Market Statistics

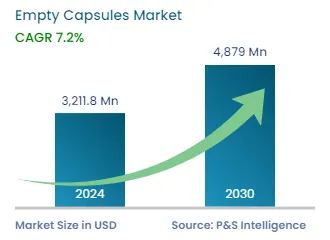

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,211.8 Million |

| 2030 Forecast | USD 4,879 Million |

| Growth Rate(CAGR) | 7.2% |

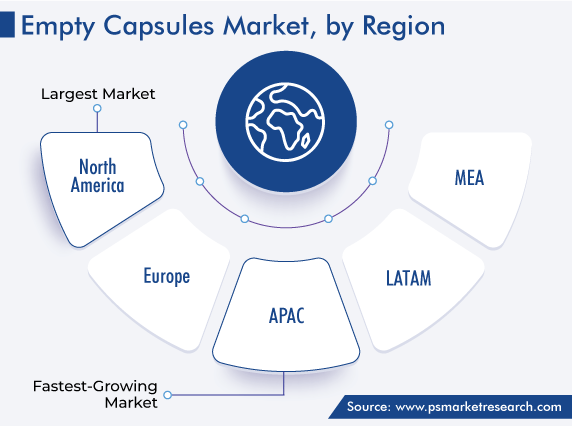

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12560

Get a Comprehensive Overview of the Empty Capsules Market Report Prepared by P&S Intelligence, Segmented by Type (Gelatin Capsules, Non-Gelatin Capsules), Functionality (Immediate-Release Capsules, Sustained-Release Capsules, Delayed-Release Capsules), Application (Antibiotic Drugs, Dietary Supplements, Antacid and Antiflatulent, Cardiovascular Therapy Drugs), End User (Pharmaceutical Industry, Nutraceutical Industry, Cosmetics Industry, Research Laboratories), and Geographic Regions. This Report Provides Insights from 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,211.8 Million |

| 2030 Forecast | USD 4,879 Million |

| Growth Rate(CAGR) | 7.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global empty capsules market generated revenue of USD 3,211.8 million in 2024, which is expected to witness a CAGR of 7.2% between 2024 and 2030, to reach USD 4,879 million by 2030. This can be ascribed to the growing adoption of encapsulated drugs among the geriatric population and the resulting high demand for empty shells in the pharmaceutical, nutraceutical, and cosmeceutical industries. Moreover, the rising count of R&D initiatives by the players and governments for new drugs and molecules, increasing number of clinical trials, and advancing drug delivery technologies are propelling the market.

There is an incessant surge in the need for effective drugs due to the rising geriatric population and increasing incidence of related chronic illnesses. The majority of the senior population prefers capsules because they are simple to swallow, dissolve more quickly than other oral dosage forms, and do not cause as much gastrointestinal discomfort.

In this regard, the shifting consumer preference toward capsules from tablets is a major factor behind the market growth. This is owing to the former’s fast disintegration, which results in quicker absorption, and the use of a tasteless and odorless gelatin coating, which makes them palatable. Moreover, the majority of the cosmeceuticals and nutraceuticals, such as CosmoPod and cod liver oil capsules, respectively, are preferred in the capsule form. The aforementioned benefits associated with capsules lead to a significant demand for empty shells in the pharmaceutical, nutraceutical, and cosmeceutical sectors worldwide.

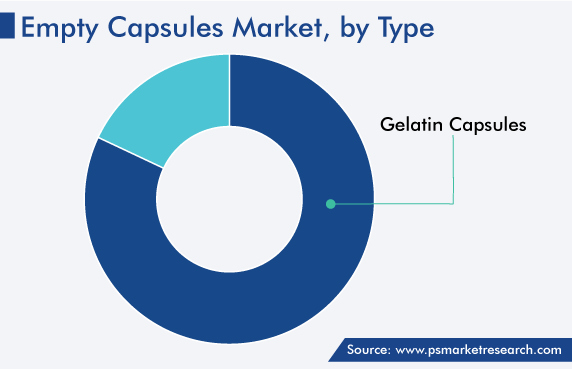

The main factors driving the empty capsules market are the rising emphasis on preventative care and the increasing commercialization of gelatin-capsule-based medication delivery systems. Therefore, based on type, gelatin capsules accounted for the larger revenue share, of more than 82%, in 2022, and this category is further expected to maintain its dominance during the forecast period.

Gelatin capsules are expected to be in a high demand because they serve as exceptional carriers that can encapsulate both hydrophilic and lipophilic medicines and offer these agents protection from degradation. They also have higher absorption rates and can serve as a matrix for effective solubilization. IR, ER, and DR formulations based on gelatin function better than traditional formulations, thus resulting in increased efficacy and, in turn, higher patient compliance.

Additionally, their low production cost than the non-gelatin form, rapid drug release, uniform mixing of the therapeutics, and formation of a barrier to atmospheric oxygen make them the preferred choice. Additionally, the easy accessibility of gelatin for the manufacturing process and the high protein content of gelatin are the other key factors that will support this category's expansion over the projection period.

Furthermore, the non-gelatin capsule category is expected to display the faster revenue increase during the forecast period. Some important considerations are the vegetarian origin of these shells, which overcomes the religious objections to capsules derived from animals; the consequent growth in the non-gelatin consumer base, and the superior stability of these vegetarian capsules compared to gelatin capsules due to the lower moisture content. Moreover, they are suitable for a variety of contents, including those that contain the aldehyde group.

The immediate-release category accounted for the larger revenue share in 2022, and it is further expected to maintain its dominance during the forecast period. This is because the immediate-release form is widely utilized for manufacturing antibiotics, antacids, painkillers, and many other kinds of drugs, owing to its advantage of the rapid onset of action. This form provides an instantaneous disintegration of the capsules in the stomach, after ingestion. Reducing the disintegration time improves the rate at which drugs dissolve. Additionally, it is widely used for manufacturing dietary supplements.

Moreover, the sustained-release category will show significant growth over this decade. This is because this variant carries out the drug release over a sustained period and provides the ability to maintain a constant level of medication within the body. Additionally, people are accepting it as it helps reduce the number of doses, which lowers expenses and improves patient compliance, especially among people with chronic diseases.

The antibiotic drugs category generated the highest revenue, of over USD 1,015 million, in 2022, and it is further expected to maintain its dominance in the future. This is owing to the increasing prevalence of different infectious diseases and chronic ailments around the world, which creates high pressure on the pharmaceutical industry and, eventually, promotes the expansion of this market.

Dietary supplements are expected to emerge as the fastest-growing category during the forecast period. This is owing to the growth in the geriatric population and the surge in the demand for immunity boosters and other nutraceutical products. In this regard, the rising awareness of personal health and wellbeing is a key factor driving the demand for vitamins and other dietary supplements.

Moreover, due to the busy schedules and evolving lifestyles, the working population worldwide struggles to meet its needs for dairy nutrients. Hence, many of these people consume supplements in the form of capsules, which propels the demand for empty shells.

Capsules containing drugs for CVDs are also witnessing an increasing demand, due to the rising prevalence of these illnesses globally. During the production of therapeutics for cardiac diseases, capsules are widely utilized, because of their fast onset of action, targeted drug delivery, and ability to withstand the acid secreted inside the body.

Drive strategic growth with comprehensive market analysis

Geographically, North America captured the largest revenue share in the empty capsules market, of around 37%, in 2022, and it is projected to grow at a robust CAGR during the forecast period. The dominance of North America can be attributed to the existence of a significant number of companies with high-volume capsule production capabilities and the use of this dosage form by a number of pharmaceutical giants. Moreover, the demand for empty capsules has increased as a result of the strengthening focus on improved pharmaceuticals and generics.

Essentially, North America dominates this market on account of the proliferation of the pharmaceutical and nutraceutical industries, rising consumer awareness pertaining to nutraceutical products, and emergence of new health-related trends in the region. Moreover, the strong government support for drug R&D and healthcare, in general, and the rising need for preventive care fuel the product demand in the region.

Additionally, because of the negative lifestyle changes in the U.S. and the resulting increase in the need for nutraceuticals for proper nutrient intake, the demand for empty supplement and vitamin capsules has increased. Similarly, the rise in the awareness on vegetarian empty shells (non-gelatin kind) and the availability of technologically advanced machines for capsule filling will drive the market in the region.

Canada will show significant growth in the North American market over the forecast period. It can be mainly attributed to the high investments being made by the key players for manufacturing pharmaceutical and vitamin tablets, as well as in strategic measures, including acquisitions and product launches, to strengthen their foothold. Moreover, the rising prevalence of all kinds of diseases and the increasing awareness of immunity, especially since the onset of the COVID-9 pandemic and considering the way it tore through the healthcare system of the region, make market players profitable in the country.

Europe is the second-largest market for empty capsules. This is owing to the rising prevalence of non-communicable diseases, such as cancer, diabetes, and heart diseases, which has increased the demand for nutraceuticals. In this regard, the ever-increasing patient pool is a strong driving force for the European market. Moreover, the demand for non-gelatin capsules in the region is rising with the growing desire for vegetable-origin capsules. Moreover, empty capsules are rising in demand in the European region due to the growing emphasis on superior pharmaceuticals, including generics.

Moreover, companies are focusing on advancing their approaches for manufacturing the capsule shells. For instance, in 2021, Nutra’V introduced a new line of capsules devoid of TiO2. These capsules, which come in both the gelatin and HPMC forms and have good machinability, provide an encapsulation alternative for component masking.

Furthermore, companies are engaging in mergers and demergers. For instance, in 2019, ACG acquired Xertecs, which creates and implements procedures, goods, and services for pharmaceutical firms all over the world. ACG's capabilities for developing innovative shells were enhanced by this purchase.

Based on Type

Based on Functionality

Based on Application

Based on End User

Geographical Analysis

The market for empty capsules generated USD 3,211.8 million in 2024.

Gelatin variants are preferred in the empty capsules industry.

North America is the largest market for empty capsules.

Antibiotic drugs are the key application in the empty capsules industry.

Non-gelatin capsules are trending in the market for empty capsules.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages