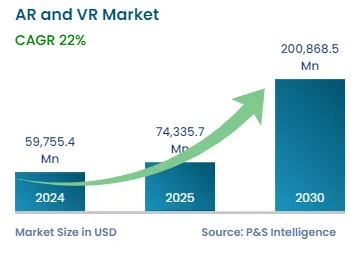

The AR and VR industry value will reach USD 200,868.5 million in 2030.

The AR and VR industry is USD 59,755.4 million in 2024.

AR technology will advance at a CAGR of 22.0% in the coming years.

The development of the AR and VR market is mainly propelled by rapid technical improvements, augmented acceptance in gaming, entertainment, education, tourism, retail, and healthcare sectors, and the convenience of wearable AR and VR devices.

The prevailing trend in the AR and VR industry is the dominance of HMDs (Head-Mounted Displays) in both AR and VR device markets, driven by lightweight displays, technical improvements, and high demand in gaming and tourism sectors.

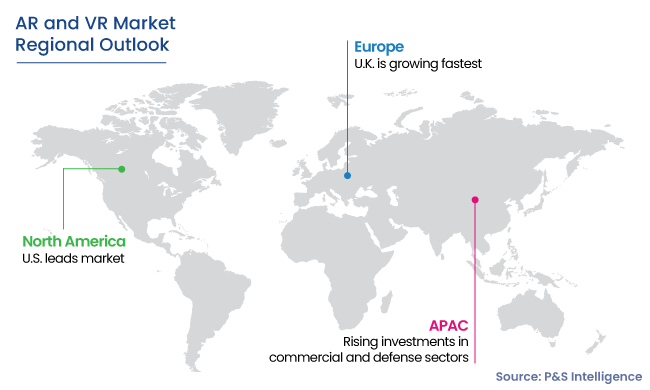

Which region is expected to be the dominant market player in the AR and VR industry?+

The North American region is expected to remain the dominant market player with a 50% industry share, fueled by substantial government investments and the presence of leading tech companies like Google, Microsoft, and Apple.