Report Code: 12899 | Available Format: PDF | Pages: 240

Crystal Oscillator Market Size and Share Analysis by Mounting Scheme (Surface-Mount, Through-Hole), Crystal Cut (AT Cut, BT Cut, SC Cut), General Circuitry (Simple-Package, Temperature-Compensated, Voltage-Controlled, Frequency-Controlled, Oven-Controlled), Application (Telecom and Networking, Consumers Electronics, Military and Aerospace, Research Measurement, Industrial, Automotive, Healthcare) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12899

- Available Format: PDF

- Pages: 240

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

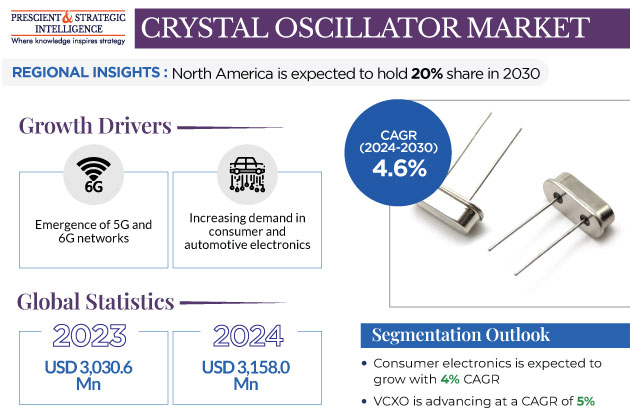

The crystal oscillator market generated revenue of USD 3,030.6 million in 2023, which is expected to witness a CAGR of 4.6% during 2024–2030, reaching USD 4,136.7 million by 2030. This is associated with the increasing demand for these instruments in consumer and automotive electronics, the emergence of 5G and 6G networks, and continuous advancements in the industrial and healthcare sectors. The growing aerospace and defense industry is also significantly contributing to the growth of the market.

Rising Product Demand in Aerospace and Defense Sector Is Driving Market

- Crystal oscillators play an essential role in aerospace and defense areas due to their high precision, reliability, and stable frequency generation.

- These characteristics are required for several essential applications, such as communications, military electronics, radar systems, navigation & guidance systems, military radar, electronic warfare systems, aircraft, spacecraft avionics, missile guidance, control systems, and test & measurement equipment.

- The main function of crystal oscillators in aerospace and defense is communication systems.

- They are an essential part of radar, radio, and satellite communication systems due to their ability to produce steady carrier frequencies, which are used to send and receive signals accurately, even if the situation is challenging or dynamic.

These oscillators are built to withstand damaging environmental conditions, including shock, vibration, radiation, and high temperatures. In order to make sure they fulfill these demands, they are put through extensive testing and qualification processes.

For precise location, navigation, and targeting, crystal oscillators provide accurate timing signals to navigation and guidance systems in missiles, drones, aircraft, and other military assets. Technological advancements further fuel the demand for reliable and customized crystal oscillators for the aerospace and defense sector.

- The ongoing developments in defense systems include satellite technology, electronic warfare systems, unmanned aerial vehicles (UAVs), and cutting-edge defense electronics.

- The aerospace and defense sectors are subject to strict requirements and higher standards for both performance and quality.

- Therefore, manufacturers of crystal oscillators for these industries prioritize products that fulfill or surpass the strict requirements.

AT Crystal-Cut Category Is Rapidly Growing

The AT crystal-cut category is rapidly growing with a CAGR of 4% from 2024-2030 in the market. This is due to their stability, reliability, and long operational life. These attributes are important in applications where component failure or downtime is not acceptable like in aerospace, communication, and defense. Several sectors are increasingly adopting AT crystals such as telecommunication which deal with the advancements towards 5G and 6G networks, the automotive industry for advanced driver assistance systems, and aerospace for accurate guidance and communication systems. These crystals also go well together with metal oxide semiconductor technology.

In comparison with other crystals, AT crystals show better stability over a wide temperature range which makes them appropriate for applications where there is a constant change in the temperature of the environment. These crystals have a wide range of frequency stability which caters to diverse applications such as in test and measurement equipment, telecommunications, and scientific instruments. Due to the increasing demand for precise timing, these crystals have become an essential part of devices that require high-frequency control.

They are commonly used in electronic devices where stability and temperature compensation are critical. The emerging demand for highly efficient electronic devices is being fulfilled by the manufacturers of smaller and more accurate AT crystals with the help of technological advancements in manufacturing. Manufacturers are continuously focusing on improving the performance and reliability of AT crystals.

Voltage Controlled Crystal Oscillator Is Rapidly Growing

Based on general circuitry, the Voltage-Controlled Crystal Oscillator (VCXO) is rapidly growing with a CAGR of 5% from 2024-2030 in the market. These crystal oscillators have a broad role in numerous electronic devices and systems that provide precise control of frequency which are adjustable by an external voltage signal. Devices such as mobile phones, wearables, tablets, and other devices contain voltage-controlled crystal oscillators which are needed for stable clock signals for connectivity and efficient operation. The tremendous growth of wireless communication technologies such as 4G, and 5G networks, where accurate frequency management is required for data transmission and synchronization and this parameter has increased the demand for VCXO.

VCXO is used for synchronization and timing in numerous industries like automotive, telecommunications, defense, and instrumentation. VCXOs are used in data centers, servers, and networking equipment for precise timing, and clock synchronization which becomes important for processing and fast transmission of data. The demand for VCXOs is going to grow in parallel with the demand for these applications.

Ongoing advancements in VCXO technology have prompted the development of smaller, more effective, and higher-performing oscillators which are meeting the demands of many sectors that need high precision and compact parts. Also, the emerging need for low-power consumption has encouraged the expansion of low-power VCXOs which target applications where power consumption is a crucial factor.

| Report Attribute | Details |

Market Size in 2023 |

USD 3,030.6 Million |

Market Size in 2024 |

USD 3,158.0 Million |

Revenue Forecast in 2030 |

USD 4,136.7 Million |

Growth Rate |

4.6% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Mounting Scheme; By Crystal Cut; By General Circuitry; By Application; By Region |

Explore more about this report - Request free sample

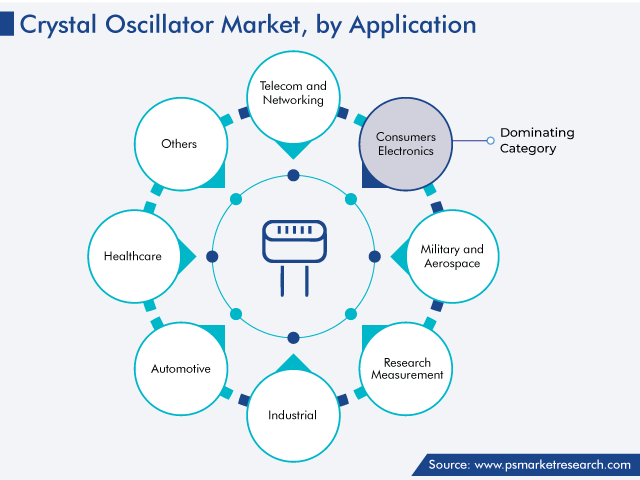

Consumers Electronics Is Fastest Category

Based on the application, consumer electronics is the fastest category and growing at a CAGR of 4% from 2024-2030 in the market. This growth is associated with the need for consumer electronic devices which require frequency stability and precise timing.

Consumer electronics have a broad variety of devices like tablets, smart home devices, smartphones, wearables, and game consoles. The continuous growth, production, and adoption of these devices have accelerated the demand for crystal oscillators for precise timing and frequency control which are crucial for maintaining clock accuracy and ensuring seamless connectivity. Modern consumers nowadays require smaller and more power-efficient devices with better efficiency which leads to the production of miniature crystal oscillators.

Smart home devices like speakers, cameras, and connected appliances need accurate timings and synchronization. Smartwatches, fitness trackers, and other wearable devices require compact size and accurate timing and this makes their reliance on crystal oscillators. There are a lot of advancements happening in game consoles and entertainment devices like audio systems and high-definition TVs. Crystal oscillators are used in these to ensure precise timing for optimal performance.

Wireless connectivity standards like Wi-Fi, Bluetooth, and NFC in consumer devices demand crystal oscillators which have a large role in maintaining synchronization for seamless communication.

Overall, the growing demand for crystal oscillators in the market is mainly attributable to quick invention and continuous release of novel consumer electronics products and increasing anticipations for high-performance and feature-packed devices.

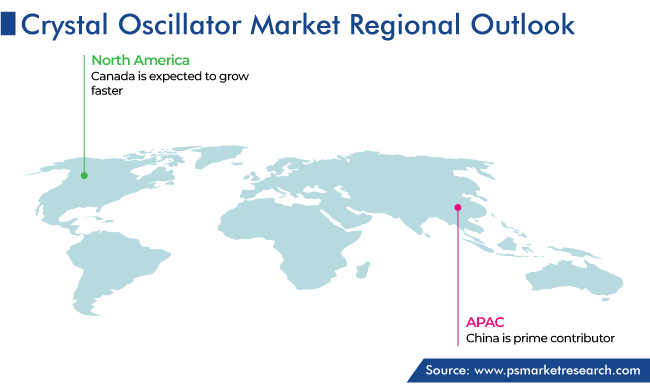

APAC Is Rapidly Growing

Geographically, APAC is rapidly growing with a CAGR of 6% from 2024-2030 in the market. The reason behind the growth is the automotive sector which uses electronic parts and contributes to the demand for crystal oscillators. The majority of automobile applications like driver assistance systems, airbag systems, and engine control systems depend on crystal oscillators.

In APAC, countries like China, Taiwan, South Korea, and Japan have strong manufacturing capabilities, specifically in electronic devices and semiconductors. The demand for tablets, wearables, smartphones, and other devices is increasing which further drives the requirement for crystal oscillators. Advanced technology, adopting novel technologies, and innovation have been the parameters of APAC countries. China is ahead of all countries in the region. Emerging countries in the regions such as India, Vietnam, and Indonesia are undergoing technological development and rapid industrialization which also adds fuel to the growth of the region.

North America Is Set To Hold Substantial Market Share

North America is expected to hold 20% share in 2030 in the market. Industry products' emerging demand is the main reason for making the region the largest in terms of shares. A lack of electronic components worldwide has also increased the prices of certain products. This creates a bright opportunity for regional market vendors.

There are major automotive manufacturers present in the region which contribute to the region’s market. Additionally, electric vehicle usage is on the rise which is helping to make growth opportunities for the vendors in the market. Further, the utilization of the Internet of Things (IoT) based devices and smartphones is increasing which ultimately enhances the demand for crystal oscillators. A regular smartphone or tablet uses up to five oscillators.

The U.S. has become the first emerging country with a potential market for crystal oscillator manufacturers. Electronic component manufacturing and semiconductor sectors produce a wide range of input devices which is required for the production of electronics.

Competitive Analysis

Currently, the major players in the market are focusing on improving the quality of quartz devices in automotive applications to compete with the advanced need for miniaturization and fulfill the expectations of consumers. Competitive strategies are used to stay ahead in the market such as reducing size, increasing stability of frequency, and meeting various industry needs in the aerospace, defense, consumer electronics, automotive, and telecommunications.

Recent Developments

In September 2023, SiTime Corporation revealed SiTime Epoch Platform to solve timing issues in the electronic sector and change the dependency of the industry on old quartz-based technology. This platform introduces oven oven-controlled oscillator (OCXO) which offers incredibly stable clock signals for network infrastructure and data centers.

In July 2023, SiTime launched the SiT5543 oscillator and extended its well-known Endura MEMS ruggedized SuperTCXO family. This temperature-controlled oscillator provides supreme stability in demanding conditions.

In July 2023, Microchip Technology allocated around USD 300 million for the expansion of its endeavors in India. India is one of the world’s swiftest-growing semiconductor industry hubs.

In June 2023, Murata Manufacturing Co Ltd launched the high-precision “XRCGE_FXA”.

In May 2022, SIWARD Crystal Technology Co Ltd had a partnership with Digi-Key Electronics, a supplier of electrical components that comprises a broad variety of SIWARD products like tuning forks, thermistors, crystals, and oscillators.

Top Crystal Oscillator Companies:

- Seiko Epson Corporation

- NIHON DEMPA KOGYO CO. LTD.

- KYOCERA Corporation

- DAISHINKU CORP.

- SiTime Corporation

- Siward Crystal Technology Co. Ltd.

- TXC CORPORATION

- HOSONIC Technology Co. Ltd.

- Murata Manufacturing Co. Ltd.

- Rakon Limited

- Vectron International Inc.

- River Eletec Corporation

- Mercury Inc.

- Microchip Technology Inc.

Market Size Breakdown by Segment

This report offers deep insights into the crystal oscillator market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Mounting Scheme

- Surface-Mount

- Through-Hole

Based on Crystal Cut

- AT Cut

- BT Cut

- SC Cut

Based on General Circuitry

- Simple-Package

- Temperature-Compensated

- Voltage-Controlled

- Frequency-Controlled

- Oven-Controlled

Based on Application

- Telecom and Networking

- Consumers Electronics

- Military and Aerospace

- Research Measurement

- Industrial

- Automotive

- Healthcare

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The industry for crystal oscillator will reach USD 3,158.0 million in 2024.

The crystal oscillator market value will reach USD 4,136.7 million in 2030.

The APAC market for crystal oscillator is growing rapidly.

The increasing product demand in the defense and aerospace sectors are the major crystal oscillator industry drivers.

VCXO is growing at a rapid CAGR in the crystal oscillator market.

Consumer electronics is the fastest-growing application in the crystal oscillator industry.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws