Report Code: 12792 | Available Format: PDF | Pages: 270

Cell Surface Marker Detection Market Share Analysis by Product (Flow Cytometry Systems, Hematology Analyzers, Cell Imaging Systems, Reagents and Kits), Application (Disease Diagnosis and Identification, Drug Discovery and Research) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12792

- Available Format: PDF

- Pages: 270

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The global cell surface marker detection market was valued at USD 5,505.5 million in 2023, and the market size is predicted to reach USD 9,427.4 million by 2030, advancing at a CAGR of 8.1% during 2024–2030. The market is driven by the increase in the demand for precision medicine, rise in the adoption of in vitro diagnostics, and technological advancements that augment throughput and the rate of automation.

In Germany, pharmaceutical companies are becoming increasingly involved in clinical trials for the improvement in the medication for diseases such as cancers, cardiovascular diseases, diabetes, and other age-related disorders, which is eventually increasing the demand for cell surface marker detection products. More than ten thousand clinical trials are currently registered in all phases of clinical research. More than 70% of them are sponsored by industry participants and the remaining by academic institutions and other entities. Of all the clinical trials, those in Phase II and Phase III account for more than 67%, and the top 10 pharma and biotech companies account for more than 30%.

In Europe, the country is a leader in clinical trials conducted, and globally, it is among the top five. In comparison to the U.S., the quality of clinical trial data is the same, and the cost is 50% lower in Germany. Thus, the key competitive advantage of the country lies in the combination of an enhanced quality and expertise and lower cost. At least 50 university hospitals and around 118 clinical institutes are involved in clinical trials in the country.

Flow Cytometry Instruments Are Dominating Market

The flow cytometry category held the largest share, of 35%, in 2023. This is mainly because this technique has the ability to measure a large number of parameters (up to 30 or more) in the same sample and collect information from millions of cells within a few seconds. Additionally, with this technique, any non-uniformity in a uniform cell population is detected, and it also removes all the dead cells or debris when providing the final data.

For the same reason, in China, flow cytometry has become vastly popular for research in recent years. The number of papers published on cytometry having contributing authors from China has increased to more than 30% of all those published in 2021 from more than 10% in 2020. This is paralleled in a surge in the acceptance rate, which is now equivalent to that in Europe and the U.S. The increasing research contributions from China are because cytometry is becoming a frontier multidisciplinary research area, illustrating a lot of research interest from both the industry and the academia.

Additionally, numerous research groups in China are developing innovative cytometric technologies. In this regard, a research group recently reported the development of a 3D hydrodynamic-focusing system with an on-chip optical design, to allow for the analysis of white blood cells with a microfluidic cytometer.

Increasing Demand for Precision Medicine

Cell surface markers are powerful tools that help in recognizing high-risk individual patients precisely, improving the accurateness of the diagnosis, advancing follow-up policies for individuals, estimating vulnerability to targeted therapy or immunotherapy, and forecasting prognostic outcomes.

Precision medicine is finding adoption in a range of subspecialties, but mostly in inherited diseases and cancer, for both treatment and diagnosis, using next-generation sequencing. Precision medicine brings down the total cost of care and improves the overall health of populations through the application of pharmacogenomics, which uses the data of patients to create safe and effective plans for patient medication.

Precision medicine is an advanced method of modifying disease treatment and prevention approaches. It will enable researchers and doctors to predict more accurately the most-suitable treatment for a patient with the information of their molecular and genetic makeup, lifestyle, and environment.

Precision medicine approaches are birthing an era of value-based care, wherein disease diagnosis, treatment, and management have become more targeted and centered around patients, enhancing the outcomes of treatment, and reducing the cost of healthcare. PM’s usefulness is growing across the whole spectrum of healthcare to attain equitable, outcome-driven care delivery. The clinical utility of personalized medicine will be high for diseases where under and overtreatment carry the risk of serious side-effects and drug resistance.

The most-tapped zone is oncology, where whole-exome sequencing (WES) and whole-genome sequencing (WGS) are being used extensively to analyze disease risk, arrange patients in strata for the selection of therapy, and monitor their therapy response. Precision medicine is also beneficial while predicting the recurrence of disease and dosage optimization.

| Report Attribute | Details |

Market Size in 2023 |

USD 5,505.5 Million |

Market Size in 2024 |

USD 5,912.9 Million |

Revenue Forecast in 2030 |

USD 9,427.4 Million |

Growth Rate |

8.1% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Application; By Region |

Explore more about this report - Request free sample

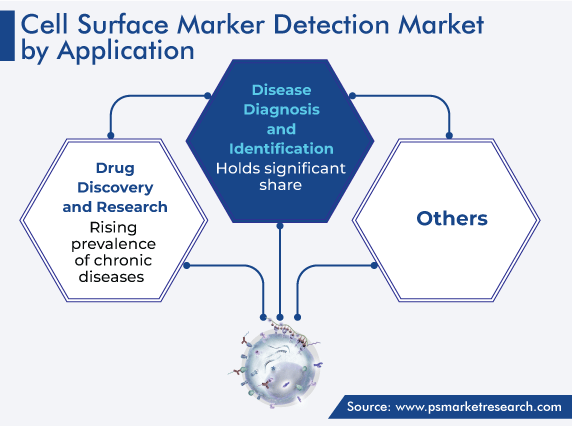

Drug Discovery and Research Is Fastest-Growing Application

The drug discovery and research category is expected to grow the fastest in the global cell surface marker detection market, with a CAGR of 8.4%, during the forecast period. This is mainly due to the rising prevalence of chronic diseases and the resulting increase in healthcare expenditure. According to a report, in 2000, in the U.S., people with one or more chronic diseases numbered more than 120 million. This number is projected to increase by more than 1% every year till 2030. Hence, between 2000 and 2030, the number of people in North America with chronic conditions will increase by around 40%, or around 50 million people.

Additionally, globally, the number of clinical trials is increasing continuously, which is driving a growth in the spending on drug discovery and research. In Europe, France has the largest pharmaceutical market, and the leading sector for industry-sponsored clinical trials is oncology. In 2020, around 42% of all the trials underway in Europe were registered in France. The French government has implemented ambitious public policies for research in oncology, as well as rare and infectious diseases, along with offering tax credits to R&D companies. The credits cover 30% of the R&D expenditure, of up to USD 110 million.

Moreover, in June 2021, due to the COVID-19 pandemic, the Government of Canada decided to update the framework of the country for clinical trials, to support the adoption of better therapies and advanced technologies. It also decreased the retention period for clinical trial records by 10 years, which has made the country alluring to sponsors due to a reduction in administrative work.

Moreover, in China, there are more than 30 national centers for clinical research and a collaborative network of more than 2,000 medical institutions in more than 250 cities. Compared to many European countries and the U.S., clinical studies in China also significantly cost less, thus making it extremely attractive to sponsors.

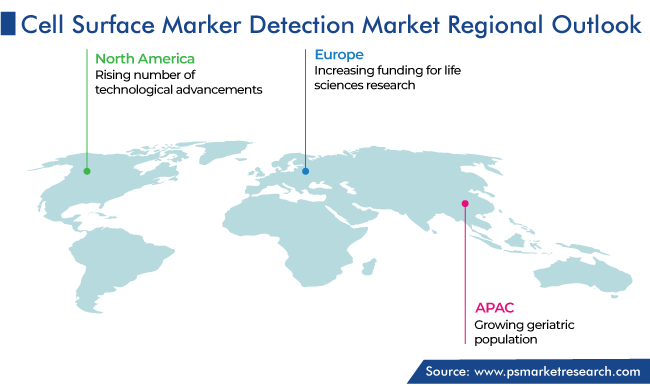

North America Held Largest Share

North America held the largest share, of 55%, in 2023, ascribed to the rising number of technological advancements, surging geriatric population, and increasing prevalence of chronic diseases.

In North America, the U.S. is experiencing a demographic shift with the increase in the number of citizens aged 65 and older. This age group’s share in the total population is projected to rise to nearly 24.0% by 2060 from 15.0% in 2016. The elderly population is more prone to chronic diseases, such as cardiac disorders, gastrointestinal problems, and cancer. Additionally, the U.S. ranks fifth in the world for age-standardized rates for all cancers.

Furthermore, the U.S. government spends a significant portion of its GDP on healthcare every year. Healthcare spending in the U.S. grew by more than 5.0% from 2021, to reach around USD 5 trillion in 2022. This is increasing the affordability of treatments, which is further contributing toward the growth of the market in the country.

Moreover, APAC is expected to grow the fastest during the forecast period. This is mainly because of the increasing geriatric population and recent advances in the drug discovery and research methodologies, especially in gene therapy. The growing population of patients with diseases including CVDs, cancer, and diabetes is also driving the market.

In India, the number of people suffering from cancer is expected to increase to around 30 million in 2025 from around 27 million in 2021. The highest incidence last year was in the North and the Northeast, and it was higher among men.

Moreover, the government is providing research grants and other incentives in developing countries, such as China and India. Furthermore, the increase in the count of private investments in the biotechnology sector is one of the major factors contributing to the regional market advance.

Top Companies Providing Cell Surface Marker Detection Solutions Are:

- Abbott Laboratories

- Becton, Dickinson and Company

- Nihon Kohden Corporation

- Thermo Fisher Scientific Inc.

- Sysmex Corporation

- Janssen Diagnostics Inc.

- Grifols SA

- Siemens Healthcare

- BioRad Laboratories Inc.

- F. Hoffmann-La Roche Ltd.

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the cell surface marker detection market, to offer accurate market estimations for 2017–2030.

Based on Product

- Flow Cytometry Systems

- Hematology Analyzers

- Cell Imaging Systems

- Reagents and Kits

Based on Application

- Disease Diagnosis and Identification

- Drug Discovery and Research

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- U.K

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

The market for cell surface marker detection solutions will value USD 9,427.4 million in 2030.

Drug discovery and research will have the highest cell surface marker detection industry CAGR.

The market for cell surface marker detection solutions is driven by the growing prevalence of diseases and the rising preference for personalized medicine.

Flow cytometry dominates the cell surface marker detection industry.

The most-important countries in the market for cell surface marker detection solutions are the U.S., France, Germany, the U.K., India, and China

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws