Report Code: 12865 | Available Format: PDF | Pages: 190

Zero Trust Architecture Market Share Report by Offering (Solution, Services), Organization Size (Small and Medium-Sized enterprises, Large enterprises), Deployment Mode (Cloud, On-Premises), Vertical (BFSI, Government and Defense, IT and ITeS, Healthcare, Retail and E-Commerce) - Global Industry Demand Forecast to 2030

- Report Code: 12865

- Available Format: PDF

- Pages: 190

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Zero-Trust Architecture Market Size & Share

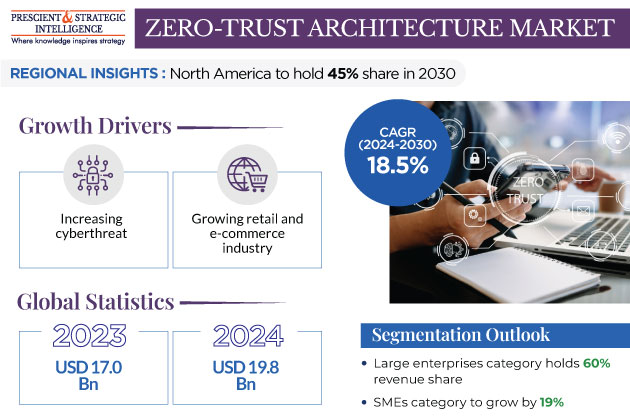

The zero trust architecture market generated revenue of USD 17.0 billion in 2023, which is expected to witness a CAGR of 18.5% during 2024–2030, reaching USD 55.0 billion by 2030. The key drivers for the market are the increasing cybersecurity threat, growing trend for BYOD and CYOD concepts, burgeoning cloud adoption, digital transformation, rising preference for remote workforces and mobile devices, and compliance and data privacy regulations.

Increasing Cyberthreats Are Primary Drivers for Market

The utilization of zero-trust engineering (ZTA) has been fundamentally expanded by the evolving digital dangers that attack organizations in each area. Ransomware assaults, high-profile information breaches, and other digital attacks are a result of the weaknesses associated with the regular security model. Approximately 1,100 attacks are carried out per week by each organization worldwide. Accordingly, organizations are beginning to understand that the old methodology of accepting everything inside the organization's limit is not adequate in the present threat landscape.

- The coronavirus pandemic led to the deployment of distant labor forces, which expanded the openness to digital threats.

- Employees who use a variety of devices and locations to access the company's resources pose new challenges, which cannot be addressed by conventional security models.

- Therefore, organizations are more focused on advanced security protocols, such as zero-trust designs, for safeguarding dispersed and distant labor forces.

Based on the guiding principle of never trust, always verify, the ZTA addresses these concerns by taking into account the possibility of attacks coming from both inside and outside the network.

Retail and E-commerce Industry Is Rapidly Growing

The retail and e-commerce industry are expected to expand at a CAGR of 20% from 2024 to 2030.

- The changes in consumer preferences, rapid technological advancements, and widespread use of digital platforms are the reasons behind the market growth in this category.

- This industry comprises the administrations of high-value resources and information, for example, classified information and item information, which are popular targets for cybercriminals.

ZTA is a useful defensive strategy because retail and e-commerce businesses are facing increasing security threats as they adopt digital technologies, such as mobile commerce, cloud computing, and the internet of things (IoT). Additionally, strict regulations, such as PCI DSS and GDPR, require these businesses to implement extensive security measures, with zero-trust serving as a solid foundation.

- Retailers are using omnichannel techniques for marketing, consistently consolidating on the web and actual stages.

- The usage of multiple digital platforms by customers to purchase stuff and learn about it impels companies to practice omnichannel marketing to ensure a steady purchasing experience across the different channels.

- Control-side pickups, snap-and-gather administrations, and immediate conveyances are all fundamental components of the retail biological system, satisfying the requirements of clients for effectiveness and simple access.

Personalization and data-driven insights have developed into essential components of success in this sector. Retailers use artificial intelligence tools and novel analytics to assess client inclinations, behavior, and buying patterns. This helps them provide personalized advice, targeted advertising, and superior customer experiences, all of which help build brand loyalty in a market that is becoming increasingly competitive.

The growth of the retail and e-commerce industries has, likewise, created issues, especially for information protection and network safety. Since a ton of information is being gathered, stored, and analyzed, it becomes critical for organizations to comply with regulations and make robust safety efforts to keep up the customer's confidence.

Large Enterprises Generate Higher Revenue

The large enterprises category is expected to generate the higher revenue, of USD 10 billion, in 2030.

- Large enterprises' sophisticated networking, programs, and terminals call for reliable solutions to protect data, by continuously evaluating and recording authentication in real time.

- The likelihood of an inside attack increases when businesses adhere to regulations as a mere formality and grant authorized users more access than necessary.

- The presence of a consistent network does not ensure IT protection, since reliable inside sources could be the source of an internal threat, in addition to external ones.

- The zero-trust security framework, which grants users the lowest possible level of authority, views authorized enterprise users as zero-trust.

Cybersecurity typically receives significant funding, specifically from large businesses to safeguard their substantial assets, confidential information, and intellectual property. Due to the complexity of their operations, large businesses frequently require zero-trust systems, which are unique and more sophisticated. Vendors might charge a lot for these custom solutions' development, implementation, and management from large companies, which is another factor that makes this category the larger contributor to the overall market revenue.

- To safeguard their IT assets, large businesses must adhere to increasingly stringent laws and implement additional measures.

- As a result, they are ahead of the curve when it comes to investing in cutting-edge security measures, such as zero-trust security, to meet compliance standards and eliminate potential risks.

- These undertakings frequently require extra administrations after the initial purchase of the ZTA solution, such as preparation, consultancy, and continuous help.

- Due to the large size, high complexity, and the diversity of financial assets, adopting and implementing zero-trust security typically results in higher profits for large businesses.

Small and Medium Enterprises Category Is Growing Rapidly

Small and medium enterprises (SMEs) are expected to have a CAGR of 19% from 2024 to 2030 in the market. This is because they are believed to be more helpless against sophisticated cyberattacks than large enterprises. Therefore, as they lack robust security solutions, small and medium-sized financial institutions, IT, manufacturing, telecom, banking, and retail businesses are frequently targeted. Further, the COVID-19 pandemic has had a significant impact on SMEs.

- However, SMEs display more flexibility and agility in implementing advanced approaches and workflows than large enterprises.

- They can quickly implement innovative solutions due to the lack of bureaucratic layers and decision-making procedures.

- Small and medium-sized businesses are now more aware of the advantages and necessity of robust security to safeguard data and systems.

Further, nowadays, cost-effective cloud solutions are available, which allows SMEs to obtain robust cybersecurity without spending a fortune. Zero-trust security ensures that the user with the correct credentials is a trusted internal user and not a hacker who is attempting to steal login credentials. As a result, SMEs are implementing multilevel authorization verification using a zero-trust security model.

| Report Attribute | Details |

Market Size in 2023 |

USD 17.0 Billion |

Market Size in 2024 |

USD 19.8 Billion |

Revenue Forecast in 2030 |

USD 55.0 Billion |

Growth Rate |

18.5% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Segments Covered |

By Offering; By Organization Size; By Deployment Mode; By Vertical; By Region |

Explore more about this report - Request free sample

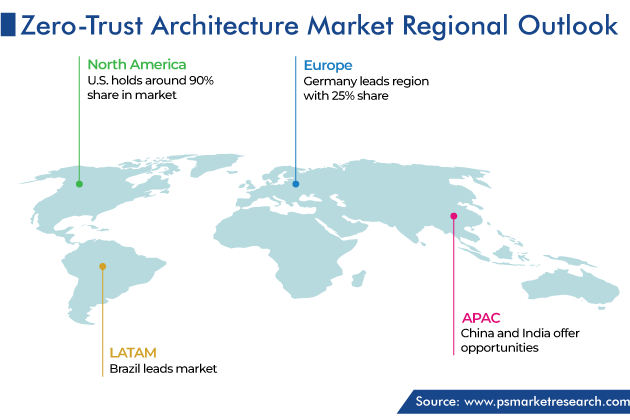

North America Is Largest Region in Market

Geographically, North America is the largest region, with revenue of USD 8 billion in 2023.

- Palo Alto Networks, Zscaler, and Cisco are all contributing to the region's market growth as they provide Easy access to North American organizations to novel solutions and technologies.

- A high level of cybersecurity awareness and increase in government and public authority investments in security are also adding fuel for the industry growth.

Numerous organizations in the region are well-versed in cybersecurity and understand the significance of zero-trust security measures to safeguard data and systems from cyberattacks. Moreover, governments in the region have implemented severe network protection guidelines, driving organizations to make solid safety efforts with ZTA and adhere to the guidelines. It is necessary to have zero-trust security model in order to enable safe access to cloud services and their efficient usage. Therefore, the region's quick acceptance of cloud computing is a key market driver as it brings both benefits and security concerns. Further, the regional market development is aided by the utilization of IoT, big data analytics, and AI.

APAC Is Fastest-Growing Market

APAC is the fastest-growing region, with a CAGR of 22%, from 2024 to 2030. This will be because of the advancing IT landscape, expanding digital threats, and rising adoption of cloud administrations and cell phones across numerous industries in India, China, and Japan.

- APAC is prone to cyberattacks because of the fast expansion in the amount and pace of the confidential information being exchanged at the national and international level.

- In order to safeguard sensitive data in healthcare, government, e-commerce, and BFSI sectors, access to secure networks must be closely monitored.

- Numerous examples of information breaches are notable in the region.

- In May 2020, the confidential information of 2 billion electors was leaked on the dark web, alongside the looming threat of the uncovering of the information of another 200 billion citizens.

- In APAC, consumers' increasing awareness of security breaches has led to a significant rise in the demand for zero-trust security solutions.

Competitive Analysis

The market is characterized by moderate-to-high product differentiation, rising advanced product adoption, and intense competition. Typically, individual cybersecurity solutions are combined to create an integrated software that looks after a company’s entire IT infrastructure, from software and databases to network access points and remote devices.

Recent Developments

In September 2023, Broadcom's acquisition of VMware led to the merging of VMware's SD-WAN capabilities with Symantec's security portfolio.

- Broadcom is set to enter the secure access service edge (SASE) industry by leveraging the strength of Symantec, VMware SD-WAN, and selected features from carbon black.

In August 2023, Perimeter 81 consented to being bought by Check Point Software Technologies Ltd.

- With this acquisition, Check Point will speed up secure-access execution for data centers, the internet, remote users, and sites.

- The main aim of this project is to provide secure and convenient security service edge solutions.

In June 2023, Cisco Systems Inc. launched Cisco Secure Access, a new SASE Solution.

- This novel tool allows user to retrieve information through a multitude of devices, applications, and places.

Moreover, in April 2023, Palo Alto Networks and Accenture launched the integrated Prisma SASE solution to improve cyber resilience. Moreover, in May 2023, Zscaler established an alliance with the Center for Internet Security (CIS) to enhance cybersecurity for local, tribal, state, and territorial governments through the CIS CyberMarket. In the same way, in June 2022, VMware collaborated with NIST’s NCCoE to ease the deployment process for zero-trust architecture and offer insights.

Top Companies in Zero-trust Architecture Market Are:

- Palo Alto Networks Inc.

- VMWare Inc.

- Zscaler Inc.

- Akamai Technologies

- Microsoft Corporation

- Cisco Systems Inc.

- IBM Corporation

- Cloudflare Inc.

- Alphabet Inc. (Google LLC)

- Checkpoint Software Technologies Ltd.

- Citrix Systems Inc.

- Trellix

- Forcepoint

- CrowdStrike

- Fortinet

- Netskope Inc.

- Perimeter 81 Ltd.

- Twingate

Market Breakdown

This report offers deep insights into the zero trust architecture market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Segment Analysis, By Offering

- Solution

- Services

Segment Analysis, By Organization Size

- Small and Medium-Sized enterprises

- Large enterprises

Segment Analysis, By Deployment Mode

- Cloud

- On-Premises

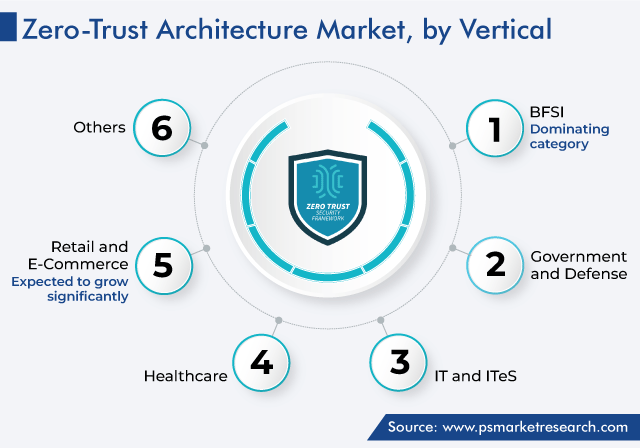

Segment Analysis, By Vertical

- BFSI

- Government and Defense

- IT and ITeS

- Healthcare

- Retail and E-Commerce

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Explore

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws