Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 1.7 billion |

| 2025 Market Size | USD 1.8 billion |

| 2032 Forecast | USD 3.1 billion |

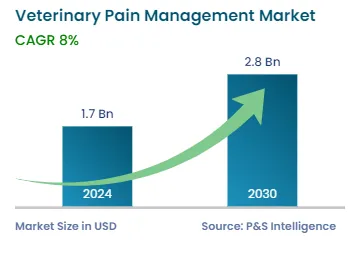

| Growth Rate(CAGR) | 8% |

| Largest Region | North America |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 12554

This Report Provides In-Depth Analysis of the Veterinary Pain Management Market Report Prepared by P&S Intelligence, Segmented by Product (Drug, Device), Application (Joint Pain, Cancer Pain, Postoperative Pain), Animal Type (Companion Animal, Livestock Animal), End User (Veterinary Hospitals, Veterinary Clinics), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 1.7 billion |

| 2025 Market Size | USD 1.8 billion |

| 2032 Forecast | USD 3.1 billion |

| Growth Rate(CAGR) | 8% |

| Largest Region | North America |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The global veterinary pain management market size was USD 1.7 billion in 2024, and the market size is predicted to reach USD 3.1 billion by 2032, advancing at a CAGR of 8% during 2025–2032.

The market is growing because of higher musculoskeletal conditions in animals with osteoarthritis and also because more animals enter pet ownership and agricultural operations. The market popularity stems from advancements in veterinary healthcare with enhanced attention to animal welfare. The increased research and development activities resulted in the creation of targeted pulsed electromagnetic field (tPEMF) therapy which functions as a drug-free non-invasive therapy by stimulating the body's anti-inflammatory response to speed up tissue healing. Two recently approved monoclonal antibodies known as bedinvetmab for canines and solensia for felines have changed veterinary pain treatment through their precise and effective approaches which received FDA and EU approval.

The market demonstrates strong potential growth because of new technological advancements, rising pet insurance coverage, and increasing healthcare spending by pet owners and government backing. The veterinary pain management industry will experience long-term success because of ongoing technological development along with the rise of human-centered pain relief methods.

The drug category held the larger market share, of 85%, in 2024. The most prevalent drugs in this segment are NSAIDs which primarily treat chronic conditions such as osteoarthritis. These medications are popular because they effectively manage pain and have simple administration methods and economical costs. Pet owners frequently choose oral NSAIDs since these drugs offer both practicality and powerful pain management for long-term conditions. The widespread regulatory approvals with clinical guidelines have made NSAIDs the standard first-line pain treatment choice for veterinarians throughout the world.

The device category will grow at a higher CAGR, of 8.5%, during the forecast period. This is because veterinary patients require treatments that avoid pharmaceutical medications and invasive procedures beyond conventional pain management approaches. The targeted pulsed electromagnetic field (tPEMF) therapy system offers tissue repair and pain relief benefits without the usual side effects of drug-based treatments. The combination of rising pet owners seeking holistic drug-free treatments and improved veterinary technology has driven the increasing market adoption. Devices used for medical therapy continue to expand their market presence because of their growing application in post-operative care and chronic disease monitoring.

The products analyzed here are:

The joint pain category held the largest market share, of 55%, in 2024. The prevalence of osteoarthritis in senior dogs and cats leads to this high need for treatment. Osteoarthritis impacts between 20% of adult canine patients and elder pet animals at rates above the adult dog percentage according to the American College of Veterinary Surgeons. The long-lasting character of this medical condition leads to extensive pain treatment needs which establishes this application as a money-making sector.

The cancer pain category will grow at a highest CAGR, of 8.1%, during the forecast period.

Advances in companion animal cancer diagnosis rate estimated at 6 million new canine cases per year within the U.S. have increased demand for improved pain management solutions. The progression of veterinary oncology alongside prolonged pet treatment requires pain management to become an essential element of complete care.

The applications analyzed here are:

The companion animal category held the larger market share, of 60%, in 2024. The high occurrence of chronic health conditions including osteoarthritis cancer and post-surgical pain affects dogs and cats specifically because they need ongoing pain relief treatments. Pet insurance growth across North America and parts of Europe together with improved veterinary services keeps this market segment active. For instance, in September 2022, Zoetis Inc. announced its acquisition of Jurox, an animal health company that develops, manufactures, and markets a wide range of veterinary medicines for livestock and companion animals. Through this acquisition, Zoetis has earned access to a broad range of products, including Alfaxan, an anesthetic product for companion animals.

The livestock animal category will grow at a higher CAGR, of 8.4%, during the forecast period, because owners now recognize both animal welfare as well as productivity benefits of appropriate pain treatments. The management of pain for livestock animals produces positive effects on healing rates and mobility as well as milk and meat production which drives researchers to focus on this area. The advancement of animal welfare regulations is driving veterinary experts and livestock producers to extend the practice of pain relief throughout their operations.

Moreover, in March 2020, Ceva Animal Health launched a cattle campaign, ‘Wave Goodbye to Pain’, to spotlight how proper pain relief in lame cattle can speed up recovery time and improve results. These types of campaigns raise awareness among veterinary professionals and farmers, in turn, accelerating the market growth.

Additionally, companion animals receive more specialized care and medical attention from their owners than production animals, which is a major factor boosting the market revenue in this category.

The animal types analyzed here are:

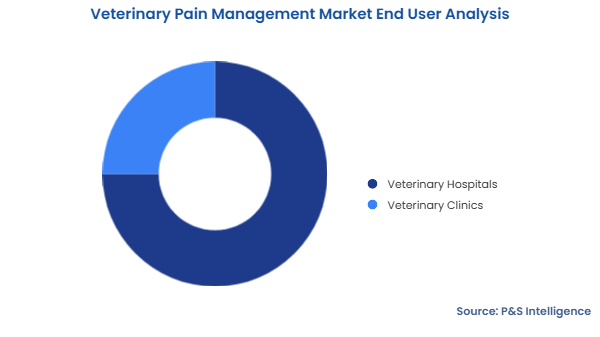

The veterinary hospitals category held the larger market share, of 75%, in 2024 and will grow at a higher CAGR, of 9%, during the forecast period. This is because they possess advanced diagnostic equipment along with surgical practices and broad pain management solutions that include medication-based and device-based therapies. Hospitals treat more complicated cases of orthopedic surgeries and cancer treatments along with other chronic secondary conditions that need complex pain relief techniques. Patients rely on hospitals as their main source for complete pain management services as hospitals offer inpatient care management surgical treatment and long-term therapeutic solutions. Modern technology investments at clinics allow them to deliver outpatient pain management services, particularly for osteoarthritis patients and those recovering from surgery.

The expanding pet population in urban and suburban regions causes clinics to function as primary healthcare providers for prevention and chronic pain assessment thus driving their growth in developed and emerging markets. Furthermore, the growing incidence of bacterial conditions in companion animals, especially dogs, is contributing to the increase in the number of veterinary hospitals. For instance, in the U.S., there are approximately 30,000 veterinary practices, among which 10% are general companion animal practices and 40–50% are referral practices.

The end users analyzed here are:

Drive strategic growth with comprehensive market analysis

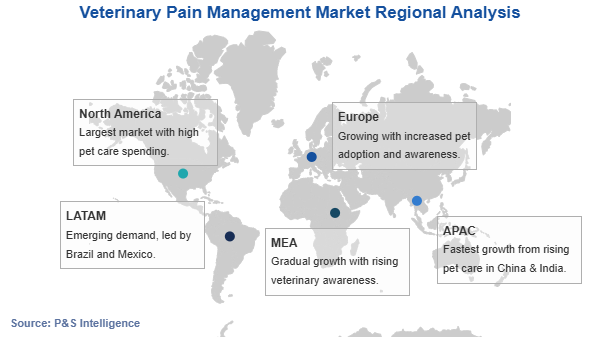

The North America held the largest market share, of 40%, in 2024. This is because this region maintains a strong veterinary healthcare infrastructure combined with heightened awareness for animal welfare. The U.S. commands market leadership because its population of companion animals exceeds 66 percent of U.S. households as reported by the American Pet Products Association. Additionally, the widespread availability of pet insurance, increasing veterinary visits, and high spending on animal healthcare of over $35 billion in veterinary care expenditures in 2023 alone, contribute to the region’s dominance.

The North American market maintains its market leadership position because of the dominant presence of Zoetis alongside Elanco and Merck & Co. Furthermore, the growing investments in research and development in the well-established animal health industry are propelling the growth of the market. For instance, in June 2022, Boehringer Ingelheim partnered with CarthroniX to explore the utility of small molecules for cancer treatment in dogs. This collaboration will emphasize identifying new molecules to target cancers in dogs, as small molecules could give superior disease control.

The APAC region will grow at a higher CAGR, of 9.5% during the forecast period because consumers have increased purchasing power and urban areas are expanding simultaneously with rising animal healthcare knowledge. The pet adoption trend is rapidly increasing in China and India where pet ownership is expanding by 12% annually throughout India along with quick economic growth for pets in Chinese urban areas. The combination of government investments to enhance veterinary facilities with expanding multinational animal health businesses drives rapid market expansion within this area. Market expansion in the Asia-Pacific region will create significant business opportunities during the next few years.

The regions analyzed in this report are:

The veterinary pain management market demonstrates high fragmentation because multiple players from global and regional sectors supply diverse products and solutions across the market. The competitive environment expands through innovations that include improved drug delivery approaches non-medicinal treatment options and customized healthcare solutions. Zoetis Inc. controls the biggest market portion due to its extensive product diversity, and its worldwide presence, along with sustained research funding. This market shows ongoing expansion because people understand animal welfare better pet ownership is increasing and veterinarians need specific pain medications for both pets and farm animals.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages