Report Code: 12850 | Available Format: PDF | Pages: 320

Agricultural Surfactants Market Size and Share Analysis by Type (Non-Ionic, Anionic, Cationic, Amphoteric), Application (Herbicides, Fungicides, Insecticides), Substrate (Synthetic, Bio-Based), Crop (Cereals & Grains, Fruits & Vegetables) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 12850

- Available Format: PDF

- Pages: 320

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

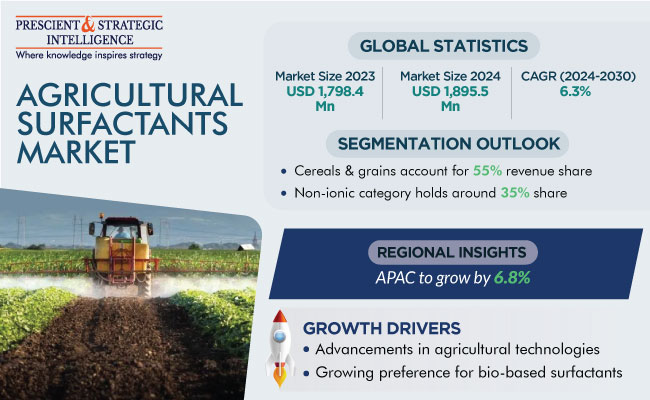

The global agricultural surfactants market size was an estimated USD 1,798.4 million in 2023, and this number is expected to increase to USD 2,734.6 million by 2030, advancing at a CAGR of 6.3% between 2024 and 2030. This can be ascribed to the advancements in the technologies and products used in agriculture, growing preference for bio-based surfactants, rising demand for better yield and feedstock quality, surging need for crop protection, and burgeoning number of supportive government schemes for the agriculture sector.

Furthermore, the mounting demand for agrochemicals and the increasing adoption of precision farming techniques across the globe contribute to the market growth.

Non-Ionic Surfactants Contribute Majority of Revenue

The non-ionic category accounted for the largest revenue share, of 35%, in 2023, and it is further expected to maintain its dominance during the forecast period. This is because such chemicals are safe for plants and provide stability and effectiveness in breaking water surface tension. They are heavily used for general wetting and spreading by adding to herbicidal spray solutions, as they are stable in cool water, less toxic to plants, and good dispersing agents. Furthermore, their addition to crop formulations enhances overall productivity by diminishing the runoff water amount.

Moreover, the anionic category will witness significant growth in the coming years. This is because these chemicals are more cost-effective than others, and they can be added to pesticides to increase their efficiency, as they consist of sulfonates, dispersants, and carboxylates.

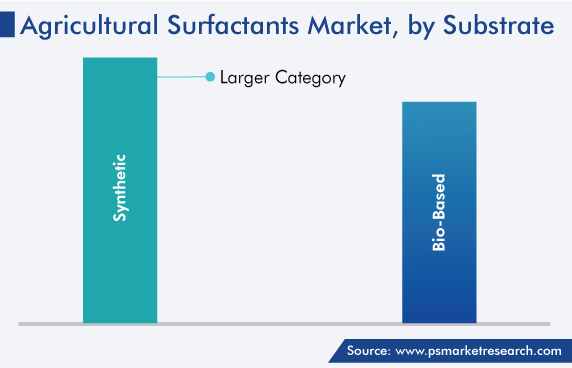

Bio-Based Substrates Will Witness Higher CAGR

The bio-based substrate category will register the higher growth rate during the prediction period, of 6.6%, due to the mounting consumer preference for eco-friendly and bio-based products. With the rising concerns regarding the environment, several agrochemical manufacturers are launching biodegradable products. Apart from being less toxic to plant, animal, and human health, their production also emits lower GHG emissions than chemicals based on petrochemical feedstock.

Synthetic crop protection solutions are majorly made from petroleum derivatives, which are not good for human health. Governments and producers of surfactants in various regions are majorly concentrating on shifting to sustainable and renewable products because of the rising concerns for the safety of the environment as well as human health. This has led to an increase in the demand for biologically derived products, which pose little risk to the environment, unlike the conventional solutions derived from petroleum, which are toxic in nature and accumulate in the marine environment.

Biosurfactants are microbial surfactants with greater effectiveness over chemically synthesized agents. These surfactants are made from eco-friendly raw materials, because of which they display high safety and biodegradability. The increasing awareness of utilizing natural and renewable ingredients in their everyday products is enhancing the biosurfactant demand among farmers.

Still, synthetic substrates contributed the majority of the revenue to the market in 2023, and it is further expected to maintain the same trend in the coming years. This is due to the cost-effectiveness and easy availability of petroleum-based solutions across the world.

Cereals & Grains Hold Largest Revenue Share

Cereals & grains held the largest revenue share in 2023, and this trend will be maintained throughout this decade. This is due to the increase in the consumption of rice, corn, wheat, barley, and oats in the North American and Asian regions, consumers’ rising awareness of the health benefits of these cereals and grains, and various subsidies and financial advantages offered by governments to farmers to grow such highly demanded food crops.

Moreover, fruits & vegetables will witness significant growth in the coming years. This can be attributed to the growing consumer consciousness of fruit intake to maintain a healthy lifestyle. These products are rich sources of vitamins and minerals, which are vital to build immunity and fight disease.

Herbicides Dominate Market

The herbicides category accounted for the largest revenue share in 2023, and it is further expected to maintain its position during the prediction period. This can be ascribed to the extremely high usage of herbicides, including oxyfluorfen and glyphosate. Therefore, market players are launching effective and low-cost solutions to cater to the high demand for such agrochemicals.

Developing nations, such as Brazil, Argentina, China, and India, are among the biggest pesticide consumers owing to their huge agriculture industry. The extensive agricultural production boosts the demand for herbicides, which further creates the need for such surfactants.

Moreover, the insecticides category is expected to grow at a significant CAGR in the coming years. This is due to the growing usage of these biocides on diverse crop types, including cereals, grains, pulses, vegetables, and fruits, owing to the susceptibility of these crops to insect infestation. Developing nations, such as China and India, widely use these chemicals to prevent a range of crops from pest infestation during the early stages of germination.

| Report Attribute | Details |

Market Size in 2023 |

USD 1,798.4 Million |

Market Size in 2024 |

USD 1,895.5 Million |

Revenue Forecast in 2030 |

USD 2,734.6 Million |

Growth Rate |

6.3% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By Substrate Type; By Crop Type; By Region |

Explore more about this report - Request free sample

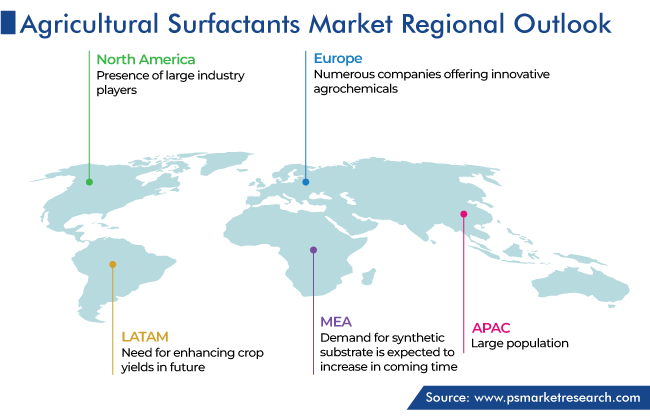

APAC Will Witness Fastest Growth

APAC will register the highest growth rate during the forecast period, of 6.8%. This can be ascribed to the large population of the region, which creates an extremely high demand for food; wide availability of arable land, increase in the number of local manufacturers and vendors of crop protection solutions, growth in the usage of agrochemicals to achieve higher productivity, and several government schemes offering support to the agriculture sector.

Moreover,

- The growing investment of foreign companies to establish manufacturing plants here owing to the cheap labor and easy availability of raw material boosts the regional market growth.

- Emerging economies, such as China and India, majorly contribute to the growth of the regional market, owing to their large populations, significant fertile and arable land, supportive government schemes, huge population of farmers and allied professionals, and increasing R&D on farming techniques.

North America holds a significant revenue share in the agricultural surfactants market, due to the presence of large industry players, availability of huge arable land, developed agriculture sector, great emphasis on technologically advanced products, and increasing preference for bio-based surfactants owing to health concerns.

Moreover,

- Pests are one of the major problems for farmers in North America. For instance, in 2021, 25 U.S. states registered an estimated 9% loss of corn yield due to invertebrate pests, while Ontario reported a loss of around 1%. The total loss amounted to around 1.3 billion bushels.

- To maintain crop yields and tackle the risk of crop damage, pesticides are offered by numerous industry players. Additionally, such companies are heavily investing in research and development, which further contributes to the market, by making more-effective agrochemicals available to farmers.

- The U.S. contributes the majority of the revenue to the industry in the region, and it is expected to maintain its lead during the prediction period. This is due to the high count of industry players, rising demand for food products, growing trend of packaged food across the nation, and increasing usage of advanced technologies in agriculture.

Europe is also witnessing a substantial growth in the demand for agricultural surfactants owing to the high acceptance rate of advanced farming technologies, existence of sizeable arable land, and availability of numerous companies offering innovative agrochemicals.

Moreover,

- The rising acceptance of organic farming, which is characterized by the non-usage of synthetic pesticides, fertilizers, and genetic modification, is a major factor responsible for the regional market growth. In place of chemically synthesized pesticides, organic biopesticides are gaining popularity, as they have a minimal negative impact on the environment, plants, people, and animals. Therefore, several companies are manufacturing a variety of bio-based pesticides, which further enhances the market potential for green surfactants.

- Germany contributes significant revenue to the market owing to the presence of a large number of industry players, high food demand, and ready availability of petroleum-based solutions for producing conventional agricultural surfactants.

Top Agricultural Surfactant Providers Are:

- The Dow Chemical Company

- BASF SE

- Solvay S.A.

- Nouryon Chemicals Holding B.V.

- Wilbur-Ellis Holdings Inc.

- Helena Agri-Enterprises LLC

- Clariant AG

- Evonik Industries AG

- Croda International Plc

Market Size Breakdown by Segment

This report offers deep insights into the agricultural surfactants market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Type

- Non-ionic

- Anionic

- Cationic

- Amphoteric

Segment Analysis, By Application

- Herbicides

- Fungicides

- Insecticides

Segment Analysis, By Substrate

- Synthetic

- Bio-Based

Segment Analysis, By Crop

- Cereals & Grains

- Fruits & Vegetables

Region/Countries Covered in This Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for agricultural surfactants values USD 1,798.4 million in 2023.

The agricultural surfactants industry is witnessing a CAGR of 6.3%.

Bio-based chemicals are trending in the market for agricultural surfactants.

The non-ionic type generates the highest agricultural surfactants industry revenue.

The market for agricultural surfactants is propelled by the growing demand for food and diminishing farmland area.

Cereals & grains dominate the agricultural surfactants industry.

APAC is expected to witness the highest CAGR in the market for agricultural surfactants.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws