Key Highlights

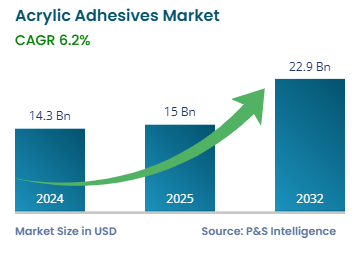

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 14.3 billion |

| Market Size in 2025 | USD 15.0 billion |

| Market Size by 2032 | USD 22.9 billion |

| Projected CAGR | 6.2% |

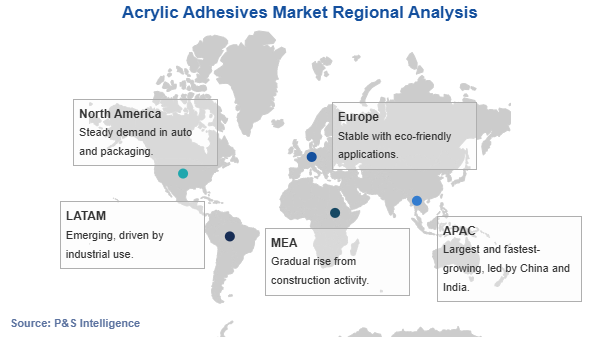

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Market Structure | Fragmented |