Report Code: 12033 | Available Format: PDF | Pages: 152

Ambient Lighting Market Research Report : By Offering (Hardware [Lamps and Luminaires {Incandescent, Halogen, Fluorescent, LED}, Lighting Controls {Sensors, Switches and Dimmers, Relay Units}], Software and Service), Type (Suspended Lights, Recessed Lights, Track Lights, Strip Lights, Surface-Mounted Lights), End User (Residential, Hospitality and Retail, Healthcare, Industrial, Corporate, Automotive) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12033

- Available Format: PDF

- Pages: 152

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

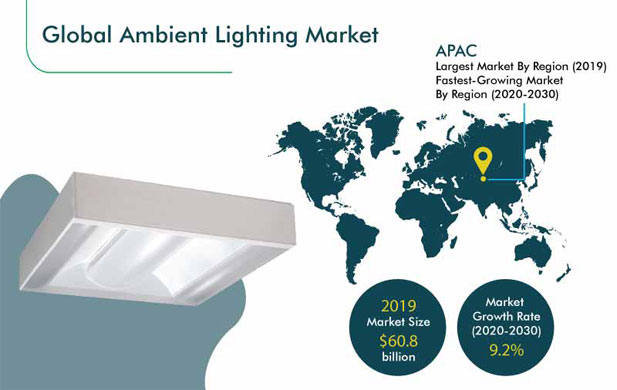

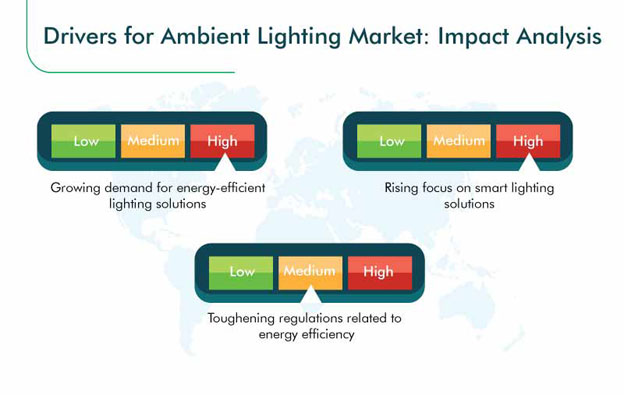

The ambient lighting market size stood at $60.8 billion in 2019, and it is expected to grow at a 9.2% CAGR between 2020 and 2030. The burgeoning demand for energy-efficient lighting solutions, surging emphasis on smart lighting, and increasing stringency of the regulatory policies pertaining to energy efficiency are the key factors driving the market growth.

However, the COVID-19 pandemic has hindered the growth of the ambient lighting industry, as it delayed the launch of residential projects and disrupted the supply chain of electronic components in numerous countries, including India and China.

Software and Service Demand To Grow Faster

The software and service category of the offering segment is expected to record the faster growth during 2020–2030. This will be due to the soaring demand for software for controlling the lighting in multiple settings, as per the requirement of users. Lighting control software provides improved functionality, such as color and brightness adjustment.

Highest Demand Being Witnessed for Recessed Lights

The recessed lights category, under the type segment, generated the highest revenue in 2019, as these lights can be used in commercial, as well as residential, settings. These lights offer improved illumination and an enhanced feel and look to the given space.

Automotive Category To Exhibit Fastest Growth

The ambient lighting market will showcase the fastest growth in the automotive category, in the end user segment, in the coming years. The booming vehicle production and increasing integration of interior lighting solutions in automobiles will drive this industry. For example, global automobile production grew from 95 million vehicles in 2016 to 97 million in 2018.

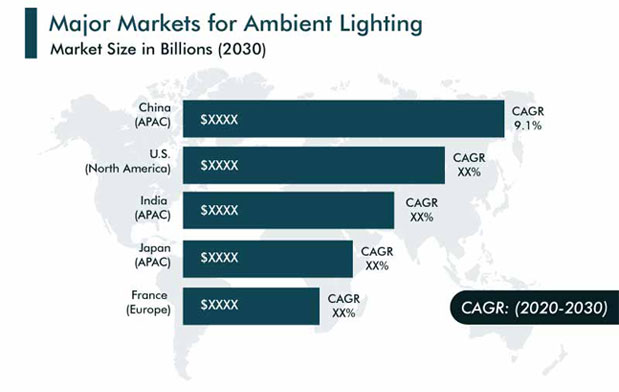

Asia-Pacific (APAC) Market Growth Thriving on Expanding Construction, Automotive, and IT Industries

The increasing construction of residential buildings, especially in China and India, and the improving automotive sector in the region will act as strong growth drivers for the market for ambient lighting in APAC. The adoption of ambient lighting is mushrooming in residential buildings due to the implementation of several government initiatives aimed at providing housing to the masses. Additionally, the rising automobile production in the major hubs, including South Korea, China, and Japan, will escalate the adoption of ambient lighting in APAC.

Additionally, the vast population and high disposable income have pulled the demand for ambient lighting from the construction projects in the region, primarily in China. For example, in 2019, residential construction in China recorded an increase of 8.7% from the 2018 figures. With the rising construction of residential units, the ambient lighting market will continue to prosper in the country.

Moreover, the flourishing information technology (IT) industry, especially in India and the Association of Southeast Asian Nations (ASEAN) countries, such as Singapore and Malaysia, is boosting the installation of such lighting systems in the corporate sector. Moreover, the fast growth of the corporate sector in Indian cities, especially Bengaluru, Delhi, and Mumbai, will propel the industry growth in the region.

Declining LED Prices and Increasing Focus on Energy-Efficient Lighting Boosting Market Growth

The skyrocketing demand for light-emitting diode (LED) lighting solutions has become a key market trend, as an LED light uses 50% less energy to generate an equivalent intensity of light as produced by compact fluorescent lamps (CFLs) and cold cathode fluorescent lamps (CCFLs). The reduced power consumption can directly curtail the annual carbon dioxide (CO2) emissions by approximately 700 million metric tons (MMT), thereby minimizing greenhouse gas emissions. Additionally, LEDs do not produce ultraviolet (UV) radiation, and they are neutral in nature. Owing to these properties, LEDs have become more viable for indoor lighting, and they have the potential to completely replace CCFLs and CFLs in the ambient lighting market.

Toughening Energy Efficiency Regulations Driving Market

The rising consciousness about environmental degradation has resulted in the implementation of stringent policies related to the energy efficiency of lights, which are offering immense potential for cost and energy savings in various sectors. For example, the U.S. Energy Standard for Buildings, implemented by the U.S. Department of Energy, is a national model code for commercial buildings and a vital parameter for creating design and related systems.

Such model energy codes for commercial and residential buildings are estimated to cut down CO2 emissions by 841 MMT and save nearly $126 billion in electricity costs. In recent years, China, one of the largest countries in the market for ambient lighting, has emerged as one of the leading energy consumers in the world, accounting for around 14% of the global power usage, with lighting as the prime focus area. In this regard, China made significant commitments through its Development Plan for LED Lighting Industry in 2017 to boost energy savings via the installation of LED lights.

Mounting Focus on Smart Lighting Solutions Steering Market Growth

The magnifying demand for smart lighting solutions is another factor driving the growth of the ambient lighting market. The popularity of LEDs in the industrial sector can be owed to their exquisite design structure and high energy efficiency. Moreover, the wide LED adoption in the residential sector has broadened the scope of advanced designs and efficiency.

In addition, the advent of the internet of things (IoT) technology and Industry 4.0 and the high requirement for smart home solutions have inspired market players to experiment more with LED lights. As energy conservation and connected domestic devices have become the prime drivers of the present-day lifestyle, players are rapidly launching solutions that leverage advanced technologies to enhance functionality, aesthetics, and performance, thus paving a smooth way for smart lighting solutions.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$60.8 billion |

Forecast Period CAGR |

9.2% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Offering, Type, End User, Geography |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Spain, Russia, Netherlands, Japan, China, India, South Korea, Indonesia, Thailand, Malaysia, Brazil, Mexico, Argentina, Colombia, Saudi Arabia, South Africa, U.A.E., Turkey, Egypt, Nigeria, Qatar |

Secondary Sources and References (Partial List) |

American Lighting Association, Energy Efficient Lighting Association (EELA), Global Lighting Association, Institute of Electrical and Electronics Engineers, Lighting Controls Association, World Bank, Electric Lamp and Component Manufacturers Association of India International Journal of Sustainable Lighting, Middle East Lighting Association |

Explore more about this report - Request free sample

Rising Focus on Smart Lighting Solutions Has Led to the Adoption of Ambient Lighting

The growing demand for smart lighting solutions is another factor driving the growth of the ambient lighting market. Energy efficiency and design structure have led to the adoption of LEDs in the industrial sector. Moreover, in the residential sector, mass-scale LED adoption has expanded the scope of advanced designs and efficiency.

Additionally, the rise of Industry 4.0 and the internet of things (IoT) and the need for smart home solutions have encouraged players to experiment more with LED lights. As connected domestic devices and energy conservation have become the major drivers of lifestyle, lighting manufacturers arefast introducing solutions that leverage latest technologies to enhance performance, aesthetics, and functionality, giving way to smart lighting systems.

Product Launches Are Aiding Companies to Strengthen Their Footprint

In recent years, players in the ambient lighting industry have launched several advanced products to stay ahead of their competitors. For instance:

- In April 2020, OSRAMLicht AG launched the HubSense intelligent lighting management system, a solution for retrofitting LED office lighting. The lighting system is suitable for upgrading existing lighting systems in small- and medium-sized businesses.

- In September 2019, Signify N.V. launched new smart light products, including Upgraded Hue Go, GU10, E14 smart bulbs, and smart buttons. The smart plug can make any table or floor lamp into a smart lamp, enabling the userto switch the light on and off using Bluetooth.

- In September 2019, Signify N.V. launched its Philips Hue Filament collection ofwarm white lights that can be used with or without a lamp shade in the room. The filament bulb combines modern technology with a vintage design that helps to control and personalize the lighting using a smartphone or a voice command.

Some of the Players in the Ambient Lighting Market

-

Signify N.V.

-

General Electric Company

-

OSRAM Licht AG

-

Acuity Brands Inc.

-

Häfele GmbH & Co KG

-

Zumtobel Group AG

-

Samsung Electronics Co. Ltd.

-

Wipro Enterprises (P) Ltd.

-

Cree Inc.

-

Hubbell Incorporated

-

Fritz Dräxlmaier GmbH & Co. KG

-

Bridgelux Inc.

-

Decon Lighting Pvt. Ltd.

-

Louis Poulsen A/S

-

Nulite Lighting

-

SPI Lighting Inc.

-

HELLA GmbH & Co. KGaA

-

Mektec Europe GmbH

-

Oshino Lamps GmbH

-

Thorn Lighting Ltd.

Ambient Lighting Market Size Breakdown by Segment

The ambient lighting market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Offering

- Hardware

- Lamps and luminaires

- Incandescent

- Halogen

- Fluorescent

- Light-emitting diode (LED)

- Lighting controls

- Sensors

- Switches and dimmers

- Relay units

- Lamps and luminaires

- Software and Service

Based on Type

- Suspended Lights

- Recessed Lights

- Track Lights

- Strip Lights

- Surface-Mounted Lights

Based on End User

- Residential

- Hospitality and Retail

- Healthcare

- Industrial

- Corporate

- Automotive

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Netherlands

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East and Africa

- Saudi Arabia

- U.A.E.

- Turkey

- Egypt

- South Africa

- Nigeria

- Qatar

The ambient lighting market size in 2019 was $60.8 billion.

The software and service offerings will witness the faster rise in demand in the ambient lighting industry.

APAC is the most-lucrative region for ambient lighting market investors.

The demand for LEDs in the ambient lighting industry is driven by the reducing prices of such products and increasing government initiatives for energy efficiency.

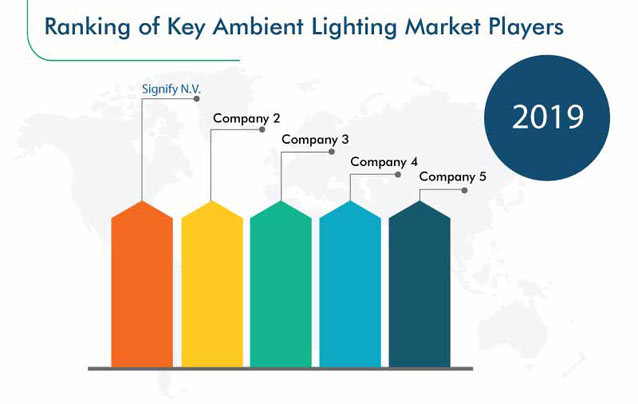

Signify N.V. dominated the ambient lighting market in 2019.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws