Market Statistics

| Study Period | 2019 - 2032 |

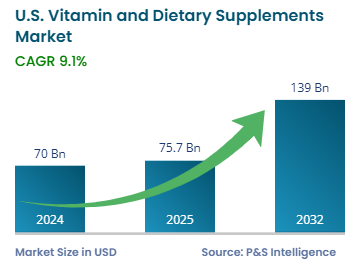

| 2024 Market Size | USD 70.0 billion |

| 2025 Market Size | USD 75.7 billion |

| 2032 Forecast | USD 139.0 billion |

| Growth Rate(CAGR) | 9.1% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13503

This Report Provides In-Depth Analysis of the U.S. Vitamin and Dietary Supplements Market Report Prepared by P&S Intelligence, Segmented by Ingredients (Vitamins, Minerals, Amino Acids & Proteins, Herbs & Botanicals, Omega-3 Fatty Acids, Probiotics), Product (Tablets, Capsules, Soft Gels, Gummies, Powders, Liquids), Application (Immunity, Energy & Weight Management, Diabetes Management, Bone & Joint Health, Gastrointestinal Health, Brain and Mental Health, Insomnia, Anti-aging), End User (Adults, Geriatric Population, Pregnant Women, Children, Infants), Distribution Channel (Supermarkets & Hypermarkets, Pharmacies & Drug Stores, Online Retail, Specialty Stores, Direct Selling), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 70.0 billion |

| 2025 Market Size | USD 75.7 billion |

| 2032 Forecast | USD 139.0 billion |

| Growth Rate(CAGR) | 9.1% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. vitamin and dietary supplements market size was USD 70.0 billion in 2024, and it will grow by 9.1% during 2025-2032, to reach USD 139.0 billion by 2032.

The market is growing because of the increased health awareness, older customers, and increasing demand for preventive medication. People are selecting supplements with multiple health benefits, such as immunological support, weight control, mental wellness, and sports performance enhancement.

The use of plant ingredients, probiotics, and functional foods further drives the market. The growing demand for personal nutrition, including supplements designed to meet specific health requirements, such as immune support and weight management, is also leading to the market growth.

The main driver of this market is e-commerce, which gives consumers an easy way to access to a large range of supplements; the trend boomed during the COVID-19 pandemic. Marketing influencers on social media platforms, including Instagram and TikTok, affect purchasing choices, particularly among the younger and health-conscious consumers, making these dietary supplements more attractive.

The Dietary Supplement Health and Education Act (DSHEA) of 1994 controls the labeling and advertising of products, and the Food and Drug Administration (FDA) checks that supplements offered in the market are safe. This provides consumer confidence and enables further market expansion.

The vitamins category held the largest market share of 75% in 2024 because of their ability to support health and wellbeing, including bone health, energy levels, and immune functions. Vitamins D, C, and B are widely consumed at all ages and segments.

The probiotics category will have the higher CAGR because of the growing awareness about the relationship between gut health and overall body health, including ingestion, digestion, and mental well-being. As consumers have more awareness about health, they prefer conscious and natural multivitamins and herbal blends.

The ingredients analyzed in this report are:

The tablets category held the largest market share of 70% in 2024 because of its long shelf-life, accurate dosage of active ingredients, convenience, and stable form for protection of the ingredients. These can be easily stored, transported, and are available at different price points, which attracts a broad range of consumers.

The liquids category will have the higher CAGR because of the versatility and faster absorption into the bloodstream. It can be used easily for the ease of ingestion among individuals who find it difficult to swallow tablets, such as children.

The products analyzed in this report are:

The immunity category held the largest market share of 80% in 2024 because of the growing focus on health after the COVID-19 pandemic. Growing awareness and an ongoing health concern among the population for maintaining a strong immune system contribute to its dominance in the market.

The energy & weight management category will have the higher CAGR due to the rising incidence of obesity and increasing awareness for fitness, weight loss, and active lifestyles. Consumers are increasingly seeking protein bars, fat burners, fiber supplements, and meal replacement shakes for weight management and energy drinks and green tea extract for energy boosting. Over 30% of the country’s population is overweight and over 40% obese.

The applications analyzed in this report are:

The adults category held the largest market share, of 60% in 2024, since adult male and female consumers are both aiming for preventive healthcare and wellness. This assists the overall wellbeing, enhances energy, and delivers to the particular health issues, such as weight management, immunity, and skin health. The need for enhanced self-care and healthy aging awareness have resulted in greater demand for these supplements.

The geriatric category will have the highest CAGR because of the increasing aging population. Elder people demand dietary supplements in order to solve their problems, such as joint pain. Many supplements, such as calcium and vitamin D, are used to enhance the quality of life among them.

The end users analyzed in this report are:

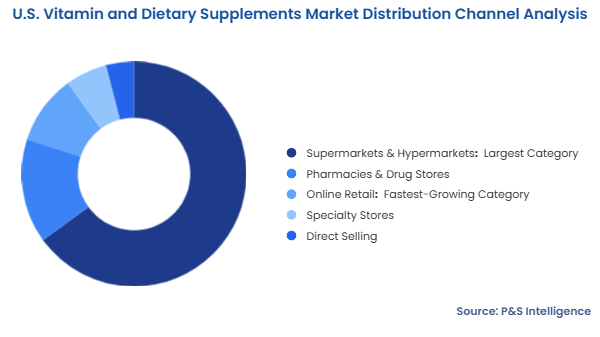

The supermarkets and hypermarkets category held the largest market share, of 65% in 2024, due to their broad availability, competitive pricing, extensive product selection, and convenience for one-stop shopping in dietary supplements.

The online retail category will have the highest CAGR due to its convenience of shopping from home, comparing prices from different apps, and accessing a wide range of products. The availability of subscription services and the product information provided by these online services. According to the survey conducted by 1WorlsSync in 2024, 73% of the U.S. consumers are reported to use their online shopping sites for these dietary supplements.

The distribution channels analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The West region held the largest market share, of 40%, in 2024 because of its health and wellness culture. A higher percentage of customers focus on plant-based and natural supplement. Customers from Oregon, California, and Washington pick supplements produced from ginseng, turmeric, and acai berry, which have more health advantages.

The South will have the highest CAGR due to the shift toward preventive care and benefits from higher consumer awareness of dietary supplements. People in Georgia, Florida, and North Carolina are increasingly taking supplements to support their health goals. Additionally, some nutrition products that are used in sports, such as energy bars, protein powders, have gained popularity in this region.

The geographical breakdown of the market is as follows:

The market is highly fragmented as a huge number of companies produce these supplements. Although there are a few major brands, a host of small, local brands exist too. The rising popularity of herbal supplements has encouraged the entry of local players who sell products with unverified claims. E-commerce has made it easier for them to access the market. A huge number of companies from China and other developing countries offer herbal and natural supplements.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages