Market Statistics

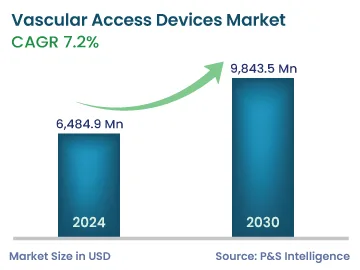

| Study Period | 2019 - 2030 |

| 2024 Market Size | 6,484.9 Million |

| 2030 Forecast | 9,843.5 Million |

| Growth Rate(CAGR) | 7.2% |

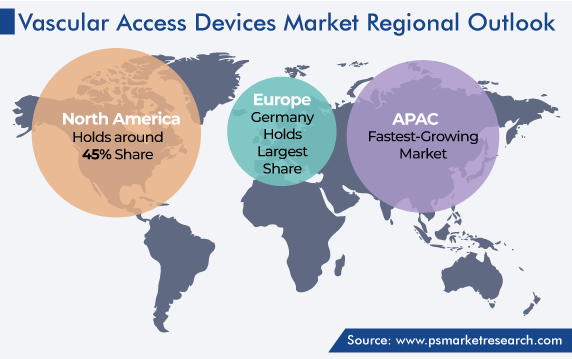

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Report Code: 12745

Get a Comprehensive Overview of the Vascular Access Devices Market Report Prepared by P&S Intelligence, Segmented by Device (Central, Peripheral, Accessories), Application (Drug Administration, Fluid & Nutrient Administration, Blood Transfusion, Diagnostics & Testing), End User (Hospitals, Clinics & Ambulatory Care Centers), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 6,484.9 Million |

| 2030 Forecast | 9,843.5 Million |

| Growth Rate(CAGR) | 7.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The vascular access devices market size stood at USD 6,484.9 million in 2024, and it is expected to grow at a CAGR of 7.2% during 2024–2030, to reach USD 9,843.5 million by 2030.

The market is driven by the rising aging population, unhealthy lifestyles, and increasing prevalence of cancer and other chronic diseases. Chronic diseases are already a major healthcare burden in high-income as well as low- and middle-income countries. Some of the most prevalent of all are cancer, diabetes, and autoimmune diseases, which require varying degrees of intervention. Immunotherapy drugs have the potential to mitigate the impact of many of these chronic diseases, which propels the usage of venial catheters.

Moreover, during the pandemic, vascular access devices played an important role in the health management of patients, by allowing for the transfusion of intravenous fluids and blood and the administration of drugs.

Therefore, such devices were in high demand due to the rising prevalence of the COVID-19 infection, with many patients showing severe respiratory symptoms and requiring intensive care. Healthcare practitioners used hypertonic saline (HTS) for such patients as it was believed to be beneficial in reducing the inflammation in similar viral illnesses, which drove the usage of such devices.

The increasing geriatric population is the key driver for the vascular access devices industry globally. The number of people aged 60 years or above is expected to increase from 1,000 million in 2020 to 1,400 million by 2030 and more than 2,100 million by 2050. Further, the population aged 80 years or more is expected to triple between 2020 and 2050, to reach more than 420 million.

Moreover, developing countries, such as India and China, are expected to have a larger geriatric population compared to developed countries, including the U.S., France, Australia, and Canada. The number of people aged 60 years and above is expected to reach approximately 107 million in the U.S., 324 million in India, and 437 million in China by 2050.

This rising aging population across the globe would lead to an increase in the burden of health problems, many of which require the continuous use of peripheral venous and other devices for fluid transfusions and other procedures involving the blood vessels.

The elderly population needs continuous and high-level care as its low immunity makes it susceptible to infections. Moreover, aged people have weakened body functions, leading to longer recovery periods in comparison to adults. This is why the elderly are especially susceptible to chronic diseases, such as cancer, diabetes, neurological disorders, and cardiovascular diseases, which leads to an increase in the demand for such devices, to offer effective care. Moreover, a lot of cases of cardiovascular diseases and cancer require surgeries at some point, which drives the use of intravenous catheters.

The vascular access device market revenue is also increasing due to the rising prevalence of chronic and lifestyle-associated diseases, which results in a surge in the number of surgeries globally. During a vascular access procedure, a flexible, sterile, thin, plastic catheter is inserted into a blood vessel, to draw blood or deliver drugs, blood and blood products, and other agents into the bloodstream, over weeks, months, or even years.

Nearly half the population suffers from at least one chronic illness, including cardiovascular disorders, which may require surgery at some point, depending on severity. Moreover, diabetes is another major chronic disease, which leads to diabetic foot ulcers in most cases. These ulcers require management by surgeries, to prevent the maceration of the surrounding tissue. Globally, the volume of surgeries conducted each year is over 300 million.

The drug administration category held the largest share, of 40%, of the market in 2023, attributed to the extensive usage of these devices for the administration of drugs for the treatment of infections, chemotherapy, and other purposes.

For instance, the systemic treatment of cancer involves the administration of chemotherapy agents, alongside targeted therapies and immunotherapy, into a central vein, using peripherally inserted central catheters (PICCs) and completely implanted ports (PORTs). Moreover, the rising prevalence of renal diseases, which are a group of progressive conditions affecting more than 10% of the global population, or more than 800 million individuals, is propelling the usage of devices that offer access to the blood vessels.

Vascular access devices can either be used peripherally, i.e., on the patient’s arm, or centrally, i.e., inserted into the jugular foramen. Such devices are majorly preferred for the continuous and repeated administration of medications, such as antibiotics.

Moreover, due to the rising prevalence of cardiac disorders and the burgeoning geriatric population, the market has experienced a rise in the demand for peripheral vascular access devices, which held a share of around 50% in 2023. This is because cardiovascular diseases are one of the primary causes of death, taking more than 19 million lives all over the world in the year 2020.

Additionally, cancer, diabetes, respiratory diseases, and almost every other kind of chronic disease are increasing in incidence on account of the lifestyle alterations and inadequate access to preventive care. Among these, cancer accounted for over 18.1 million new diagnoses and nearly 10 million deaths across the globe in 2020. The rising burden of such ailments will propel the demand for peripheral vascular access devices at a CAGR of 6.9% during the forecast period.

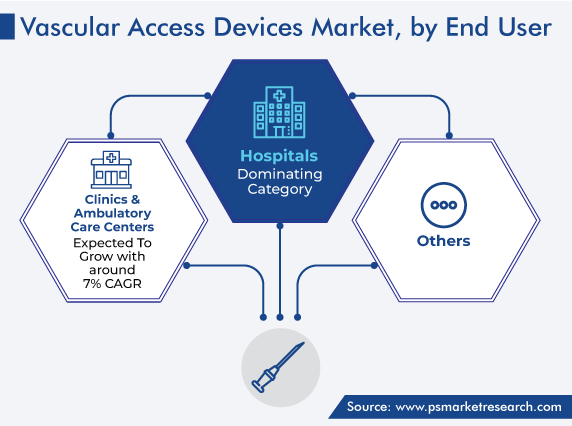

With a revenue share of 55% in 2023, the hospitals category dominates the market. With the rising dialysis usage due to the wide prevalence of diabetes globally, the usage of such devices for the infusion or collection of the blood and in the transfer of nutritional fluid continues to pick up at hospitals. Overall, the rising chronic disease prevalence is driving hospitalization volumes, in turn, promoting the consumption of vascular access devices.

Therefore, over the last few years, the world has experienced a significant rise in the number of hospitals. Moreover, the skilled healthcare staff employed at hospitals would help these places maintain their dominance on the market.

Drive strategic growth with comprehensive market analysis

North America dominated the market, with a share of more than 45%, in 2023. The large number of players in the region and the fast adoption of advanced medical equipment result in the growth of the regional market. Moreover, the favorable framework for healthcare cost reimbursement makes it easy for patients to seek quality healthcare.

Additionally, the market has been experiencing a faster growth in the U.S. than in Canada. The former country is internationally recognized for its healthcare facilities and innovations, with the government putting in substantial capital investments since a long time. Moreover, it is the biggest investor in healthcare due to its sizable population, established network of researchers, and expansive healthcare industry.

Further, the large number of hospitals, increasing disposable income, and government efforts to improve the standard of care drive the market at the higher rate in the country.

This fully customizable report gives a detailed analysis of the vascular access devices market, based on all the relevant segments and geographies.

Based on Device

Based on Application

Based on End User

Geographical Analysis

The market for vascular access devices will grow by 7.2% till 2030.

The vascular access devices industry is growing because of the rising incidence of chronic diseases, increasing volume of surgeries, and surging geriatric population.

In 2024, the market for vascular access devices valued USD 6,484.9 million.

Hospitals dominate the vascular access devices industry.

North America, led by the U.S., is the largest market for vascular access devices.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages