Report Code: 12077 | Available Format: PDF | Pages: 124

U.S. Prostate Cancer Treatment Device Market Research Report: By Type (Radiation, Surgery, High-Intensity Focused Ultrasound, Cryotherapy), End User (Hospitals, Specialty Centers) - Industry Analysis and Growth Forecast to 2030

- Report Code: 12077

- Available Format: PDF

- Pages: 124

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

U.S. Prostate Cancer Treatment Device Market Overview

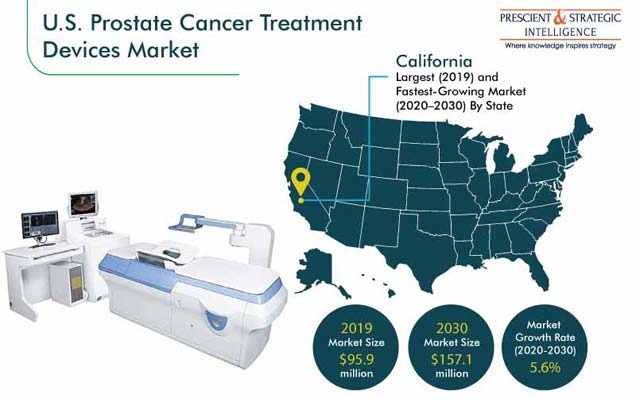

The U.S. prostate cancer treatment devices market size was valued at $95.9 million in 2019, and it is expected to progress at a CAGR of 5.6% during the forecast period (2020–2030). The market is majorly driven by surging number of prostate cancer cases being registered in the country each year. Additionally, after skin cancer, prostate cancer is the most common cancer type among men, where one out of every nine men in the country suffer prostate disease in the U.S.

Due to the COVID-19 pandemic, the U.S. prostate cancer treatment devices market is expected to witness slow growth for the period 2020–2021. Furthermore, nonurgent in-person clinic visits are being postponed or conducted remotely via phone or teleconference. Prostate cancer screening, imaging, and biopsies are also being suspended or postponed in general, mainly to protect prostate cancer patients from COVID-19.

Radiation to Be Fastest-Growing Category in the Industry during Forecast Period

The U.S. prostate cancer treatment devices market on the basis of type is categorized into radiation, surgery, cryotherapy, high-intensity focused ultrasound (HIFU), and others. The radiation category is expected to witness highest CAGR during the forecast period, mainly due to its high preference for treatment of patients over other devices. Broad acceptance and adoption of radiotherapy and launch of advanced equipment are some of other major factors driving the market for the radiation category.

Hospitals Expected to Be the Largest and Fastest-Growing Category in the Market

The U.S. prostate cancer treatment devices market on the basis of end user is categorized into hospitals, specialty centers, and others. Of these, the hospitals category dominates the market and is expected to witness highest CAGR during the forecast period. This can be attributed to the complex nature of treatment for prostate cancer, which is mostly carried out in hospitals in the presence of trained healthcare professionals. These healthcare settings are the first point of contact for the diagnosis and treatment of prostate cancer and provide the best possible care to the patients.

California—Largest and Fastest-Growing Medical Market in U.S.

In 2019, California held the largest share in the U.S. prostate cancer treatment devices market. It is expected to continue retain the trend in the market till 2030. This can be attributed to significantly large number of hospitals in the state and increasing number of prostate cancer patients seeking for the possible treatment.

.jpg)

Adoption of Robotic Prostatectomy Is a Key Market Trend

Rising adoption of robotic prostatectomy is one of the major trends observed in the U.S. prostate cancer treatment devices market. Robot-assisted radical prostatectomy (RP) has been gaining traction and is witnessing high adoption rate in the U.S. It is a type of minimally invasive surgery that uses surgical robotic equipment to remove entire prostate. This minimally invasive approach has the advantage of smaller incision, reduced pain, less blood loss, lower transfusion rate, and less hospital stay, as compared to conventional open surgery with similar cure rate.

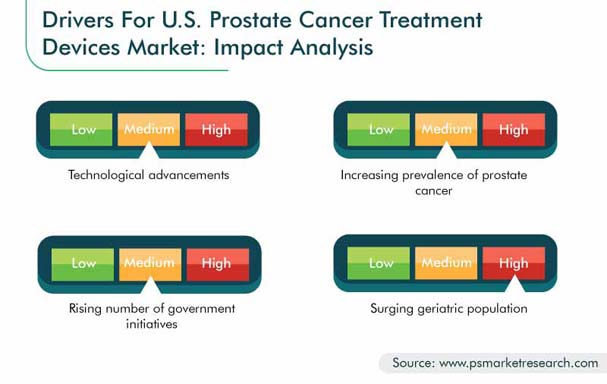

Technological Advancements to Boost Market Growth during the Forecast Period

Availability of more advanced, automated, and efficient clinical tools, along with the advent of more precise forms of treatments (e.g., brachytherapy, stereotactic radiosurgery [SRS], and image-guided radiation therapy [IGRT]), is resulting in augmenting growth of the prostate cancer treatment devices market. For instance, in June 2020, Accuray Incorporated launched CyberKnife S7 System, a device with real-time artificial intelligence (AI)-driven motion tracking and synchronization treatment delivery for all SRS and stereotactic body radiation therapy (SBRT) treatments. The CyberKnife S7 System is the next-generation CyberKnife platform—a robotic, non-invasive radiation therapy device capable of treating cancerous and benign tumors throughout the body, including prostate glands.

Increasing Prevalence of Prostate Cancer Is Driving the Market

As per the American Cancer Society (ACS), prostate cancer is one of the most common cancers in male population in the U.S. Country is expected to witness 191,930 new cases of prostate cancer in 2020. This large number of prostate cancer cases is expected to generate demand for various types of treatment devices, such as radiotherapy, surgery, and cryotherapy. Therefore, increasing prevalence of prostate cancer is expected to drive the prostate cancer treatment devices industry during the forecast period.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$95.9 million |

Forecast Period CAGR |

5.6% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Therapy Comparison, Average Pricing Analysis, Segmentation Analysis, State-wise Breakdown, Competitive Analysis, Companies’ Strategical Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Type; End User; State |

Market Size of Geographies |

Texas, California, Florida, Illinois, Pennsylvania, Ohio, New York, Michigan, Georgia, Kansas |

Secondary Sources and References (Partial List) |

American Cancer Society, American Hospital Association, Association for the, Advancement of Medical Instrumentation, Centers for Medicare & Medicaid Services, Center for Devices and Radiological Health, Health and Human Services, United States Food and Drug Administration, World Health Organization, The World Bank Group |

Explore more about this report - Request free sample

Rising number of Government Initiatives

The U.S. government annually spends a significant portion of its GDP on healthcare. The National Health Expenditure Accounts (NHEA) reported that healthcare spending in the U.S. grew by 4.3% to reach $3.3 trillion in 2016, which further increased to 5.4% in 2017. This rising healthcare spending is increasing the affordability of the treatment and management of diseases, which is further contributing toward the growth of the prostate cancer treatment devices market in the country.

For instance, in October 2017, the National Cancer Institute initiated Prostate Specialized Programs of Research Excellence (SPORE), a program designed to convert scientific findings into clinical settings-based outcomes. The institute also facilitates the development of new technologies and studies to gain a better understanding of monitoring, prevention, diagnosis, and treatment of different diseases. It plays a central role in advancing translational cancer research with academia, industry, other government agencies, and the international research community. Therefore, rising research and development programs coupled with increasing initiatives by the government are further expected to drive the prostate cancer treatment devices market growth.

Market Players Gaining Competitive Advantage with Product Launches and Partnerships

The U.S. prostate cancer treatment devices market is highly competitive in nature with the presence of few key players. In recent years, the major players in the market have taken several measures, such as product launches and business partnerships, to gain a competitive edge. For instance:

- In May 2020, EDAP TMS SA announced that the company signed an exclusive worldwide distribution agreement with Exact Imaging, a developer of high-resolution micro-ultrasound imaging technologies. Under the terms of the agreement, EDAP will market Exact Imaging’s micro-ultrasound diagnostic devices alongside its Focal One HIFU treatment solution. The combination of these technologies represents complete end-to-end solution.

- Similarly, in November 2019, Profound Medical Corporation announced that Health Canada approved the TULSA-PRO system for the ablation of low-to-intermediate risk organ-confined prostate cancer.

The Key Players in U.S. Prostate Cancer Treatment Devices Market include:

-

SonaCare Medical LLC

-

EDAP TMS SA

-

Profound Medical Corporation

-

Eckert & Ziegler AG

-

HealthTronics Inc.

-

Boston Scientific Corporation

-

Elekta AB

-

Accuray Incorporated

-

Varian Medical Systems Inc.

-

Becton, Dickinson and Company

-

Intuitive Surgical Inc.

-

ViewRay Inc.

-

Provision Healthcare

-

Isoray Inc.

-

Theragenics Corporation

U.S. Prostate Cancer Treatment Devices Market Size Breakdown by Segment

The U.S. prostate cancer treatment devices market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Type

- Radiation

- Surgery

- High-Intensity Focused Ultrasound (HIFU)

- Cryotherapy

Based on End User

- Hospitals

- Specialty Centers

Geographical Analysis

- California

- Texas

- Florida

- New York

- Pennsylvania

- Illinois

- Ohio

- New Jersey

- Massachusetts

- Minnesota

The U.S. prostate cancer treatment device market will grow at a CAGR of 5.6% during 2020–2030.

The U.S. prostate cancer treatment device market will be driven by the increasing incidence of prostate cancer.

California registered the maximum sales of prostate cancer treatment devices in 2019.

Robotic prostatectomy is the key trend in the U.S. prostate cancer treatment device industry.

The segments of the U.S. prostate cancer treatment device industry include end user, type, and state.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws