9 Mn | 30.5% | Consolidated |

Key Information Available in this Report

|

|

|||

Major Players

Market Analysis

The electric bus charging station market was valued at USD 3,116.6 million in 2023, witnessing a massive compound annual growth rate (CAGR) of 30.5% between 2024 and 2030.

This market is being driven by the surging deployment of electric buses in order to adopt the global sustainable landscape along with a futuristic approach by governments in allowance with their respective policies to switch to a greener and hybrid transportation solution regarding electric bus infrastructure development and surging investments for the same.

- Moreover, electric bus charging systems generally operate on a crucial scale stabilizing the grid by managing the demand for electricity. These systems are well equipped with quick facilitation between plug-in electric vehicles and power outlets, enabling easy and safe charging of vehicle batteries.

- Furthermore, due to this advantage, various automotive and electric component manufacturers are collaborating to enhance electric vehicle charging infrastructure to meet the increasing demand for electric vehicles.

- Additionally, governments have been extra conscious about adopting an electric vehicle approach, as a result, some countries have taken measures to encourage the use of electric buses to curb environmental concerns like high fuel consumption and increasing greenhouse emissions.

- For example, India has launched FAME Phase 2 to promote the rapid introduction of hybrid electric passenger vehicles by incorporating the necessary infrastructure. In order to support this approach, the Indian government has also set up lucrative incentives to promote electric vehicles in the country.

- Several incentives such as tax rebates, grants, and subsidies are the driving force launched by governments, in order to develop electric bus infrastructure.

Increasing Advancement in E-Mobility

- E-mobility is rapidly changing the passenger vehicle landscape and playing an important role in the development of the electric bus charging station market. The transformative trend encompasses a wide range of electric vehicles (EVs), with electrical buses emerging as a superior solution for sustainable urban transport.

- The rise of e-mobility can be seen propelling from the last few years, due to the increasing concerns for environmental sustainability steering the whole world toward a cleaner and greener landscape.

- E-buses being electrical and supported by green renewable batteries can be seen perfectly aligned with zero tailpipe emission with zero footprints. Thus, it plays a pivotal role in the advancement of e-battery technology with the development of specific bus charging stations.

- As electric buses generally use high-capacity batteries; therefore; in order to make them functional, more practical, and cost-effective, there is a growing need for developing more refined and practical bus charging stations.

- In addition, the rise of the market beyond the public transit agencies creates a more overwhelming demand for electric bus charging stations and associated infrastructure.

- For example, in Shenzhen, China, public transport was able to claim the reduction of fossil fuel by 95%, accounting for an overall reduction of CO2 emission by 20% just by the use of electric buses and EVs.

Emerging Innovation with AI and IoT

- Developments in technologies such as artificial intelligence and internet of things (IoT) have opened new capabilities for the bus charging market.

- With the integration of these high-end technologies, it has become easier to perform functions such as real-time monitoring, remote management of charging stations, and tracking the lower limit and the upper limit of electricity, hence providing valuable insights serving as a major and broader growth-inducing factor.

- Moreover, the employment of a more optimized and advanced smarter grid enables the possibilities to serve the advantages such as highly optimized electric flow in the charging stations, thus reducing the operation costs and accelerating the market growth.

- Furthermore, the ongoing advancements in EV charging technology, such as fast charging solutions, wireless charging, and well-equipped smart charging management systems, are enhancing the effectiveness and efficiency of electric bus charging stations.

Depot Charging Holds the Largest Market Share

Depot charging can be stated as one of the most significant components of bus charging infrastructure. It plays a pivotal role in the operation and management of electric bus fleets. This method generally works with recharging electric buses while they are parked at depots or bus terminals. Additionally, depot charging stations have higher performance and longer charging times, as they aim to fully recharge the batteries of buses to ensure sufficient cruising range for daily operations.

Moreover, depot charging stations are generally overnight charging stations when the buses are not in service. These stations are usually less complex and expensive to install as compared to the other highly developed on-route or fast charging stations.

Furthermore, various other factors such as reduced impact on the grid, lower maintenance cost, effective fleet management, and positive battery management drive this category to hold considerable importance in the market.

Besides this, inductive charging is the new emerging and evolving technology for charging batteries. It is used in wireless charging solutions for electric buses, eliminating the need for wire, thus making it more safe and secure without being exposed to conductors. It transfers electrical energy between a charging pad embedded in the floor and a receiver installed in the bus, eliminating the need for any physical contact.

During the analysis, we have analyzed below types of charging stations:

- Depot Charging (Largest Category)

- Opportunity Charging

- Inductive Charging (Fastest-Growing Category)

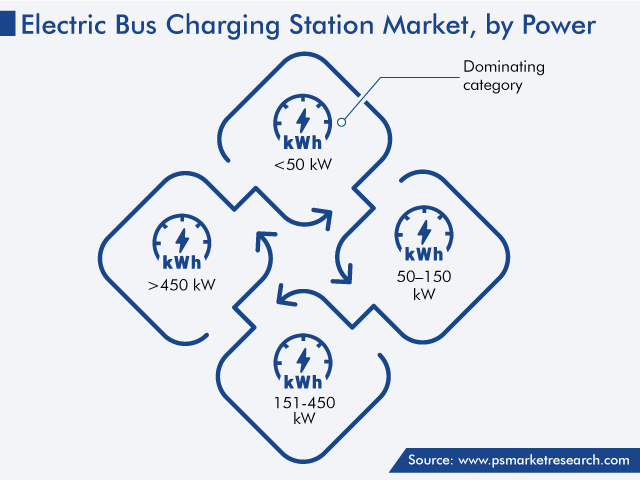

Less Than 50 kW Grasping the Highest Revenue

Among the different power level infrastructures, less than 50 kW charging stations grasped the market revenue worth around $2 billion in 2023. This type of charging station is generally installed in facilities where the buses are charged overnight or during extended layover. Charging infrastructure in this category generally supports slow charging suitable for electric buses carrying lower mileage requirements.

Below listed power ranges of charging stations are covered in the report:

- <50 kW (Largest and Fastest-Growing Category)

- 50–150 kW

- 151–450 kW

- >450 kW

Onboard Category To Witness a Higher CAGR

- The onboard category under the service segment is expected to witness a higher compound annual growth rate of 35% in the coming years.

- This can be ascribed to embedded charging equipment, which makes it easier to install charging panels directly on electric buses. This system includes chargers, batteries, and inverters clubbed to bus design.

- Moreover, the simplified infrastructure used in these charging devices helps in eliminating the need for external extensive time taking charging stations at depots along long routes.

- Additionally, the onboard charging is more suitable for slower-charging electronic buses since it converts the alternative current (AC) power from the smart grid into direct current (DC).

- This type of charging station is often used in shorter routes, where the charging can be planned according to the bus schedules.

Two types of chargers are covered in the report:

- Off-Board (Larger Category)

- On-Board (Faster-Growing Category)

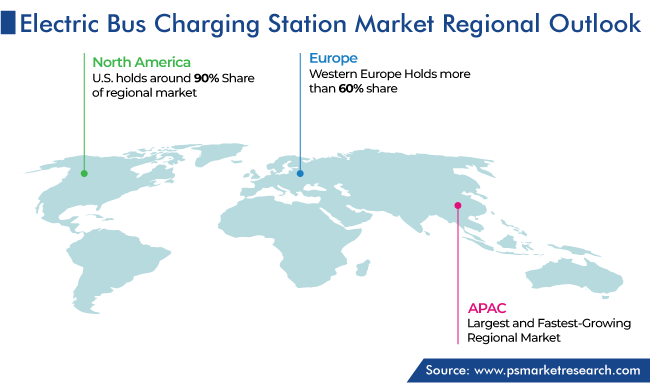

Asia–Pacific (APAC) Dominates the Global Market

Geographically, Asia–Pacific (APAC) contributed to the highest revenue to the bus charging station market, due to the large-scale development and usage of electric buses in China along with India and South Korea. Moreover, the market is also expected to witness the fastest growth, advancing at a CAGR of 33%, during the forecast period. This growth in the region can be ascribed to governments’ funding like tax breaks, subsidies for electric bus purchases, lower tariffs on importing batteries for electrical passenger vehicles, and more sustainable traveling policies adopted by the governments.

For example, in India, the Government of India contracted around USD 10 billion in August 2022 to acquire 5000 electric buses by 2030. In addition, the Delhi Transport Corporation stated that it will add around 8000 buses to the National Capital Territory (NCT) by 2025.

Similarly, China is a major player in the global electric bus market, operating 98% of all electric buses worldwide. Also, China is expected to maintain its dominance in the forecast period as well. This is due to widespread subsidies and national regulations for the electrification of its transportation sector.

Moreover, the North American market is witnessing steady growth. This is due to governments’ supportive measures, incentives, and growing environmental awareness, which are driving the investment in charging infrastructure in major cities.

Furthermore, the European electric bus charging infrastructure market is driven by strong government initiatives, ambitious emission-reducing targets, and a focus on sustainable public transport. Countries such as Norway, the Netherlands, and Germany have introduced charging stations for electric buses on a large scale, contributing significantly to market growth in the region.

Regions and countries studied in the report include:

- Asia-Pacific (APAC) (Largest and Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Europe

- Germany (Largest Country Market)

- U.K. (Fastest-Growing Country Market)

- France

- Italy

- Spain

- Rest of Europe

- North America

- U.S. (Larger and Faster-Growing Country Market)

- Canada

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Electric Bus Charging Station Companies News

- In September 2022, ABB Emobility joined manufacturing operations in countries like Columbia and Carolina to develop large-scale charger-producing units along with the creation of 100 new jobs.

- In August 2022, Siemens and MAHILE Group entered into a collaboration on a wireless charging system for electric vehicles. This collaboration was bounded by the commitments of both the organization to develop and test comprehensive electronic infrastructure and automotive engineering systems. These companies together focused on inductive charging for the upcoming future demands.

Electric Bus Charging Infrastructure Companies:

- Heliox B.V.

- Ekoenergetyka-Polska Sp. z 0.0.

- Powerdale NV

- JEMA Energy S.A.

- Bombardier Inc.

- Schunk Carbon Technology

- Siemens AG

- ABB Ltd.

- POTEVIO CORPORATION

- Advanced Vehicle Manufacturing Inc.

- Starcharge Energy Pte. Ltd.

- Proterra Inc.

- Qingdao TGOOD Electric Co. Ltd.

- Furrer+Frey AG

- ALSTOM Holdings

- ChargePoint Inc.

- BYD Motors Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws