Market Statistics

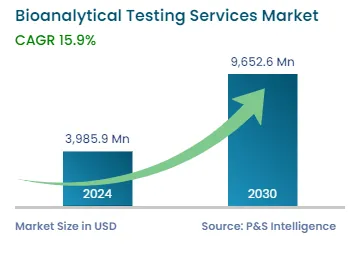

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,985.9 Million |

| 2030 Forecast | USD 9,652.6 Million |

| Growth Rate(CAGR) | 15.9% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12719

Get a Comprehensive Overview of the Bioanalytical Testing Services Market Report Prepared by P&S Intelligence, Segmented by Molecule Type (Small, Large), Test Type (Bioavailability, Bioequivalence, Pharmacokinetic, Pharmacodynamics), End User (Pharmaceutical and Biotechnology Companies, Contract Development and Manufacturing Organizations, Contract Research Organizations), Workflow (Sample Preparation, Sample Analysis), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 3,985.9 Million |

| 2030 Forecast | USD 9,652.6 Million |

| Growth Rate(CAGR) | 15.9% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global bioanalytical testing services market generated revenue of USD 3,985.9 million in 2024, and it is projected to witness a CAGR of 15.9% during 2024–2030, to reach USD 9,652.6 million by 2030. This is attributed to the established life sciences industry utilizing bioanalytical testing, the presence of key service providers, the increased number of ongoing clinical trials, high research and development expenditure, and the expansion of biosimilar and generic markets. Additionally, the expansion of pharmaceutical and biopharmaceutical firms outsourcing clinical, preclinical, and laboratory testing services is another factor driving the market growth.

Moreover, the increasing preference of key players toward analytical testing of biosimilars and biologics, the rising healthcare spending for providing improved health services, and the surging focus of industry players on the approvals and launches of testing services during crucial times are boosting the market demand.

Furthermore, the rising rate of outsourcing research and development activities by leading pharmaceutical businesses to emphasize on their core capabilities is providing a significant positive impact on this market. Also, surging innovations and competitive pressure are leading firms to outsource such services. In addition, the rising prevalence of infectious and chronic diseases and government policies to control the outbreaks of infectious diseases such as COVID-19, HIV, etc. is expected to provide more opportunities to utilize these testing services for the detection of diseases, which, in turn, leads to the growth of the market.

Moreover, the adoption of bioanalytical testing by pharmaceutical companies is increasing for drug development, due to its advantage to provide high-quality and accurate results. Additionally, the services offered by companies for advancing drug development, including biomarkers, anti-drug antibodies, and pharmacokinetic assays, make the market profitable.

Increasing Preference Toward Outsourcing Analytical Testing

A large number of biopharmaceutical organizations are outsourcing bioanalytical testing rather than using in-house testing for the development of drugs and the validation of several assays at both the preclinical and clinical stages. This is because these businesses are trying to be more effective in the process of drug development by concentrating on their core capabilities to introduce new products to the market, with optimal staffing and in a more efficient and cost-effective manner.

In the pharmaceutical sector, analytical and testing services are more frequently used for mass production, due to the competition for drug launches. Thus, a large number of CROs are choosing specific providers over long-term as compared to short-term contracts. Also, these providers have high capabilities in providing advanced testing services to pharmaceutical companies for their drug development processes.

Moreover, outsourcing bioanalytical testing services helps pharmaceutical organizations to reduce the risk of spending a large amount of funds to purchase analytical equipment and maintain manpower. Therefore, the approachability of specialized service providers with advanced competencies to provide optimal and effective results quickly has led to the surging attention among pharmaceutical companies to outsource testing services to third-party service providers.

The small molecule category held the largest market share, of 50%, in 2023, and it is also expected to maintain its dominance during the forthcoming period. This is because small molecules are traditional pharmaceuticals, and typically they have a low molecular weight of less than 900 Daltons and regulate a biological process. Moreover, many outsourcing companies are offering studies on many small molecules such as pharmacokinetic studies, pharmacodynamic studies, and assays of biomarkers.

Furthermore, many contract research organizations offer several testing services for small molecules. For example, XenoTech LLC, a subsidiary of BioIVT LLC, offers analytical services including high-performance liquid chromatography (HPLC) with mass spectrometry, different detectors, and ultraviolet-visible spectroscopy to various non-regulated small molecule bioanalysis, to determine a precise measurement of metabolite concentration and/or parent drugs in various biological matrices to help absorption, distribution, metabolism, and excretion (ADME), drug-drug interaction (DDI), and drug metabolism and pharmacokinetics (DMPK) studies in drug development. By using these tests, they can help promoters in lot-release testing and developing small molecules.

In addition, many branded and generic compounds are typically small molecules. Also, manufacturers have to conduct and give reports of bioanalytical testing, due to the rising patent expiration. Thus, this factor boosts the acceptance of bioanalytical testing for small molecules.

Whereas, the large molecule category is projected to witness the highest CAGR during the forecast period. This can be because many biologics or amino acid-based molecules are under development. Moreover, the testing of these molecules needs advanced techniques, improved infrastructure, and new-generation analytical instruments, which are mainly accessible with bioanalytical service providers. Thus, outsourcing of bioanalytical testing of these molecules is a key trend in the market.

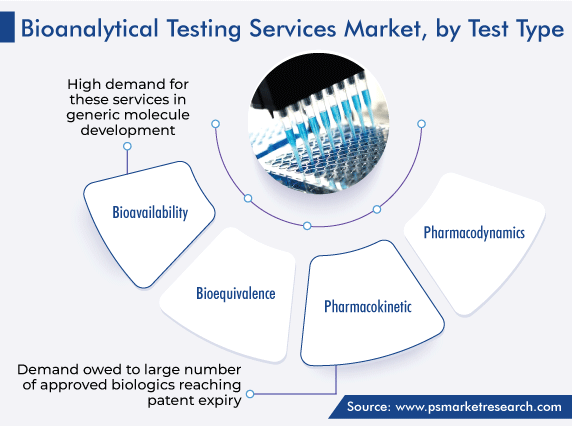

On the basis of test type, the bioavailability category accounted for the largest revenue share, of 40%, in 2023, and it is further expected to maintain its dominance during the analysis period. This is attributed to the high demand for these services in generic molecule development. Moreover, companies are more focused on producing the best effective therapeutic drugs with effective drug moiety. Additionally, the rising consumer concern about self-care is boosting the consumption of pharmaceutical drugs, which, in turn, significantly drives the demand for bioavailability testing.

On the other hand, the pharmacokinetic category is expected to register the highest CAGR during the forthcoming period. This can be ascribed to a large number of approved biologics reaching patent expiry. To support clinical and non-clinical studies, pharmacokinetic assays are required to measure biosimilar and reference products with comparable precision and accuracy. The most optimal approach is to develop a single pharmacokinetic assay, using a single analytical standard, for quantifying the measurement of the biosimilar and reference products in the serum matrix. Thus, the bioanalytical testing approach is widely utilized for knowing the pharmacokinetics.

Based on end user, the pharmaceutical and biopharmaceutical companies category accounted for the largest revenue share, of 35%, in 2023, and it is further expected to maintain its dominance during the analysis period. This is because these companies are mainly focused on the development of new drugs for the treatment of various diseases, and are also more concentrated on the mass manufacturing of drugs due to the rising prevalence of diseases and many infectious cases. So, the companies are adopting outsourcing of the early-phase development of drug, laboratory, and clinical testing services to improve profit margins, avoid high expenditure, and reduce time duration to validate the products and processes.

On the other hand, the contract research organizations category is expected to show the highest CAGR during the forthcoming period. This can be because CROs are helping pharmaceutical companies to cater to the need for pharmaceutical products, and many organizations are encouraging in-house tests and intensifying test capabilities in several places.

Drive strategic growth with comprehensive market analysis

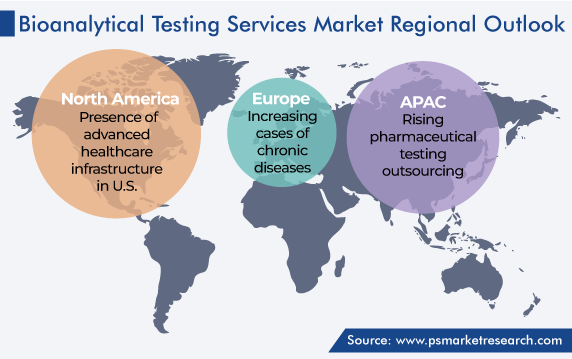

Geographically, North America occupied the largest share in the bioanalytical testing services market, of around 45%, in 2023, and the regional industry is expected to experience a strong CAGR during the projection period. This is attributed to the existence of a large number of patients with chronic diseases, the rise in the acceptance of large molecule therapeutics and peptides, significant growth in the pharmaceutical and biotechnical industries, and the presence of major service providers for bioanalytical services in the region.

The U.S. leads the North American market, due to the presence of advanced healthcare infrastructure, a large number of pharmaceutical manufacturing facilities, and major contract research organizations and service providers of bioanalytical testing, in the country.

The European bioanalytical testing services market accounts for the second-largest revenue share. This is attributed to the rising amount of investment by pharmaceutical and biotechnology companies in R&D activities, the increasing cases of chronic diseases, and a large number of contract manufacturing and research organizations utilizing bioanalytical testing in the region.

Germany leads the European market, owing to its promotion of in-house testing facilities of bioanalytical testing, expanding test facilities, and companies being more focused on outsourcing testing services in the country. On the other hand, the market in France shows significant growth, due to companies expanding their projects for providing bioanalytical contract solutions.

This report offers deep insights into the bioanalytical testing services industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Molecule Type

Based on Test Type

Based on End User

Based on Workflow

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages