Western Europe Heavy Ground Transportation Vehicles Market Future Prospects

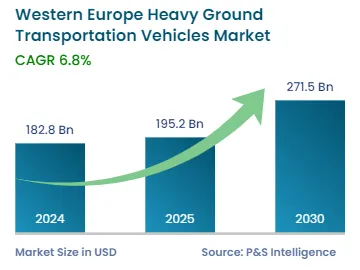

The Western European heavy ground transportation vehicles market size is estimated to have stood at USD 182.8 billion in 2024, which is expected to progress at a CAGR of 6.8% during 2024–2030, to reach USD 271.5 billion by 2030.

This is ascribed to the rise in urbanization rate, innovations in automotive technologies, and an increase in trade activities in the region. Additionally, the push for electrification and the evolution of digital technologies are creating new use cases of advanced trucks and trailer telematics.

With the continuous expansion in HDV model accessibility and variety, consistent improvements in batteries and power modules, and a decrease in the cost of batteries and other electric transmission components, many producers have come up with designs to deliberately eliminate combustion engines from the HDV sector by 2040. Additionally, a large number of automakers in Europe have announced short-term targets for zero-emission HDV sales from 2025 to 2030.

Zero-emission HDV uptake is expected to significantly increase over the next decade, driven by the EU-wide regulations regarding pollution reduction. Additionally, several companies in this region, such as AB Volvo, Mercedes-Benz Group AG, and Traton Group, are investing in R&D and launching new vehicles.

In addition, the European population is growing continuously, as is the number of passenger and commercial vehicles in use. For instance, with a population of 83.2 million, Germany is the largest consumer market in the EU. The significance of the German market goes well beyond its borders.