Report Code: 12798 | Available Format: PDF | Pages: 260

Ablation Technology Market Size and Share Analysis by Product (Radiofrequency Devices, Laser/Light Devices, Ultrasound Devices, Electrical Devices, Cryoablation Devices, Microwaves), Application (Cardiovascular, Cancer, Gynecological, Pain), End User (Hospitals, Ambulatory Surgical Centers, Medical Spas & Aesthetic Clinics) - Global Industry Demand Forecast to 2030

- Report Code: 12798

- Available Format: PDF

- Pages: 260

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Ablation Technology Market Size & Share

The global ablation technology market generated USD 5,313.2 million revenue in 2023, and it is projected to witness a CAGR of 9.0% during 2024–2030, to reach USD 9,672.9 million by 2030. This is attributed to the increase in the number of cases of chronic diseases, such as cancer, heart diseases, and gynecological, ophthalmologic, and urological diseases. This leads to a rise in the demand for effective surgical therapies, which, in turn, drives the volume of ablation devices.

Other factors driving the growth of the market are the rising awareness about ablation procedures, increasing healthcare expenditure, surging number of cancer cases, low cost of this procedure, and technological innovations in associated devices. Furthermore, the increasing number of hospitals and ambulatory surgery centers is expected to boost the growth of the market.

Moreover, the rise in the elderly population and increase in the demand for minimally invasive procedures, owing to their advantages over the conventional, open procedures, will drive the product demand. Minimally invasive procedures are now widely used to remove tumors and lymph nodes and for cardiovascular diseases, as they leave minute marks on the body, unlike an open surgery.

In addition, minimally invasive techniques show accurate results and are cost-saving for both care providers and patients. Additionally, the variety of such procedures available for different parts of the body, such as adrenalectomies, brain surgeries, colectomies, hiatal hernia repairs, and nephrectomies, has made them immensely popular. Other procedures for which MISs can be used include heart surgeries, splenectomies (spleen removal), spine surgeries, and cholecystectomies (gallbladder surgery).

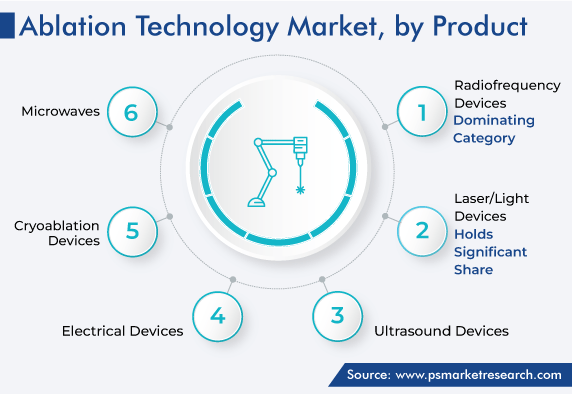

Radiofrequency Ablators Category Accounts for Largest Share

The radiofrequency ablators (RFA) category accounted for the largest share, of 25%, in 2023, and it is expected to witness a CAGR of 9.2% during 2024–2030. This is due to the increasing usage of RFA for the treatment of benign and cancerous tumors, chronic back and neck pain, chronic venous insufficiency in the legs, and many other conditions. RFA is also used for atrial fibrillation, in which the heartbeat is irregular.

Moreover, the FDA approvals for advanced radiofrequency ablators are expected to boost the market in the coming years. For instance, in December 2022, RF Medical Co. Ltd., a Korean medical device company, received the FDA clearance for its patented MYGEN M-3004 generator and MYOBLATE RFA system for use in the U.S.

Moreover, advanced ablation systems have shown promising results in animal models in numerous studies. For instance, in December 2022, NeuroOne Medical completed a feasibility study for its OneRF ablation system, which utilizes the existing implanted stereo-electroencephalography (sEEG) diagnostic electrodes for brain tissue lesioning.

The company used its FDA-cleared sEEG electrodes, combined with an RF generator and a unique temperature controller, which monitors and maintains the temperature at which the ablation is performed. This allows clinicians to set the temperature and time for each ablation.

Moreover, Acotec Scientific Holdings Ltd. has received the marketing approval for its radiofrequency system from China’s NMPA to treat varicose veins.

Laser ablation also holds a significant share in the market, due to the research being conducted on this technology. For instance, it was concluded in an article published in January 2023 that the endovenous laser ablation of superficial venous reflux, with compression therapy, is associated with a shorter healing time for venous ulceration and minimized chances of recurrence.

Moreover, another recent study published in the journal Biomedical Optics mentions a laser-based approach to performing microbiopsies. This approach makes biopsies faster, more cost-effective, and less harmful for the patient.

In addition, in January 2023, BT BeaMedical Technologies and Shina System Ltd. entered into a development agreement to leverage the capabilities of Shina to develop and commercially deploy BeaMed’s StingRay laser system for brain surgeries, post gaining the regulatory clearance.

Moreover, the FDA has granted its Investigational Device Exemption to Avenda Health Inc.’s Focal Point ablation system, which is powered by AI-based patient management software, known as iQuest. The device directly destroys prostate tumors and does not harm the healthy tissue in the surrounding areas.

Ultrasound ablators also hold a significant share due to the recent advancements in them. For instance, in December 2022, physicians at the UTSW developed four-tract tractography as an improved method to customize MRI-guided, HIFU therapy for medication refractory tremors in Parkinson’s disease patients. The results of the clinical trials of this approach, published in the Brain Communications journal, suggest that it decreases treatment times, enables more-accurate targeting of the brain, improves treatment response, and reduces side-effects.

The cryoablation category is expected to experience the highest CAGR, during 2024–2030, due to the high effectiveness of this therapy. For instance, a study published in the Journal of Urology states that for patients with early-stage renal cell carcinomas, cryoablation, which destroys the cancer by freezing it, yields a lower risk of death compared to heat-based ablation.

Moreover, the FDA has given an extended approval to Medtronic’s Freezor and Freezor Xtra cardiac cryoablation focal catheters to treat atrioventricular nodal reentrant tachycardia (AVNRT) in pediatric patients.

Moreover, in April 2022, Channel Medsystems Inc. created the Cerene cryotherapy device for endometrial ablation during the treatment of heavy menstrual bleeding with abdominal pain, tiredness, and cramping.

Cardiovascular Treatments Account for Highest Usage of Ablation Technology

By application, the cardiovascular category held the largest share in 2023. This is because the ablation technology is widely used in the treatment of atrial fibrillation, wherein it helps in breaking up the electrical signals that cause the irregular heartbeats. Moreover, every cell in the myocardium creates its own signal to create a heartbeat. If some of the cells are not syncing with other cells, arrhythmia (irregular heartbeat) occurs. Here, the ablation process is used to block the electric signals causing the arrhythmia.

Mergers & Acquisitions Are Key Trends

In December 2022, Boston Scientific Corporation announced it will acquire a majority stake in Acotec Scientific Holdings Limited, a Chinese medical device company. Acotec’s portfolio includes thrombus catheters, RFA technologies, and various other products.

Moreover, in August 2022, Medtronic plc announced the acquisition of Affera Inc. to expand its cardiac ablation portfolio with the addition of the latter’s cardiac mapping and navigation platform.

| Report Attribute | Details |

Market Size in 2023 |

USD 5,313.2 Million |

Market Size in 2024 |

USD 5,754.2 Million |

Revenue Forecast in 2030 |

USD 9,672.9 Million |

Growth Rate |

9.0% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product; By Application; By End User; By Region |

Explore more about this report - Request free sample

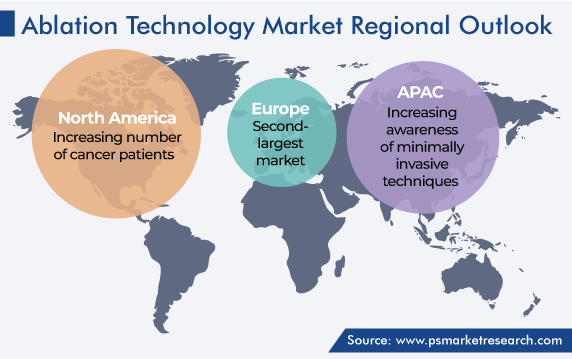

North America Held Largest Share in Market

North America was the largest consumer in the ablation technology market in 2023, due to the developments in the technology and rising awareness regarding its usefulness for various treatments.

The increase in the number of patients with chronic diseases (especially cancer) is adding to the growth of the market. Already, cancer is one of the top ten leading causes of death in the country. Its mortality rate is expected to rise to around 3 million by the end of 2040. Similarly, around 37.3 million people in the country were found to have diabetes, and around 96 million adults were found to have pre-diabetes.

Additionally, the rising prevalence of chronic pain and the growing awareness of pain management in the country boost the treatment demand. According to the CDC, in the U.S., chronic pain is one of the most-common conditions in adults. This condition is linked to restrictions in mobility and daily activities, dependence on opioids, anxiety, and depression.

Moreover, companies are investing in AI to offer better healthcare. For instance, in January 2023, Volta Medical Inc., which develops AI solutions to treat atrial fibrillation and other cardiac arrhythmias, announced EUR 36-million Series B funding, which brought the total raised capital to more than EUR 70 million. U.S.-based Vensana Capital led the funding round, with Lightstone Ventures and Glide Healthcare coinvesting.

Asia-Pacific will be the fastest-growing ablation technology market, with a CAGR of 9.5%, during 2024–2030. This is attributed to the increasing awareness of minimally invasive techniques, advancing healthcare systems, and growing economies. For instance, in October 2022, Fortis launched a 200-bedded multi-specialty hospital in Greater Noida. The hospital is expected to host a large number of international patients as well, which would contribute to the growth of India’s medical tourism industry.

Moreover, in October 2022, the Government of Gujarat approved the construction of a new multi-specialty hospital at the Anusya Leprosy campus. The INR 22.5-crore hospital will offer treatments for a range of cardiac illnesses.

Some of the Key Players in the Market Are:

- Medtronic plc.

- Johnson & Johnson Services Inc.

- Abbott Laboratories

- Boston Scientific Corporation

- Olympus Corporation

- Stryker Corporation

- Smith & Nephew plc

- Varian Medical Systems Inc.

- CONMED Corporation

- AngioDynamics Inc.

Market Size Breakdown by Segment

This fully customizable report gives a detailed analysis of the ablation technology market from 2017 to 2030, based on all the relevant segments and geographies.

Based on Product

- Radiofrequency Devices

- Laser/Light Devices

- Ultrasound Devices

- Electrical Devices

- Cryoablation Devices

- Microwaves

Based on Application

- Cardiovascular

- Cancer

- Gynecological

- Pain

Based on End User

- Hospitals

- Ambulatory Surgical Centers

- Medical Spas & Aesthetic Clinics

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The market for ablation technology generated USD 5,313.2 million in 2023.

The biggest ablation technology industry drivers are the rising incidence of chronic diseases, preference for MISs, geriatric population, and healthcare infrastructure investments.

Radiofrequency ablators dominate the market for ablation technology.

CVDs are the largest application in the ablation technology industry.

The market for ablation technology will grow the fastest in APAC.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws