Market Statistics

| Study Period | 2019 - 2030 |

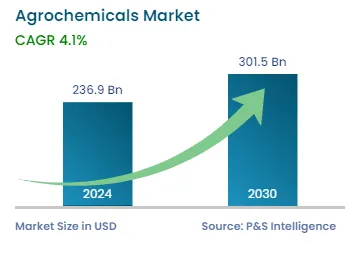

| 2024 Market Size | USD 236.9 Billion |

| 2030 Forecast | USD 301.5 Billion |

| Growth Rate(CAGR) | 4.1% |

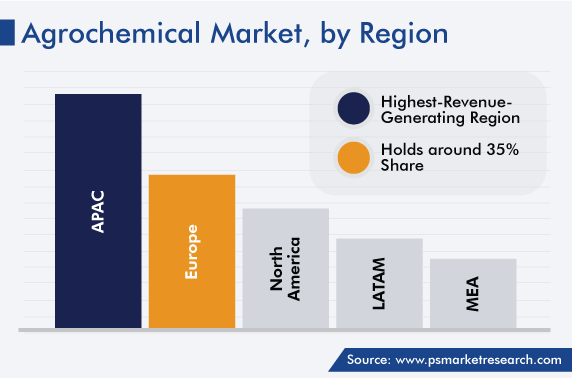

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Report Code: 12652

Get a Comprehensive Overview of the Agrochemicals Market Report Prepared by P&S Intelligence, Segmented by Type (Fertilizers, Pesticides, Plant Growth Regulators), Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 236.9 Billion |

| 2030 Forecast | USD 301.5 Billion |

| Growth Rate(CAGR) | 4.1% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global agrochemicals market was valued at USD 236.9 billion in 2024, and the market size is predicted to reach USD 301.5 billion by 2030, advancing at a CAGR of 4.1% during 2024–2030. The market is driven by the increasing population and the consequently rising demand for food. This is leading to a growing demand for fertilizers among farmers in order to supply nutrients to the crops and enhance their yield.

Agrochemicals are chemicals that can be safely applied to crops in order to give farmers a better quality and higher productivity. Insecticides, fungicides, and herbicides are also collectively known as crop protection products. Pesticides are chemical compounds that are used to kill pests that damage the crop or result in a poor quality of the products. Whereas, a fertilizer is used to enhance the quality of the crops by providing them with the required nutrients.

Due to the rising population, food demand is expected to increase by anywhere between 60% and 99% by 2050. With this, farmers worldwide will need to increase crop production, either by increasing the area under cultivation or increasing the productivity of the existing agricultural lands, through the use of fertilizers. Therefore, the usage of such chemicals to provide a better quantity and quality of agricultural products is rising.

Furthermore, the continuously ongoing R&D activities in order to create high-quality agricultural chemicals will propel the market. The availability of food is directly dependent on the extent and efficiency of agriculture. Therefore, governments have heavily invested in this sector. For instance, In India, the government encourages farmers through different programs, such as Aatmanirbhar Bharat, to achieve high yields. The aim of this scheme is to promote sustainable agricultural practices, increase farmers’ income, and reduce the dependence on imports. The government also provides financial support to farmers to supplement their income and help ensure an optimum supply of agricultural commodities around the country.

In addition, the major companies in the market have increased their focus on the modernization of the farming sector. For this, they are raising awareness on agricultural chemicals and enabling their purchase on e-commerce platforms. These developments are likely to boost the availability of the required inputs, thereby accelerating the growth of the industry.

Rising Population Leads To Increase in Food Demand

As per the UN, the world’s population is around 8.1 billion in 2023, and it is set to cross 10 billion by the end of this decade.

The increase in the population has a strong impact on food demand. To make matters worse, the availability of land for agriculture is gradually declining owing to urbanization, which is impelling farmers to deploy various types of chemicals in order to maximize crop productivity and improve soil health. Therefore, in order to meet the rising demand for food, the usage of , such as pesticides, and fertilizers has become necessary.

Insects are considered among the biggest threats to crops. They damage the growing crops by eating their leaves and burrowing holes in the stems and roots. Apart from this, they cause indirect damage by transmitting bacterial, viral, or fungal infections to the crop, which can, further, be transmitted to humans. For instance, in 2022, weeds resulted in 37% of the all yield losses due to pests, but the share of weeds may be as high as 90% in some cases.

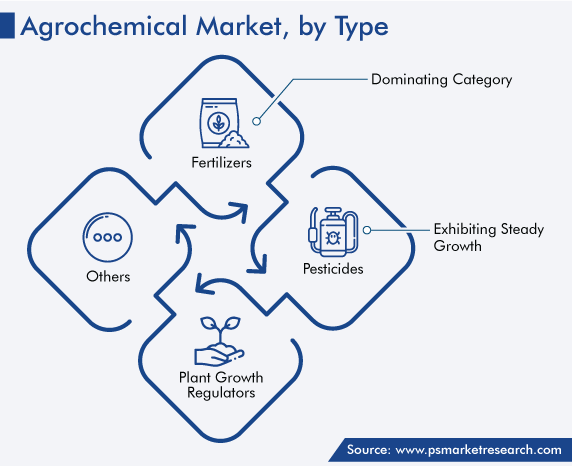

The fertilizer category dominated the market, with a revenue share of 80%, in 2022. The increase in sales is expected to be significant over the forecast period due to the production of a large quantity of fertilizers and companies and governments’ efforts to make farmers aware of their benefits. Essentially, the population expansion is likely to raise the demand for fertilizers by putting the agrarian community under intense pressure to cater to the increasing demand for food. Moreover, the growing penetration of organic fertilizers is expected to enhance efficiency and safety. For instance, in 2022, Bayer AG collaborate with Ginkgo Bioworks to develop a more-environment-friendly nitrogen fertilizer and weed killer.

The cereals and grains category is projected to witness the fastest growth during the forecast period. Such chemicals are used the most extensively on cereals and grains because crops such as rice may have a lower yield and low amounts of nutrients due to the poor quality of the soil. To overcome this problem, minerals are added to fertilizers, in order to boost the grain nutrient content and output.

Furthermore, there are numerous benefits of cereals and grains, such as reduction in the risk of obesity, diabetes, and cancer. In the food and beverage industry, several grains are used as raw materials to improve the nutrition profiles of a variety of products. Moreover, due to its large population and limited land for cultivation, Asia’s position in the global food market tilts heavily toward the demand side. So, in order to fulfill the requirement for carbohydrate-rich food, the use of crop protection products for the cultivation of cereals and grains has almost become a need for farmers.

In addition, the fruits and vegetable category is expected to be the second-fastest growing. This growth will be due to the rising awareness among customers of health and fitness, for which a proper intake of vitamins and minerals is essential. Hence, as the cultivation of fruits and vegetables, which are the key sources of minerals and vitamins, increases, so will the consumption of an array of agrochemicals

Many market players are actively involved in strategic collaborations and product launches to strengthen their product portfolios and achieve a huge market share. For instance,

In August 2022, BASF SE and Corteva Agriscience announced a long-term agreement to develop soybeans that tolerate herbicides better. The collaboration is also aimed at better ways of managing tough-to-control and herbicide-resistant weeds utilizing better trait stacks and other modes that are effective and have long-lasting effects.

In May 2022, Sumitomo Chemical received the registration approval in Brazil for its soybean fungicide, named EXCALIA MAX, which contains the novel active ingredient INDIFLIN.

Drive strategic growth with comprehensive market analysis

Geographically, Asia-Pacific had the dominating market share in 2022, and it is expected to maintain its dominance during the forecast period. This is due to the presence of a large population and major players in the market. Chemical companies catering to the farming community are using collaborations, mergers, and acquisitions to enter the Asia-Pacific region, to gain a significant market share.

For instance, Syngenta and Bayer CropScience are among the many companies that have expanded their presence in China by enhancing the quality of their crop protection products. They are also more focused on mergers and acquisitions in order to build a substantial market share in the Chinese market.

China, India, and Japan are the key contributors to the regional market. Among them, China is the world’s largest producer of crops and manufacturer of crop protection products. More than 30% of the world’s pesticides and fertilizers are used here. Due to the expanding population, growing economy, and rising urbanization rate, the area of arable land is decreasing. As a result, the Government of China is strongly focused on food security, which is increasing the production of cereals and grains in order to meet the rising food demand.

Furthermore, India is the world’s fourth-largest producer of crop protection products and the 13th-largest exporter of pesticides globally. The high production of wheat and rice is the major factor that is driving the market growth. The rising population creates a huge demand for food products; so, the use of pesticides is burgeoning in India. For instance, UPL, a key agricultural chemical company in India, generated INR 46,240 crore in revenue in 2022.

North America will hold the second-largest share during the forecast years. This will be due to the decreasing number of agricultural fields and rising demand for nutritious food. Therefore, the need for improving crop productivity and quality has risen, which is driving the consumption of crop protection agents and fertilizers. Moreover, U.S. is the world’s largest producer of blueberries, for which ammonia sulfate, urea, and ammonia nitrate are used as fertilizers.

This report offers deep insights into the agrochemical industry, with size estimation for 2019 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Type

Based on Application

Geographical Analysis

The market for agrochemicals will value USD 301.5 billion by 2030.

Fertilizers dominate the agrochemical industry.

Organic and nano fertilizers are trending in the market for agrochemicals.

Government initiatives that seek to alleviate hunger and reduce food imports offer opportunities in the agrochemical industry.

APAC will generate the highest revenue in the market for agrochemicals.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages