Flow Cytometry Market Future Prospects

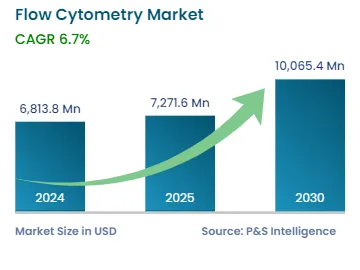

The flow cytometry market will generate an estimated revenue of USD 6,813.8 million in 2024, and it is projected to grow at a CAGR of 6.7% from 2024 to 2030, reaching USD 10,065.4 million by 2030. This is mainly due to the growth in drug development, increased research activities with new technologies of flow cytometry, and rise in the adoption of analytical instruments in clinical diagnostics. Moreover, flow cytometry is extensively used in cancer research and in-vitro molecular studies.

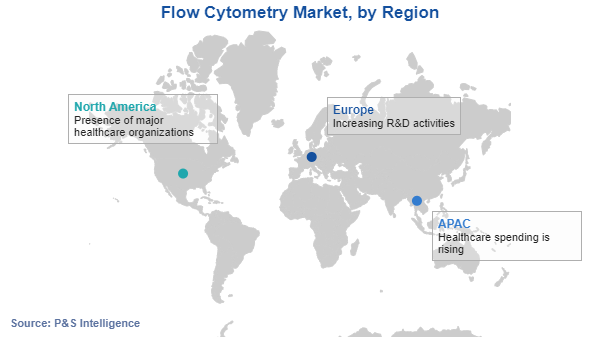

In addition, initiatives taken by government and private organizations brought major investments in biomedical R&D and advancements in the diagnosis of various disorders, which are driving the market for analytical tools.

Major advancements in flow cytometry technology have been witnessed. Recently, a private medical technology company, Becton, Dickinson and Company, in association with the European Molecular Biology Laboratory, a government lab, declared an innovation in the technology, in which image-based decisioning and advanced fluorescence imaging were added to sort individual cells at high speed, based on the visual details of each cell. Conventionally, quantification and identification of certain biomarkers on a cell were operated through different cell sorting tools. The innovation can capture multiple images of individual cells at a speed of 15,000 cells per second.

The potential in the innovation can revolutionize immunology, genomics research, and cell biology, as well as enable the development of new cell-based therapeutics. Thus, new techniques, applications, and improvements in flow cytometers have boosted their demand at a significant pace.

Moreover, advanced reagents for flow cytometry support dye technology and AI, which take less time in optimizing panels and improvise the experiment time for drug development. The analysis shows the high demand for reagents, which are helpful in the flow cytometric assays for better results and faster drug development processes. Moreover, the market for reagents is augmented by the advancements in fluorochromes or dyes useful in the analysis of samples more precisely.

Likewise, another factor contributing to the uptake of the flow cytometry market is the surging adoption of AI to provide modern user-friendly software for data acquisition, analysis, and reporting. The analysis from past years shows the rapid growth in demand for advanced software supporting flow cytometry.

Immunophenotyping is one of the key diagnostic techniques used by hospitals and health centers, which use flow cytometry to differentiate cells based on types of antigens or markers on the surface of the cells. In the present scenario, as chronic diseases and disorders are prevalent globally, there has been a multi-folded increase in the need for diagnosis as well.

Healthcare centers perform immunophenotyping for diagnosis of primary immunodeficiency disorders, leukemia and lymphoma, stem cells, and paroxysmal nocturnal hemoglobinuria (PNH), and reporting immune status in patients with HIV infection and other malignancy diseases.