Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 26.8 Billion |

| 2030 Forecast | USD 56.7 Billion |

| Growth Rate(CAGR) | 13.3% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12565

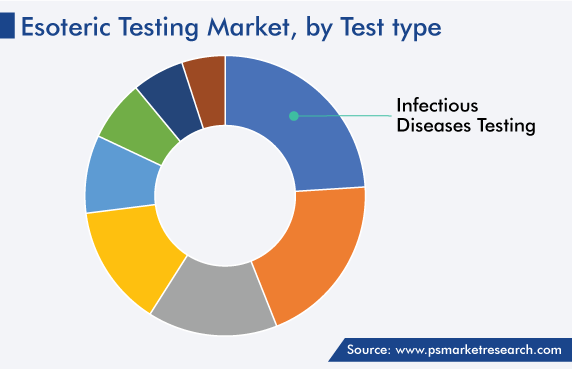

Get a Comprehensive Overview of the Esoteric Testing Market Report Prepared by P&S Intelligence, Segmented by Test Type (Infectious Diseases Testing, Endocrinology Testing, Oncology Testing, Genetics Testing, Toxicology Testing, Immunology Testing, Neurology Testing), Technology (Chemiluminescence Immunoassay, Enzyme-Linked Immunosorbent Assay, Mass Spectrometry, Real-Time PCR, DNA Sequencing, Flow Cytometry), End User (Independent & Reference Laboratories, Hospital-Based Laboratories), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 26.8 Billion |

| 2030 Forecast | USD 56.7 Billion |

| Growth Rate(CAGR) | 13.3% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global esoteric testing market generated revenue of USD 26.8 billion in 2024, which is expected to witness a CAGR of 13.3% during 2024–2030, reaching USD 56.7 billion by 2030. This will be due to the rising prevalence of chronic, infectious, and rare genetic diseases, as well as the increasing geriatric population. Additionally, the emergence of advanced technologies, such as gene mass spectrometry and gene sequencing, which enable confident diagnoses and address unmet diagnostic needs; and the increase in the number of tests per patient are driving the expansion of the global market.

Moreover, an increase in the demand for early disease diagnosis, using specialized tests; growth in the utilization of the esoteric DNA sequencing technology in precision medicine, the awareness of which continues to rise; and an increase in the funding and research grants for the creation of novel esoteric tests lead to the market expansion. By using causal machine learning, which is one of the AI technologies, medical diagnosis accuracy is being improved, as providing an accurate and cost-effective diagnosis has been a major challenge for the world's healthcare systems.

The industry has been witnessing a favorable effect of the COVID-19 outbreak too. The COVID-19 pandemic put a strain on healthcare systems around the world, but it has also increased the need for infection screening centers and real-time polymerase chain reaction (RT-PCR) tests to diagnose COVID-19. Moreover, the challenge in front of biotechnological and pharmaceutical companies due to the pandemic in finding a potential vaccine has been driving the acceptance of the esoteric testing approach.

Based on test type, the infectious disease testing category accounted for the largest share, of more than 24%, in the market, due to the rising demand for technically advanced molecular diagnosis methods, itself on account of the increasing burden of infectious diseases. Additionally, the improvements in the healthcare infrastructure of developing countries have led to the large share of the category.

The genetic testing category is expected to grow with the highest CAGR, due to the advancing genetic testing technologies, growing count of genetic disorder patients, increasing awareness of genetic testing for cancer screening and prenatal screening, and government support for fast and accurate genetic diagnoses.

Furthermore, oncology testing is expected to show significant growth in the esoteric testing market during the forecast period. The growing significance of early cancer identification and treatment will favorably affect the market expansion in this sector. Cancer is ranked the second-biggest cause of death. Globally, nearly 10 million new cases of cancer were reported in 2022. Lung, breast, and prostate cancers are the three most-prevalent types of cancer. Therefore, the rising R&D spending in the field of oncology would increase the usage of enhanced tests.

Based on technology, the market is categorized into chemiluminescence immunoassay, ELISA, mass spectrometry, RT-PCR, DNA sequencing, flow cytometry, and others. Among these, CLIA accounted for the largest revenue share for esoteric testing market, and it is further expected to maintain its dominance in the future. This is owing to his high performance, in terms of precision, efficacy of diagnosis, and ability to detect analytes present in minute quantities. Other than these reasons, it is predicted that the increase in the research and development efforts related to the diagnosis of autoimmune disorders, where CLIA is heavily utilized to evaluate the symptoms, will accelerate the category's growth in the future.

However, the DNA sequencing category is expected to witness the fastest growth during the forecast period, owing to the rising prevalence of infectious diseases, including hepatitis, dengue, and AIDS, along with neurological disorders and cancer. Along with this, the booming geriatric population and the rising demand for affordable diagnostic testing services will propel the advance of this category.

Moreover, the usage of ELISA will grow significantly during the prediction time frame. One of the main factors influencing the demand for this test is its ability to recognize numerous disease antigens. For instance, indirect ELISA-based assays are widely used to test the blood or saliva for HIV. Thus, the growing use of ELISA to identify diverse disease-causing agents creates a sizable opportunity for the market participants to make investments for the creation of novel ELISA kits.

Drive strategic growth with comprehensive market analysis

Geographically, North America held the largest share, of around 36%, in 2022, and it is expected to grow at a robust CAGR during the review period, due to the high per capita income and healthcare expenditure, vast population of the elderly and chronic disease patients, and the presence of leading companies in the region. Moreover, the increase in the number of diagnostic tests and technological advancements in esoteric tests are the other key factors aiding the growth of the market in the region.

Furthermore, Canada is showing significant growth in this market due to its advancing healthcare infrastructure, rising number of government initiatives for making diagnostic services accessible and affordable, surging demand for ELISA and RT-PCR tests, and the presence of key players providing the associated assay kits, reagents, and testing equipment.

Specifically, companies are launching advanced products in the region for the early detection of cancer. For instance, Myriad Genetics Inc. introduced the EndoPredict test for patients with ER+ HER2-early-stage breast cancer in the U.S. in March 2021.

Moreover, companies are acquiring providers of the related solutions to enhance their presence. For instance, Laboratory Corporation of America Holdings announced plans to acquire the autoimmune business unit of Myriad Genetics in May 2021. Similarly, Quest Diagnostics signed an agreement with GRAIL in February 2021 for the former to supply collected specimens for testing via Galleri, a blood test kit for the early diagnosis of certain cancers.

Moreover, Europe will show significant growth in this market due to the advancement in the regional countries’ health infrastructure, rising incidence of communicable diseases, and favorable policies for reimbursement. The European Commission estimates that between 27 and 36 million persons in Europe are affected by uncommon diseases. Additionally, the Centers for Disease Control and Prevention estimates that there were about 54,285 salmonella cases in 2017.

In the continent, the adoption of esoteric testing methods is rising swiftly in Germany, due to an increase in the prevalence of degenerative diseases, expansion of screening practices, and technological developments in specialized screening methods. Moreover, with the growing awareness of precise tests for diseases among the population, as a result of the government-sponsored programs, healthcare personnel are adopting these solutions for accurate and early detection.

APAC is expected to progress with the highest CAGR during the forecast period. This is primarily due to the increasing awareness of esoteric tests, rising focus of companies on expanding their operations in countries such as India, Australia, and South Korea, and booming prevalence of chronic ailments.

Based on Test Type

Based on Technology

Based on End User

Geographical Analysis

The market for esoteric testing valued USD 26.8 billion in 2024.

The esoteric industry is driven by the rising incidence of chronic, genetic, and infectious diseases.

The combination of RT-PCR and ELISA is trending in the market for esoteric testing.

North America holds the largest share in the esoteric testing industry, and APAC will witness the highest CAGR.

Infectious disease testing dominates the market for esoteric testing.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages