Key Highlights

| Study Period | 2019 - 2032 |

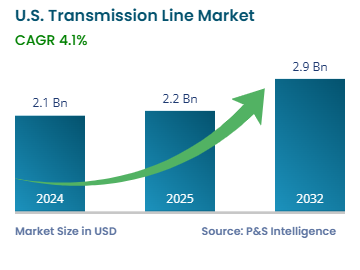

| Market Size in 2024 | USD 2.1 Billion |

| Market Size in 2025 | USD 2.2 Billion |

| Market Size by 2032 | USD 2.9 Billion |

| Projected CAGR | 4.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Market Structure | Consolidated |

Report Code: 13538

This Report Provides In-Depth Analysis of the U.S. Transmission Line Market Report Prepared by P&S Intelligence, Segmented by Type (Overhead Transmission Lines, Underground Transmission Lines, Submarine Transmission Lines), Voltage (130kV - 220kV, 221kV - 660kV, Above 660kV), Conductor (Conventional, High temperature), Product (AC Transmission Lines, DC Transmission Lines), End User (Utility, Telecommunication), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.1 Billion |

| Market Size in 2025 | USD 2.2 Billion |

| Market Size by 2032 | USD 2.9 Billion |

| Projected CAGR | 4.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Market Structure | Consolidated |

|

Explore the market potential with our data-driven report

The U.S. transmission line market was valued at USD 2.1 billion in 2024, and this number is expected to increase to USD 2.9 billion by 2032, advancing at a CAGR of 4.1% during 2025–2032.

The market is driven by the rising demand for electricity, the incorporation of renewable energy sources, and the requirement for a modernized grid infrastructure. These factors propel the requirement for the construction of new transmission lines and the replacement of the existing ones, to enhance their reliability, capacity, and resilience.

The Infrastructure Investment and Jobs Act (2021) established the Transmission Facilitation Program (TFP) for the Department of Energy, which has sanctioned USD 2.5 billion to develop high-capacity T&D lines across the U.S. In all, the IIJA has established 60 programs to develop, expand, and enhance the country’s electricity infrastructure. The IIJA has sanctioned USD 5 billion to develop grids resilient against natural disasters, UAS 6 billion to enhance the lives of nuclear power plants, USD 125 million in incentives to hydroelectricity projects, and another USD 75 million to enhance their efficiency.

The overhead category dominates the market, with a revenue share of 60% in 2024, due to their cost-effectiveness, ease of installation, and well-established infrastructure. These factors make them the primary choice for long-distance power transmission across the country. Furthermore, the ongoing rural electrification projects and renewable energy capacity expansion create the requirement for an extensive overground transmission line network.

Here are the types studied in the report:

The 221–660 kV category accounted for the largest revenue share, of around 50%, in 2024, and this category is further expected to grow the fastest during the forecast period. This is due to its suitability for medium-to-long-distance power transmission as it witnesses minimal energy losses. These high-voltage lines are crucial for connecting power plants to the grid, to facilitate high-capacity electricity transmission across vast distances.

The voltages covered in the report are:

The conventional category dominates the market with a revenue share of 55% in 2024, due to their existing infrastructure and cost-efficiency in transmission. Aluminum and copper conductors are used due to their durability, longevity, appreciable conductivity, and cost-effectiveness.

The following are the conductors studied in the report:

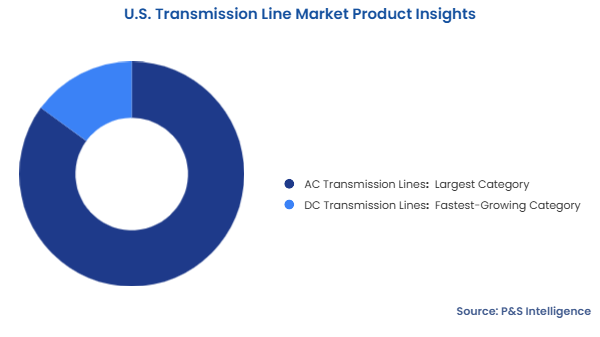

The AC category dominates the market with a revenue share of 85% in 2024. This is due to its affordability, established infrastructure, and ability to transmit high volumes of electricity across long distances as well as locally. AC transmission lines are preferred for new electrical grid and expansion projects because they are convenient to maintain and compatible with existing systems.

The following are the products studied in the report:

The utility category dominates the market with a revenue share of 80% in 2024. This is due to the large amount of electricity delivered from power stations to the residential, commercial, and industrial sectors. This is due to the rising demand for electricity, need to expand and upgrade transmission networks for renewable energy sources, and government funding for grid modernization. Electric utilities in the country are investing in advanced technologies for grid resilience and to meet the rising demand for electricity reliably. The EIA says that utility-scale power plants in the country produced 4.18 trillion kWh of electricity in 2023.

The following are the end users studied in the report:

Drive strategic growth with comprehensive market analysis

The Southern region is the market leader with a revenue share of 40% in 2024, because of its significant investments in grid expansion and modernization. Moreover, Texas is the leader in wind energy generation. Texas, Florida, and Georgia are currently experiencing major infrastructure developments, including expansive renewable energy initiatives. As per the EIA, retail electricity sales in the Southern region of the country in 2023 stood at 492,820,385 MWh in Texas, 250,940,214 MWh in Florida, 142,028,831 MWh in Georgia, 133,091,108 MWh in North Carolina, and 132,318,505 MWh in Virginia.

Here are the regions covered in the report:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages