Market Statistics

| Study Period | 2019 - 2030 |

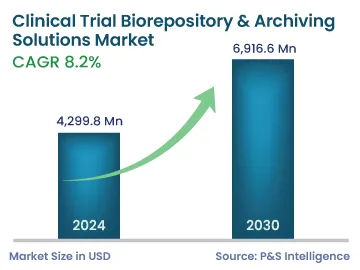

| 2024 Market Size | 4,299.8 Million |

| 2030 Forecast | 6,916.6 Million |

| Growth Rate(CAGR) | 8.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12783

Get a Comprehensive Overview of the Clinical Trial Biorepository & Archiving Solutions Market Report Prepared by P&S Intelligence, Segmented by Product (Human Tissue, Plasma, Organs, Stem Cells), Phase (Phase I, Phase II, Phase III, Phase IV), Offering (Biorepository Services, Archiving Solutions), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 4,299.8 Million |

| 2030 Forecast | 6,916.6 Million |

| Growth Rate(CAGR) | 8.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global clinical trial biorepository & archiving solutions market generated revenue of USD 4299.8 million in 2024, which is projected to exhibit a CAGR of 8.2%, to reach USD 6,916.6 million by 2030. The market advance is attributed to the growing number of firms providing a wide range of services and the burgeoning trend of the outsourcing of storage and other cold-chain operations, so that the critical resources can concentrate more on pharmaceutical development. Moreover, storage and transportation technologies are continuously advancing, which, combined with the l regulatory requirements on bio-storage and the current trends in this space, can immensely help save cost, time, and effort.

Recently, the enormous growth in the demand for stem cell therapy, immunotherapy, and other kinds of regenerative medicines has significantly augmented the demand for low-temperature storage of biological samples. Moreover, many small biopharmaceutical companies do not have an adequate budget, which is why they are shifting toward outsourcing specimen storage and cold-chain logistics. This approach can relieve them of the burden of the high costs of cold-chain management equipment management, equipment and specimen temperature tracking and monitoring, inventory control, and other repository quality management aspects.

Moreover, by outsourcing to biorepositories, biopharmaceutical firms can reduce the biohazards and the delays in regulatory approvals resulting from maintaining and managing large volumes of liquid nitrogen. Moreover, the prevalence of chronic and infectious diseases is increasing, due to which companies are focusing strongly on the discovery and launch of new drugs. Hence, the number of medical trials is increasing; so, companies are availing biorepository & archiving services for the management of the data generated during the whole process.

Moreover, people in different parts of the world have different disease profiles, with those in the larger countries displaying a significant prevalence of more diseases than those in the smaller ones. Therefore, the count of medical studies on novel or rare diseases that, otherwise, might not have attracted sponsors, is growing, which will benefit this market. Moreover, the rising diseased population would encourage pharmaceutical companies to raise their investment in clinical trials of new treatment regimens.

Further, biobanking is seen as an important area by biopharmaceutical companies, as tailored treatments and translation research data are readily available. With the emergence of biobanks, the volume of samples that can be collected and stored for research on companion diagnostics and biomarkers has risen significantly. The growing usage of biomarkers to ascertain and study the underlying causes of diseases is driving the industry growth.

The clinical trial biorepository & archiving solutions market is growing rapidly due to the enhancement in the availability of low-cost devices to organize data, for simplifying reporting, utilizing software that offers the functionality of an integrated designed to help manage laboratory samples and data. Moreover, complex data is created during trials, and the management of such data and all the biorepository processes makes such software necessary, thus creating an opportunity for the providers of archiving solutions.

These systems enable master management, sample lifecycle reporting, stability study, and secure management of the data generated from instruments and during, scheduling, inventory, storage, logistics, and analytical workflow creation. In the coming years, the demand for complete, integrated solutions, to reduce data management errors and enhance the qualitative analysis of research findings, is expected to drive the market growth. Moreover, owing to its advantages, such as inventory tracking without losses, streamlined workflows, efficient sample management, and automated data exchange and reporting, industries are adopting laboratory data management systems widely.

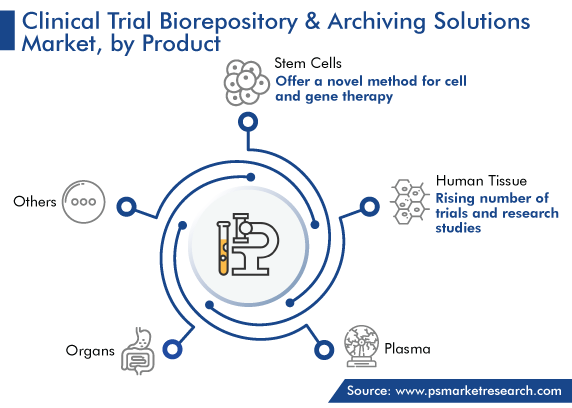

On the basis of product, stem cells held the largest revenue share, of 40%, in 2023, and this category is further expected to maintain its dominance in the future. Stem cells have drawn a lot of attention because they offer a novel method for cell and gene therapy. It is, thus, important to optimize culturing conditions, cryostorage protocols, and monitoring systems, to obtain ready-to-use cells for clinical applications. Further, in a recent discovery, scientists learned that stem cell therapies can successfully treat heart diseases, thus enhancing the optimism that such regenerative methods may one day be used to cure a variety of difficult-to-treat diseases.

The human tissue category will show the fastest growth during the projection time frame. This will be owing to the rising number of trials and research studies involving the human tissue. The goal of most biomedical research studies is to upgrade the approaches for the treatment and management of diseases. Over the years, the usage of human tissue has increased to develop biologics, to achieve these goals.

On the basis of phase, the phase III category accounted for the largest revenue share, of 45%, in 2023, and it is further expected to maintain its dominance in the future. This is owing to the fact that phase III trials utilize a large number of specimens and samples for long-term research, which results in a growing demand for clinical trial biorepository and archiving solutions. Researchers and scientists assess the efficacy and safety of novel treatments in phase III of the clinical trial process. In most of the phase III clinical trials, a large patient population is involved for a long duration. In addition to this, this phase has a higher incidence of rare and long-term side-effects, as a large number of people participate over a long time.

The phase II category will show the highest growth rate during the forecast period. After phase III trials, the highest patient participation rate is seen in phase II trials. Moreover, the category is set to grow as a result of the large number of phase II clinical studies that are sponsored or not sponsored by the pharmaceutical sector, their complexity, and their globalization. Essentially, the increasing investment in pharmaceutical and biopharmaceutical R&D is propelling the market growth in this category.

Drive strategic growth with comprehensive market analysis

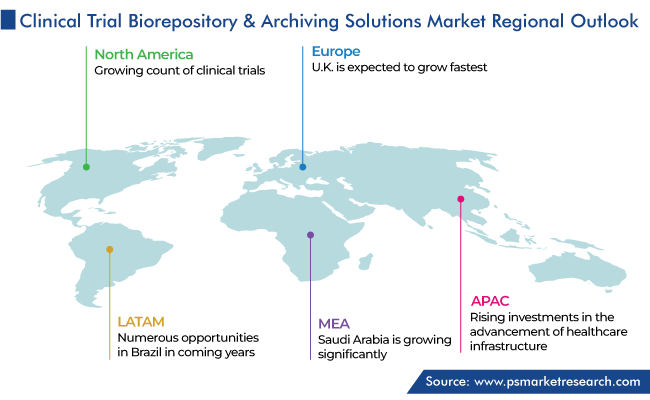

North America captured the largest revenue share of the market, of around 55%, in 2023, and it is further expected to maintain its dominance during the forecast period. This is due to the growing count of clinical trials, the existence of global market leaders, and the usage of advanced technologies in the region. Moreover, the existence of a large number of service providers, CROs, and biopharmaceutical companies augments the market growth potential.

The U.S. dominates the market in North America due to the growing healthcare expenditure and the existence of a large number of CROs in the country. Moreover, the growing outsourcing of cold-chain management operations and the rising focus on precision medicine propel the market.

Moreover, Canada has made a significant contribution in making North America the dominating regional market with its growing pharmaceutical industry and the dependence of companies on outsourcing. Essentially, the demand for data management tools due to the growing extent of clinical trials is the main market driver.

Moreover, India is undergoing significant growth in the APAC market due to the rising investments in the advancement of the healthcare infrastructure and the robust support of the government for the setup of research laboratories. The Indian government is committed to the creation of 150,000 health and wellness centers.

This fully customizable report gives a detailed analysis of the clinical trial biorepository & archiving solutions market, based on all the relevant segments and geographies.

Based on Product

Based on Phase

Based on Offering

Geographical Analysis

The market for clinical trial biorepository & archiving solutions valued USD 4299.8 million in 2024.

The clinical trial biorepository & archiving solutions industry will reach USD 6,916.6 million by 2030.

Stem cells are dominant on the market for clinical trial biorepository & archiving solutions.

Phase III is the largest and phase II the fastest-growing category in the clinical trial biorepository & archiving solutions industry.

North America is the largest market for clinical trial biorepository & archiving solutions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages