Key Highlights

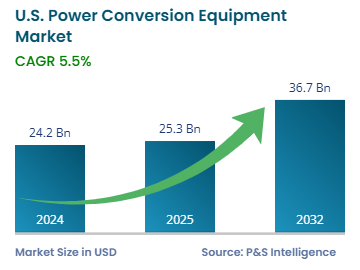

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 24.2 Billion |

| Market Size in 2025 | USD 25.3 Billion |

| Market Size by 2032 | USD 36.7 Billion |

| Projected CAGR | 5.5% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13581

This Report Provides In-Depth Analysis of the U.S. Power Conversion Equipment Market Report Prepared by P&S Intelligence, Segmented by Product Type (AC-DC Converters, DC-AC Converters (Inverters), DC-DC Converters, AC-AC Converters, Hybrid Power Converters), Power Rating (Low Power (<1 kW), Medium Power (1 kW - 100 kW), High Power (100 kW - 1 MW), Very High Power (>1 MW)), End-Use Industry (Industrial, Energy & Utilities, Automotive & Transportation, Consumer Electronics, Data Centers & IT Infrastructure, Healthcare & Medical Devices), Application (Renewable Energy Integration (Solar, Wind, Hydropower), Electric Vehicle (EV) Charging & Powertrains, Power Backup & Uninterruptible Power Supply (UPS), Grid Stabilization & Smart Grids, Motor Drives & Industrial Automation, Aerospace & Defense Power Systems), Technology (Silicon-based Power Converters, Gallium Nitride (GaN) Power Converters, Silicon Carbide (SiC) Power Converters, Wide Bandgap (WBG) Semiconductor Power Converters), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 24.2 Billion |

| Market Size in 2025 | USD 25.3 Billion |

| Market Size by 2032 | USD 36.7 Billion |

| Projected CAGR | 5.5% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. power conversion equipment market size in 2024 was USD 24.2 billion, and it will reach USD 36.7 billion by 2032 at a CAGR of 5.5% during 2025–2032. The rising demand for a reliable and efficient power supply in industries, businesses, and households propels the sale of high-efficiency converters, inverters, rectifiers, and transformers. In this regard, the market is driven by the rise of renewable power, expansion of the electric vehicle industry, and adoption of energy-efficient systems. The U.S. Department of Energy (DoE) launched the USD 10.5-billion Grid Resilience and Innovation Partnership (GRIP) Program in 2023, aiming to modernize grid infrastructure, integrating more renewable power, and expanding storage.

The electrification of industrial processes, emergence of smart grids, expansion of data centers due to the rising usage of AI and other high technologies, and initiatives for domestic manufacturing to cut down on imports are other major drivers. As per estimates, just the widespread adoption of EVs could raise the country’s electricity demand by up to 185 TWh by the end of this decade. Further, in 2023, the industrial sector of the country used 1,025 Terawatt-hours of electricity, which was 2.3% more than in 2020. In October 2023, the government allocated USD 3.46 billion to 58 grid modernization projects in 44 states.

Among AC–DC converters, UPSs dominate the market with a share of 60%. The increasing number of power blackouts because of unpredictable weather conditions and outdated power grid infrastructure creates a high demand for better backup power solutions. The market in this category is essentially driven by the increasing residential demand for backup power equipment. UPS systems are vital for critical infrastructure, such as telecom towers & base stations, to power communication networks round the clock.

The product types analyzed here are:

The medium (1 kW–100 kW) category has the largest share, of 65%. This is due to the widespread use of UPS and inverters in the medium power range to protect power quality in different sectors, such as healthcare, telecommunications, and manufacturing. The integration of renewable energy systems into the power grid also leads to a high demand for inverters within this power range. The growing number of data centers creates a need for reliable power backup systems as well.

The power ratings analyzed here are:

The industrial sector dominates the market with a share of 70% because industries use power converters for motor drives, automation systems, and manufacturing equipment. With industrial technology upgrades via automation and the integration of advanced machinery, manufacturers require efficient power conversion equipment for higher performance and energy efficiency.

The end uses analyzed here are:

Power backup & UPS is the leading categories with a share of 75%. Reliable backup power solutions are increasing in demand due to a surging number of power outages because of unstable weather condition and low electrical grid infrastructure. The U.S. experienced more than 210 major grid disturbances in 2023, up from 163 in 2020, according to the U.S. Energy Information Administration (EIA).

The applications analyzed here are:

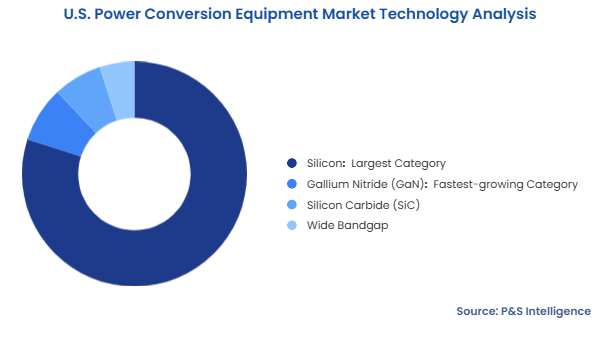

The silicon category leads the market with a share of 80% because it is affordable, reliable, and suitable for numerous industries, from consumer electronics to industrial machinery. The advancements in electric vehicles and increase in renewable energy production drive this category as well. Via the Inflation Reduction Act, the U.S. government has sanctioned over USD 369 billion for energy security and climate change initiatives between 2022 and 2032. This funding is being used to support renewable integration, grid modernization, and energy-efficient technologies.

The technologies analyzed here are:

Drive strategic growth with comprehensive market analysis

The West region dominates the industry with a share of 40% because companies are making major investments in energy infrastructure and adopting advanced power systems to support the increasing electricity needs. California, Arizona, and Nevada are heavily investing in advanced energy infrastructure, EV charging networks, and renewable projects, driving the adoption of power conversion systems. In May 2024, California invested USD 41 billion to build a 100% clean electric grid.

The regions analyzed here are:

The market is fragmented because it contains global competitors and emerging specialized businesses, which serve different product divisions. The major players are Schneider Electric, ABB, Eaton, General Electric, and Siemens due to their diverse products, good distribution channels, and extensive R&D capabilities. The market also includes multiple smaller businesses specializing in renewable integration, EV charging technology, and industrial automation systems. While the major power companies offer high-voltage equipment for heavy-duty utility and industrial applications, the smaller players often cater to residents and commercial businesses with low- and medium-voltage equipment.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages