Report Code: 10338 | Available Format: PDF

- Home

- Life Sciences

- Cell Analysis Market

Cell Analysis Market Research Report: Size, Share, Key Trends, Growth Drivers, Regional Outlook, Revenue Estimation and Forecast, 2023–2030

- Report Code: 10338

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

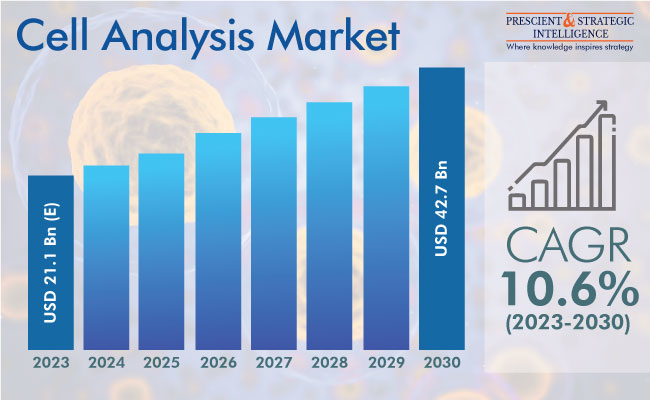

The size of the cell analysis market has been estimated to be USD 21.1 billion in 2023, and it will touch USD 42.7 billion by 2030, powering at a rate of 10.6% between 2023 and 2030. The growing funding by governments for cell-based research, rising prevalence of chronic and infectious diseases, elevating preference for personalized medicine, increasing drug R&D activities, advancing biotechnology sector, and surging geriatric population are the key drivers.

Cell analysis can be termed as the examination of cells for studying the DNA, RNA, proteins, and other metabolites in them. Applications of this approach include metabolomics, transcriptomics, genomics, and proteomics. In clinical diagnostics, digitally powered cell analysis tools standardize and automate workflows and offer important information for the instantaneous monitoring of diseases and creation of novel treatments.

Moreover, the improving precision of cell imaging and analysis systems is helping in reducing the time taken in drug discovery and their price. In the current scenario, thousands of cells in a sample are analyzed, and the results are calculated on the basis of the average cell response. Further, applications of these approaches go beyond healthcare, extending to agricultural biotechnology (GM crops) as well.

Cell-Based Assays Are Widely Used for Drug Discovery

Based on end user, the pharmaceutical and biotechnology companies category holds the largest share in the market. This is attributed to the sharp surge in the cases of chronic diseases, especially those with a genetic component, in recent years. As a result, the drug R&D sector has undergone numerous advancements in the technologies used.

The traditional approaches of the assessment of drug delivery modes comprise animal testing methods, which are costly and time taking, offer a limited throughput, and have a lot of concerns associated with them. The recently approved cell-based assays combine the advantages offered by animal models and cell cultures, thus letting researchers improve the efficiency of the detection of leads in early screening.

Pandemic Had Positive Impact on Industry

COVID-19 impacted the industry in a positive manner. The requirement for cell analysis rose throughout the pandemic as researchers used the related methods for gaining insights into the virus and how the body reacts to it and developing likely treatments. Essentially, the surge in the funding by governments for R&D on COVID-19 and related therapies brought about a rise in the usage of cell analytics at a global level.

For example, in 2021, as per an article in the American Journal of Physiology-Lung Cellular and Molecular Physiology, cell analyses were done via CyTOF for studying the changes in the peripheral blood mononuclear cells of COVID-19 patients. Similarly, studies have linked a higher WBC count with less likeliness of hospital discharge and a higher mortality risk for patients.

Therefore, the pandemic has highlighted the significance of cell-based assays for understanding the behavior of the virus inside the host, assessing the feasibility of possible treatments, and measuring the immune response. This has driven the requirement for the tools used for such processes, for instance, microscopes, flow cytometers, and cell counters.

| Report Attribute | Details |

Market Size in 2023 |

USD 21.1 Billion (E) |

Revenue Forecast in 2030 |

USD 42.7 Billion |

Growth Rate |

10.6% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

APAC Will Be Fastest-Growing Region

North America dominates the cell analysis market in 2023, and it will continue to dominate it till the end of this decade. The growth of the industry is because of the increase in the occurrence of breast cancer, lung cancer, and other devastating chronic diseases. For example, as per the American Cancer Society, in 2021, there were around 1.8 million new cancer cases and 606,520 deaths in the U.S. Understanding cellular and genetic mutations is key to diagnosing cancer and arriving at an accurate prognosis.

Further, a surge in the requirement for automated cell analysis technologies amongst pharma companies for developing new therapies for chronic diseases powers the growth of the industry. For instance, the number of annual Parkinson’s diagnosis is more than 90,000 in the U.S. Recent cell analysis studies have shown that the overexpression of the CADPS2 gene may indicate the presence of the dopaminergic neurons damaged by the disease, even helping identify them in the midbrain.

The market in APAC will grow the fastest in the next seven years. The regional growth is augmented by a surge in the number of scientific innovations, a rise in the funding by governments, and an increase in the elderly population suffering from chronic diseases. For example, as per the UNFPA, by 2050, the geriatric populations in APAC will reach 1.3 billion. Furthermore, the growth in the requirement for advanced healthcare services in China and India powers the industry.

Consumables Dominate Industry

Based on offering, consumables have the largest share in the industry. The increase in the occurrence of all kinds of ailments and the rise in the requirement for assay-related supplies are powering the growth of this category. Among them, reagents are frequently used in cellular studies and are a repetitive purchase for all end users.

The software category will likely grow the fastest over the forecast period, as software is vital for the collection, storage, analysis, and sharing of data generated during cellular studies. Moreover, with the advancements in bioinformatics, especially cloud-delivered software, the biotechnology sector continues to evolve, as the cloud allows for remote collaboration among researchers from anywhere and anytime.

Flow Cytometry Is Most-Used Technique

On the basis of technique, flow cytometry is leading the industry, and this trend will continue till the end of this decade. The increasing use of flow cytometry for the identification and measurement of the chemical and physical properties of cells or particles is a prime factor responsible for the growth of the industry.

Essentially, the adaptability of flow cytometry is powering its acceptance in clinical diagnostics and drug research and development. The increasing requirement for studying immune profiling, cellular heterogeneity, and rare cell detection also plays a part in the increasing requirement for this procedure.

Single-Cell Analysis Procedure Volume To Rise Swiftly

The single-cell analysis category is expected to be the fastest-growing during the forecast period, based on process. To understand diseases and genetics on a deeper level, individual cells are isolated from large populations and put through a number of tests. This procedure is essential to study the structure, presence, and functioning of proteins, DNA, RNA, and genes, without which modern humans’ understanding of diseases will remain inadequate.

Who Are Key Players in Cell Analysis Market?

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Beckton, Dickinson and Company

- General Electric Company

- Merck KGaA

- Agilent Technologies Inc.

- Olympus Corporation

- Promega Corporation

- PerkinElmer Inc.

- Tecan Trading AG

- Miltenyi Biotec

- Carl Zeiss AG

- Bio-Rad Laboratories Inc.

- Sysmex Corporation

- BioStatus Limited

- NanoCellect Biomedical Inc.

- Illumina Inc.

- Qiagen N.V.

- Sartorius AG

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws