Australia Micromobility Market Analysis

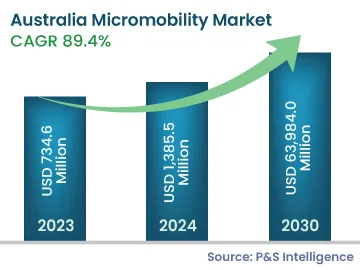

The Australian micromobility market generated revenue of USD 734.6 million in 2023, which is expected to witness a CAGR of 89.4% during 2024–2030, to reach USD 63,984.0 million by 2030. The key factors for the growth of the market are the low price and convenience of these solutions, rising demand for first- and last-mile connectivity, and escalating need for reducing traffic congestion in urban areas.

Micromobility in the country had enticed a lot of entrepreneurial and user interest till 2019. However, the preventive measures taken by the government, such as complete lockdowns and even curfews in hotspot areas, halted the healthy demand trend for micromobility services from March 2020 to June 2020. But, the COVID-19 pandemic created opportunities for the micromobility market in Australia as well, as fewer people are choosing the crowded public transit presently, which is why the demand for alternate means of transportation is growing.

Micromobility has emerged as one of the most-effective forms of transportation, with a growing number of people in the country using it. The notion is supported by the government laws and structures that have created dedicated paths and road lanes and allocated parking places for these vehicles even in congested locations.

With the increment in the cost of ownership of vehicles, people have started moving toward accessible, affordable, and hassle-free transportation means, such as car-pooling, ride-hailing, vehicle renting, and micromobility, which are all part of the larger mobility as a service (MaaS) ecosystem. With this, commuters can access various efficient modes of transport in one trip. Daily users of public mobility services are now able to reduce their dependence on costlier modes of transport for first- and last-mile travel.

Furthermore, numerous service providers are taking initiatives to expand their area of services by establishing an integrated mobility system. The providers are not focusing on providing one service, but involving themselves in multiple vehicle sharing programs. Moreover, companies, including Spot, are focusing on digitizing parking options and rules via interactive and user-friendly maps for both drivers and parking managers, which improves the parking and mobility experience for both users and service providers. Therefore, the integration of MaaS is creating multiple growth opportunities for micromobility service providers.