Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 59.4 Billion |

| 2025 Market Size | USD 73.5 Billion |

| 2032 Forecast | USD 360.6 Billion |

| Growth Rate(CAGR) | 25.5% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 11594

This Report Provides In-Depth Analysis of the Commercial Electric Vehicle Market Report Prepared by P&S Intelligence, Segmented by Propulsion (BEV, HEV, PHEV, FCEV), Vehicle Type (Bus, Truck), Battery Type (LFP, Li-NMC), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 59.4 Billion |

| 2025 Market Size | USD 73.5 Billion |

| 2032 Forecast | USD 360.6 Billion |

| Growth Rate(CAGR) | 25.5% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

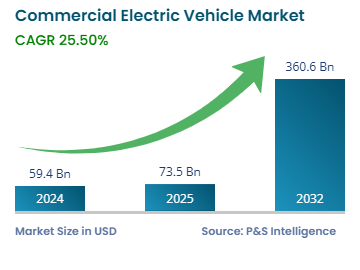

The commercial electric vehicle market size stood at USD 59.4 billion in 2024, and it is expected to grow at a CAGR of 25.5% during 2025–2032, to reach USD 360.6 billion by 2032.

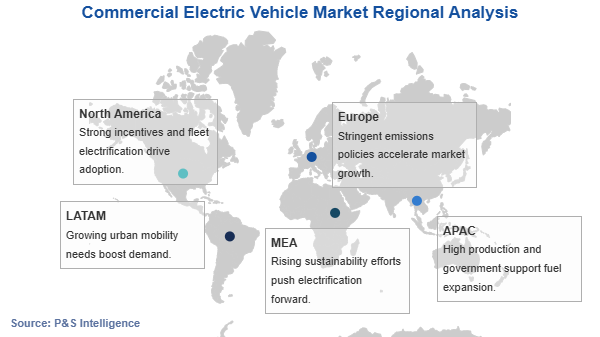

The declining cost and improving operational efficiency of batteries and the long-term cost benefits of EVs are the major factors driving the market growth. Along with these, the growing concerns over greenhouse gas (GHG) emissions and increasing government support, in the form of grants and subsidies, for such vehicles are expected to benefit the market during the forecast period.

Furthermore, all the big cities in China are substantially polluted. The government of China is, thus, focusing on improving the air quality by taking several systematic steps, which include strict emission norms and the replacement of conventional fuel-based commercial vehicles with electric variants. In most of the cities in the country, the largest source of pollution is emissions from automobiles. Therefore, the government is replacing them with eco-friendly vehicles. Thus, the auto industry in China is rapidly turning all-electric, and China’s vehicle production technologies are evolving faster than the rest of the world.

Globally, countries are cutting their traffic-related emissions and introducing thresholds for commercial automobiles. For instance, the European Union (EU) has proposed that the average carbon dioxide emissions from heavy-duty commercial vehicles in 2030 be at least 30% lower than in 2019. Major European manufacturers are, hence, producing such vehicles, in order to achieve the stated target.

BEVs held the largest market share, over 60%, in 2024, in terms of value, and it will also witness the higher CAGR over the forecast period. This is owing to the strong government support, in the form of subsidies, incentives, and other financial benefits, to promote the usage of eco-friendly vehicles.

China is a major market for commercial BEVs. According to the newly released third phase of the subsidy policy of China, bus operators receive higher subsidies on BEVs compared to PHEVs. Besides, major manufacturers are focusing on adding BEVs to their product portfolios, which is further boosting the market growth across the nation.

Moreover, the North American market in this category is projected to witness significant growth during the forecast period owing to the stringent emission norms and tax rebates, grants, and subsidies for such vehicles. Owing to these reasons, in the region, the U.S. is the larger market for battery-powered buses and trucks.

Several other initiatives have been also taken by the government of the U.S. to encourage the implementation of electric buses and trucks in the country, including exemption from emission tests, vehicle inspections, and toll charges. Furthermore, the key players in the U.S. are developing new bus and truck models with enhanced capabilities and improved performance. Thus, the developments in models, complemented by the installation of simplified and quicker charging systems, are expected to result in the replacement of conventional buses and trucks with their electric counterparts.

Additionally, in order to ease the burden of the high upfront costs, new business models are being focused upon, such as commercial vehicle sharing, battery leasing, and joint procurement, which are further enhancing the market growth potential.

These propulsions were analyzed:

Electric buses are the larger category because of the huge demand for electric buses by city governments and public transit firms. In addition, the long-term cost benefits of electric buses and increasing replacement sales are other reasons for the rising sales of electric buses. In this regard, national and state governments in India and China are highly significant as they operate and have ordered thousands of electric buses. For instance, Delhi Transport Corporation (DTC) induced 350 electric buses in February 2024 and another 320 in July.

Electric trucks will have the higher CAGR during the forecast period, of 28%. This will be due to the rapidly increasing freight demand across the globe and significant economic growth in developing countries, such as China. For instance, in August 2024, AB Volvo received an order from DVS for 300 electric trucks. In all, DSV plans to have over 2,000 electric trucks in its fleet by decade-end.

These vehicle types were analyzed:

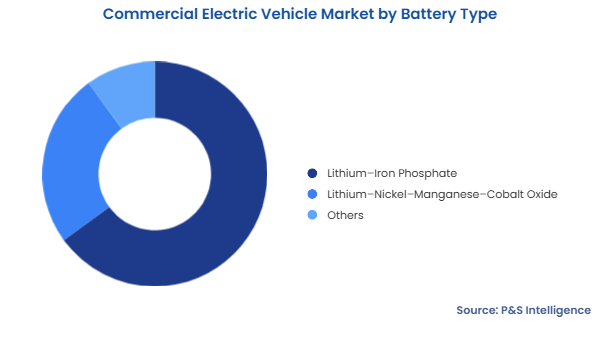

The LFP category dominated the commercial electric vehicle market in 2024 with 65% value share. LFP batteries are safer than other batteries available in the market and are therefore more preferred for heavy-duty electric buses and trucks.

During the forecast period, the fastest growth in the market is expected from NMC battery-powered commercial electric vehicles. With increasing investments for the development of advanced NMC batteries, the safety levels offered by these batteries are expected to come at par with those offered by LFP batteries.

These batteries were analyzed:

Drive strategic growth with comprehensive market analysis

The APAC commercial electric vehicle market held the largest share in 2024, of 50%, and it will also witness the highest CAGR, of 27%, during the forecast period. Much of the market growth in the region can be attributed to the sales in China. The Chinese government’s commitment to increase the share of such buses in the transportation system of the country, reducing battery prices, and improving operational efficiency are some of the major factors driving the sale of such automobiles in the country.

As per the International Energy Agency (IEA), 50% of the heavy commercial vehicle sales in China in 2023 were electric. The country also had 85% of the EV fast chargers in the world in 2023.

India is also adopting concrete policies to include electric buses in government and private fleets. The government hopes to increase the number of electric buses in public fleets by 38,000 by 2027. In July 2024, Maharashtra had 2,111 operational electric buses, Delhi had 2,011, Karnataka 1,195, Gujarat 894, and Uttar Pradesh 758. As per the IEA, India also funded the installation of 7,000 EV fast chargers in 2023.

These regions and countries were analyzed:

The regions and countries analyzed for this report include:

The market for commercial electric vehicles valued USD 59.4 billion in 2024.

The commercial electric vehicle industry is driven by the rising environmental concerns and government support for EV purchase and production.

The market for commercial electric vehicles is fragmented.

APAC dominates the commercial electric vehicle industry.

BEVs hold the largest share in the market for commercial electric vehicles.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages