Market Statistics

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 16.3 Billion |

| 2030 Forecast | USD 26.2 Billion |

| Growth Rate(CAGR) | 8.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Report Code: 11815

Get a Comprehensive Overview of the Automotive Turbocharger Market Report Prepared by P&S Intelligence, Segmented by Technology (Twin-Turbo, Wastegate, Variable Geometry), Fuel Type (Diesel, Gasoline, Alternative Fuel/CNG), Material (Cast Iron, Aluminum), Vehicle Type (LCV, HCV), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 16.3 Billion |

| 2030 Forecast | USD 26.2 Billion |

| Growth Rate(CAGR) | 8.2% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

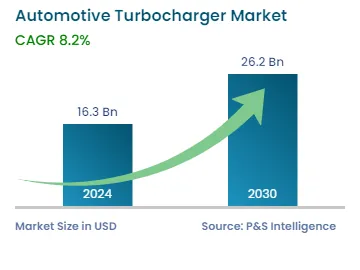

The global automotive turbocharger market estimated revenue is USD 16.3 billion in 2024, which is projected to reach USD 26.2 billion by 2030, growing at a CAGR of 8.2% during 2024–2030.

This is due to the strict emission norms implemented by governments in view of the environmental concerns and to achieve sustainable development. A turbocharger helps in reducing emissions and increasing fuel efficiency. The surging population globally, resulting in an increasing demand for passenger cars, is essentially adding to the growth of the market, specifically in Asia-Pacific. In turn, the increasing automotive production and technological advancements in the industry are boosting the demand for these components.

A turbocharger is used in a variety of automobiles to increase the fuel efficiency and power output. It comprises a turbine and a compressor, joined by a shaft. The turbine is driven by the engine’s exhaust gases to power the compressor, which allows more air into the engine. This enables the fuel to burn better, thus leading to enhanced performance and efficiency. It is thus used in a variety of applications, such as marine engines, aircraft engines, hybrid powertrains, agricultural equipment, and racing and sports cars.

Currently, the market is primarily driven by their usage in passenger cars. However, people are now more aware of the emissions caused by vehicles; so, they are shifting focus on traveling via public modes of transport, especially buses. Further, governments and regulatory bodies globally have implemented stringent emission standards for vehicles to lower greenhouse gas emissions and improve the air quality, which propels the integration of turbochargers in the diesel engines of heavy-duty vehicles.

Further, there has been a growing focus on sustainable development in every sector. These components aid in achieving this by enabling smaller engines to produce similar power as larger, conventional engines. This results in an enhanced fuel economy and lower carbon footprint, thus enabling the addressal of environmental concerns and achievement of sustainability.

Additionally, twin-turbochargers provide enhanced performance, power, and overall driving experience. Owing to these features, they are being extensively used in sports cars and SUVs, the demand for which is at an all-time high. Car enthusiasts all around the world watch F1, where the cars widely employ turbochargers to increase output, reduce turbo lag, balance power delivery, and enhance low-end torque.

Strict Emission Norms and Downsizing of Engines Drive Market

The market for automotive turbochargers is mainly driven by the stringent emission norms implemented by governments all around the world. The increase in automobile production and sales is viewed as one of the topmost factors for environmental degradation. Since the demand for automobiles will forever be on the rise due to the increasing population, emission reduction technologies might need a significant rethink. The main objective of using automotive turbochargers is to enhance vehicle performance, while keeping emissions and fuel consumption to the minimum.

Further, there has been a significant decline in the demand for diesel engines because of the increasing fuel prices, rampant global warming, and higher cost of diesel automobiles than gasoline ones. In various countries, such as India, China, Japan, and South Korea, the demand for gasoline engines has increased owing to their lower emissions. Additionally, the Indian government has mandated Bharat Stage 6 (BS-6) engines in order to lower the sulfur content in emissions. Other global emission norms, such as Euro-6, PROCONVE P-8, and China-6, have, similarly, shifted the focus to gasoline-powered engines. This is further adding to the demand for turbochargers in passenger cars.

Moreover, there has been a growing demand for fuel-efficient vehicles with the rising rates of inflation. Additionally, with the massive population increase in emerging economies, the demand for every category of vehicles is surging. These factors are forcing automakers to focus on engine downsizing, which involves reducing the displacement, while enhancing power output and performance. It has become a well-known strategy in the automotive industry to comply with the strict emission regulations.

Accordingly, engine manufacturing companies are lowering the number of cylinders and their piston displacement and installing turbochargers, which create more torque and power. This downsizing of engines will provide improved safety, low cost, greater durability, and enhanced fuel efficiency, thereby driving the market during the prediction period.

Furthermore, there has been a growing popularity of hybrid electric vehicles in an effort to achieve a smaller carbon footprint and sustainable development. Thus, automobile manufacturers are investing huge amounts to improve the battery range, while keeping costs to a minimum. Turbochargers are used in HEVs to regenerate energy and supply them backup power. This integration of the turbo range extender is expected to boost the market growth in the years to come.

This wastegate dominates the technology segment of the market, with a revenue share of 55%, and it is expected to grow at a CAGR of 8.0%.

This dominance can be ascribed to the market familiarity of wastegate turbochargers, which can be easily installed in a wide range of automobiles, including cars, trucks, and SUVs. Further, their versatility and adaptability to various engines sizes and configurations are responsible for their popularity. They have been used extensively in different vehicles for decades, thus making them a trusted and familiar option for manufacturers and consumers. They are generally more economical and easier to install compared to other, more-complex variants.

Further, most automobile manufacturers use wastegate turbochargers to control the quick boost levels with the help of electrically actuated bypass valves. Due to their operation at high temperatures, they are cooled by water and produced with alloys that display appreciable resistance to high temperatures. Further, they can be fitted into smaller spaces, lower turbo lags, are lightweight, and facilitate optimum engine performance.

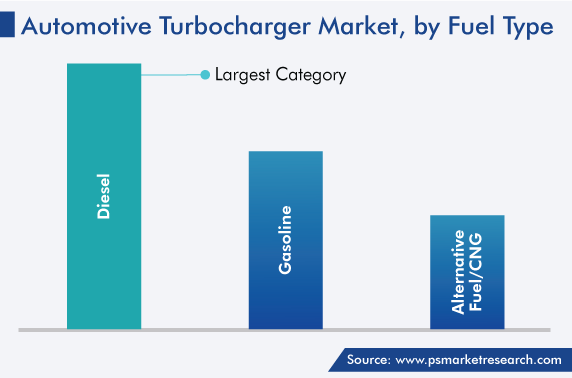

The diesel category holds the largest market revenue share, of 45%, and it is expected to grow at a significant CAGR, of 7.6%.

This is due to the widespread usage of diesel engines in trucks, buses, agricultural machinery, and construction equipment. Turbochargers are extensively used in bigger engines owing to the greater density of diesel than gasoline. The former can offer more energy in a given volume, thus making it more efficient for a variety of vehicles, as the engine can perform for longer durations on a single tank of fuel. Diesel engines are capable of extracting more energy from the fuel as they have a higher compression ratio.

Moreover, these power sources provide more torque, thus making them suitable for transporting heavier loads. This makes them widely popular and almost a mandate in commercial vehicles. Diesel fuel is also cheaper than gasoline, thus making it more economical for vehicle owners. These engines also have a longer life, which helps consumers in saving money in the long run.

The cast iron category holds the largest revenue share, of 60.0%, and it is expected to grow at a CAGR of 8.3%.

This is due to the extensive usage of turbochargers made of cast iron in heavy-duty trucks. With the growing popularity of online shopping platforms, the demand for freight transportation services has increased globally. This propels the sale of heavy commercial vehicles and, in turn, for cast iron turbine housings in turbocharged diesel engines.

Moreover, cast iron is inexpensive and provides great heat resistance, which makes it suitable for manufacturing turbochargers. It has a melting point of around 2,500 degrees Fahrenheit, which is much higher than the temperatures turbochargers generally operate at. Moreover, this material can withstand the high pressures and forces generated by turbochargers. Additionally, it provides good lubrication, which aids in reducing friction and wear, thus enabling a longer life for vehicles.

Drive strategic growth with comprehensive market analysis

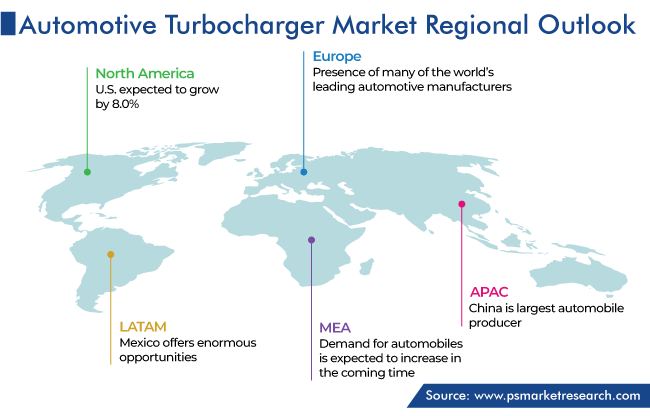

The APAC region dominates the market, with a revenue share of 45%. This is owing to the surging demand for passenger cars and strict emission regulations implemented by the governments in the region. China and India are the two most-populous countries in the world, which is why they witness an extensive demand for automobiles from both the private and commercial sectors. To meet this demand and align with environmental norms, manufacturers are widely utilizing turbochargers. Further, with an increase in the disposable income, people are shifting toward SUVs and high-performance vehicles, which employ these components to achieve maximum performance and fuel efficiency.

Moreover, China is the largest automobile producer in the world owing to its advanced production processes and availability of cheap labor. In 2021, it produced 26 million passenger cars and commercial vehicles, while the production for 2022 stood at over 27 million units. India also produces a significant number of automobiles as a result of the surging demand for personal cars due to the increase in the per capita income.

Further, the world’s leading manufacturers, such as Toyota, Honda, and Hyundai, have most of their manufacturing plants in the region. These OEMs are continuously striving to develop new technologies and investing huge amounts in innovating turbochargers. This is why Asia-Pacific is expected to continue its dominance on the market in the near future.

This fully customizable report gives a detailed analysis of the automotive turbocharger industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Technology

Based on Fuel Type

Based on Material

Based on Vehicle Type

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages