Market Statistics

| Study Period | 2019 - 2030 |

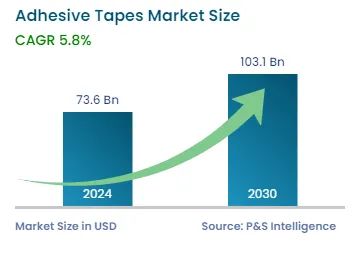

| 2024 Market Size | USD 73.6 Billion |

| 2030 Forecast | USD 103.1 Billion |

| Growth Rate(CAGR) | 5.8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 10868

Get a Comprehensive Overview of the Adhesive Tapes Market Report Prepared by P&S Intelligence, Segmented by Type (Commodity, Specialty), Technology (Water-Based, Solvent-Based, Hot-Melt-Based), End Use (Packaging, Consumer and Office, Healthcare, Automotive, Electrical and Electronics, Building and Construction), Resin (Acrylic, Rubber, Silicone), Backing Material (Paper, PVC, PP), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 73.6 Billion |

| 2030 Forecast | USD 103.1 Billion |

| Growth Rate(CAGR) | 5.8% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The global adhesive tapes market size is estimated to have stood at USD 73.6 billion in 2024, and it is expected to reach USD 103.1 billion by 2030, advancing at a CAGR of 5.8% during the forecast period. This is attributed to the large-scale consumption of these materials for various packaging applications in industries such as electrical and electronics and e-commerce, the growing healthcare industry, the increasing R&D spending by giants, technological advancements, and the rising number of innovative product launches.

Expanding Automotive Sector Drives the Demand

One of the strongest drivers for the market is the increasing production of electric vehicles, with OEMs encouraged by government subsidies. In addition, the tightening of carbon regulations in the majority of countries is expected to encourage innovations for clean and green automobile technologies, including electric and hybrid powertrains, batteries, lightweight aerodynamics, and drag-reducing designs.

Moreover, the burgeoning consumer demand for energy-efficient vehicles is expected to support the automotive industry across the globe. There has been a constructive outlook for the automobile industry across well-developed markets, including the U.K., the U.S., and Germany, as well as developing markets, including China and India. In addition, technological developments and the need for performance enhancements in vehicles have led to the installation of specialized components. Thus, this factor is expected to have a positive impact on the demand for adhesive tapes.

Furthermore, adhesive tapes find wide applications in the automotive sector, mainly double-sided tapes, protection tapes, and foam tapes, as they are easy to affix and remove. According to the International Organization of Motor Vehicle Manufacturers (OICA), the production and sale of automobiles increased considerably in 2021 compared to 2020. Hence, the developments in automotive technology and the introduction of new automobiles, such as smart cars and aluminum trucks, are expected to drive the demand for adhesive tapes globally in the coming years.

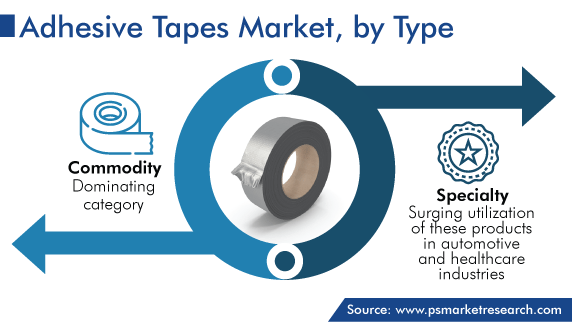

The commodity category is estimated to have accounted for a larger revenue of USD 41.2 billion in 2023, and it is further expected to maintain its dominance during the projection period. This is attributed to the high usage of adhesive tapes for packaging applications for commodities.

On the other hand, the specialty category is predicted to grow at a substantial rate during the forecast period. This can be due to the surging utilization of these products in rapidly growing industries, such as automotive, healthcare, electrical and electronics, and construction and building, across different regions.

Over the past few decades, rapid economic development in emerging economies, such as China, India, and Indonesia, has resulted in an increase in the per capita income. With the rising income levels, the standard of living in these countries has also increased considerably. Due to the changing lifestyles, there has been a rise in the demand for packaging solutions. This, in turn, has boosted the need for tapes, for the purpose of packaging and carton-sealing, bundling, and strapping of products and heavy-duty cartons.

Moreover, these are now one of the major promotional tools for brand owners, due to the advancements in digital printing and systems. To outspread the reach of their brands beyond retail stores and into customers' houses, brand owners are now demanding secondary packages. In the coming years, this aspect is expected to boost the needs of the retail sector for strapping and sealing materials for packaging applications. Hence, the growth in the industry is expected to continue driving the adhesive tapes market in the coming years.

The hot melt-based category accounts for the largest market share and it will also maintain its position during the coming years. This is ascribed to its high usage in a variety of manufacturing processes, such as bookbinding, woodworking, construction, product assembling, and box or carton heat sealing.

Whereas, the water-based category will register the fastest growth during the forecast period. This can be due to the increasing demand for environment-friendly water-based adhesive products, coupled with regulatory support.

The increase in the adoption of water-based adhesive tapes is being witnessed in many end-use verticals, including infrastructure. The majority of the demand is expected to come from China, India, and Malaysia, due to the increasing investments in railways for the development of rapid transit systems and railway tracks, and in water distribution and sewerage projects for the installation of larger pipes and stormwater drainage systems.

Thus, rapid growth in the infrastructure sector is resulting in the surging demand for these variants for bonding building materials, meeting air sealing requirements, flashing doors and windows, and roofing purposes. Moreover, they are also gradually edging out solvent-based, as water-based adhesives help reduce volatile organic compound (VOC) emissions and improve air quality.

On the other hand, solvent-based adhesives are highly flammable and form ground-level ozone as a result of VOC emissions. Since water-based adhesives are made of natural polymers or vegetable sources, they are eco-friendly in nature and, therefore, find wide applications across several industries. Thus, the growing shift toward eco-friendly tapes is a major trend witnessed in the market.

The healthcare category will witness the fastest growth during the forecast period, advancing at a CAGR of 6.3%. This can be due to the rising R&D spending in the sector, the increasing health consciousness among people, the escalating count of hospitals and ASCs, the growing demand for in-vitro diagnostics, and the surging launches of medical equipment and related products, including hydrophilic films, oral dissolvable films, and transdermal drug delivery patches.

Whereas, the packaging category holds the largest share of the market, and it is predicted to maintain its position in the coming years. This is because almost every industry makes use of such tapes for several applications. Moreover, the increasing trend of online shopping in emerging economies is boosting the demand for retail e-commerce packaging, which, in turn, requires these products for various purposes.

Furthermore, the automotive sector contributes a significant share to the market. This is ascribed to the quick replacement of nut and bolt fasteners to lighten and improve the appearance of vehicles, the growing automobile sector especially in emerging countries, the rising trend of EVs across the globe, and technological advancements.

Moreover, the building and construction category will witness substantial growth in the coming years. This can be due to the surging government expenditure on large-scale infrastructure projects, including airports, rail stations, and highways, and the mounting number of public–private infrastructure development collaborations.

Acrylic resin accounts for the highest revenue share and it is also expected to maintain its position during the projection period. This is due to the high demand for acrylic adhesive products, owing to their chemical and physical properties, lower cost, and vast applications in several end-use verticals, such as healthcare, automotive, and packaging.

On the basis of backing material, the market is classified into paper, polyvinyl chloride (PVC), polypropylene (PP), and others. Among these, the paper category holds the largest share of the market, and it will continue to do so during the coming years as well. This is because they have a wide range of applications and are made of affordable paper with a rubber adhesive coating. They are also available in several colors, eco-friendly, temperature-resistant, and have superior adhesion.

Drive strategic growth with comprehensive market analysis

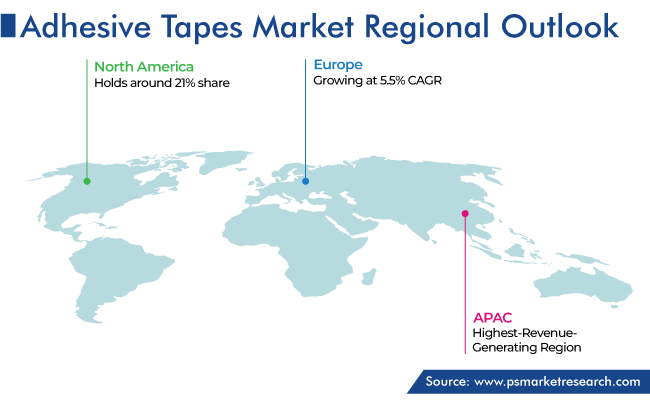

Globally, the APAC adhesive tapes market is estimated to have generated for the highest revenue, of $37.8 billion, in 2023, and it is expected to advance at a significant CAGR in the coming years. This is ascribed to the easy availability of raw materials; the growing electrical and electronics industry, where these tapes are extensively used; the increasing demand from the automotive sector, owing to the escalating number of vehicles used for the transportation of goods as well as private-owned cars; and the presence of a large number of prominent manufacturers in the region.

Moreover, the North American market accounts for a significant share. This is attributed to the high per capita income, surging number of key players, technological advancements, mushrooming construction rate, and mounting preference for packaged food, which leads to the growth of the packaging industry in the region.

Furthermore, Europe accounts for a significant share of the market, and it will maintain its position during the coming years. This is due to the well-established automobile sector, the growing packaging industry, and the high acceptance rate of cutting-edge technology.

This fully customizable report gives a detailed analysis of the adhesive tapes industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Type

Based on Technology

Based on End Use

Based on Resin

Based on Backing Material

Geographical Analysis

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages