Market Statistics

| Study Period | 2019 - 2030 |

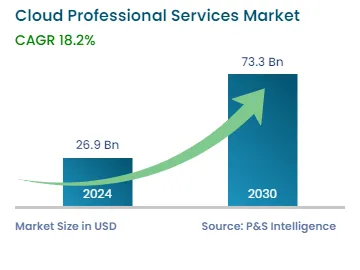

| 2024 Market Size | USD 26.9 Billion |

| 2030 Forecast | USD 73.3 Billion |

| Growth Rate(CAGR) | 18.2% |

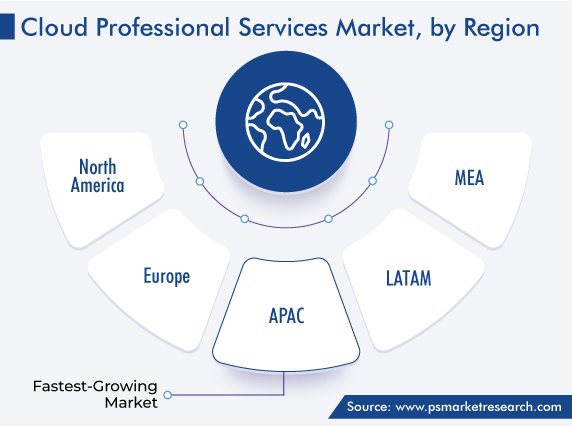

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12585

Get a Comprehensive Overview of the Cloud Professional Services Market Report Prepared by P&S Intelligence, Segmented by Service Type (Consulting, Integration & Optimization, Implementation & Migration, Application Development & Modernization), Service Model (PaaS, SaaS, IaaS), Deployment Model (Public Cloud, Private Cloud), Organization Size (SMEs, Large Enterprises), Vertical (BFSI, Retail & Consumer Goods, IT & ITeS, Telecommunications, Healthcare & Life Sciences, Manufacturing, Energy & Utilities, Government & Defense), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 26.9 Billion |

| 2030 Forecast | USD 73.3 Billion |

| Growth Rate(CAGR) | 18.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global cloud professional services market size stood at USD 26.9 billion in 2024, and it is expected to advance at a compound annual growth rate of 18.2% during 2024–2030, to reach USD 73.3 billion by 2030.

The growing popularity of cloud computing, especially with the surge in the usage of remote working models during the pandemic, is propelling the demand for cloud-based services. As a result, various companies provide cloud-based services for organizations of all sizes, to help them manage their cloud infrastructure cost-effectively. These services are provided through various tools, frameworks, and practices, which enable companies to simplify their operations, minimize the overall production cost, and reduce human errors during manufacturing.

More than 90% of the companies are choosing cloud services across the globe, and many have increased their spending on them to almost 33%. Essentially, the increasing focus of businesses across verticals on digitization is propelling the adoption of cloud-based services to enhance their agility and protect their valuable data.

Further, cloud-based services helped companies of all sizes sustain themselves during the COVID-19 period, and they would now help them recover from the lasting economic effects of the pandemic. Cloud services help companies innovate quickly, thus improving their speed to market, responsiveness, and agility. Out of every five companies, four are ready to increase their cloud budgets soon, and since the pandemic, out of every two, one has accelerated its cloud journey.

The public cloud category accounted for the larger revenue share in 2022, and it is also expected to maintain its dominance throughout the forecast period. The public cloud is provided by a third party over the public internet, which is available for everyone who wants to use it. In this approach, several resources, such as storage and other pieces of hardware, applications, and virtual servers, are available over the internet to the user, to meet their needs for scalability, pay-as-per-usage pricing strategy, and ease of deployment.

More than 80% of the businesses are using public cloud services, and more than 35% of the Indian companies are willing to spend on them. Small organizations are more willing to adopt public clouds because they help them reduce their new software, hardware, maintenance, and implementation costs.

In addition, consumer-facing companies require more elasticity and on-demand unlimited computing access, to quickly respond to the fluctuations in consumer demands. For instance, during China's Singles' Day shopping festival, e-commerce traffic can reach almost 30 times that of a normal shopping day.

Additionally, more than 65% of the small organizations' first preference is public cloud services, because of their cost-effectiveness. Moreover, almost 67% of the companies are expected to increase their spending on public cloud applications by 2023.

Globally, several companies adopted artificial intelligence and machine learning technologies to support their remotely working employees, manage their IT infrastructure, and ensure proper functioning during the pandemic. It is now a common belief that AI and ML-based cloud applications have the potential to support data insights, the automation of manual tasks, and large-scale data analytics. Hence, every year, almost 91% of the businesses invest in some form of AI for some purpose. It is also expected that more than 44% of the private-sector organizations are going to invest in AI by 2030.

Some organizations are adopting AI to improve their customer experiences via innovation and automation in financial services, OTT, communication, gaming, and other solutions.

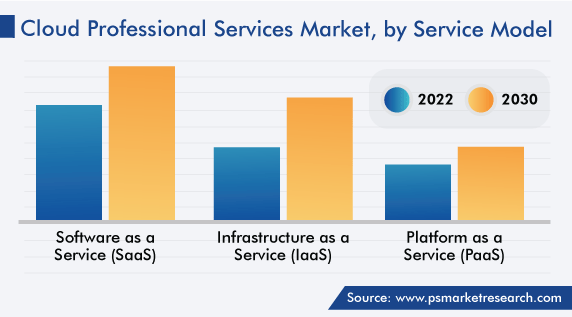

The IaaS category is expected to grow at a CAGR of 17.9% over the next few years. IaaS provides networking, servers, memory, storage, and other connected hardware and software as a cloud service, which is allowing firms to replace their conventional on-premises servers. It gives flexibility to the end user when they require custom-built apps or standard software and also provides a repository for the storage of their data. Customers use these services on the internet via a pay-as-per-use model.

In addition, in conventional hosting services, the IT infrastructure is leased for a certain period and the client pays for the configuration and period regardless of the services they use. While, in the IaaS cloud computing platform, consumers dynamically scale the configuration in the services as their needs change and pay only for the services they use. IaaS is available via all three cloud models: private, public, and hybrid.

The PaaS category is expected to grow at a steady rate during the forecast period. The demand for PaaS is increasing among organizations for augmenting productivity, security, speed, and efficiency, which are all key markers of performance. In addition, the demand is also growing due to the rising need to reduce the time to market and the expenses on application development.

Drive strategic growth with comprehensive market analysis

The APAC region is expected to grow at a CAGR of 18.2% over the next few years. The growth is primarily because with the help of cloud services, companies can reduce their operating expenses, enhance their IT infrastructure, and optimize their operations. The increasing demand for mobility and the prevalent cloud trends in Japan, India, and China are also propelling the growth of the market. Earlier, companies depended on on-premises hardware, but since the pandemic, the situation has almost changed, and companies have started adopting cloud-based services to provide better client experiences.

Moreover, the strong economies, presence of numerous digital hubs with advanced ICT infrastructure, and high IT spending are propelling the adoption of cloud professional services in the region. Moreover, many government policies have been implemented in regional countries to boost cloud adoption. Further, many of the tech giants, such as Google, Amazon, and Microsoft, have their data centers in India, which leads to an easy availability of cloud computing resources.

India is the among the fastest-growing economies, with a USD-3.5-trillion GDP already. Many companies here are redesigning their modus operandi, wherein the cloud provides a plethora of solutions. Compliance failure and security are great risk factors for companies, due to which many of them are using cloud-based services. Almost all ministries of the Indian government are using cloud services to enhance service delivery to the public.

In addition, more than 50 million new startups and small and medium enterprises in India are considering using cloud-based technologies. Improving the economy, increasing the literacy rate, enhancing the internet penetration, and implementing e-governance projects are the major focus areas of India’s digitalization initiative. The Indian government is augmenting the adoption of the cloud computing technology to expand its e-governance initiatives, to reduce corruption by ensuring quick service delivery and eliminating middlemen, who usually work on commissions.

Moreover, China, the most-populated country in the world, has more than 800 million internet users, who generate a huge amount of data, which must be stored efficiently and securely. Moreover, cloud-based servers are more affordable, secure, and scalable than on-site servers, which is why the demand for the former is escalating among the government agencies, large organizations, and financial entities in this country. Experts believe organizations in the country may increase their investment in public cloud services to 19.7% of their total IT spending in 2025.

This report offers deep insights into the cloud professional services industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Service Type

Based on Service Model

Based on Deployment Model

Based on Organization Size

Based on Vertical

Geographical Analysis

The cloud professional services industry is driven by the rapid adoption of cloud computing for enhanced business agility and reduced operational costs.

Consulting service demand will rise the fastest in the market for cloud professional services.

Public clouds are preferred in the cloud professional services industry.

The CAGR of the market for cloud professional services will be the highest in APAC.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages