Key Highlights

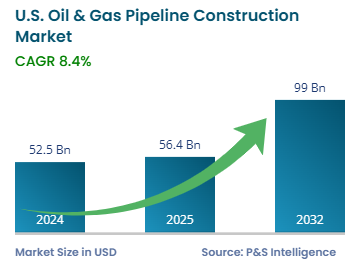

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 52.5 Billion |

| Market Size in 2025 | USD 56.4 Billion |

| Market Size by 2032 | USD 99 Billion |

| Projected CAGR | 8.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

Report Code: 13595

This Report Provides In-Depth Analysis of the U.S. Oil & Gas Pipeline Construction Market Report Prepared by P&S Intelligence, Segmented by Pipeline Type (Oil, Gas), Application (Oil, Gas), Technology (Oil, Gas), Material (Oil, Gas), Construction type (Oil, Gas), Distribution Channel (Direct Sales, EPC Contractors & Service Providers, Third-Party Distributors), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 52.5 Billion |

| Market Size in 2025 | USD 56.4 Billion |

| Market Size by 2032 | USD 99 Billion |

| Projected CAGR | 8.4% |

| Largest Region | South |

| Fastest Growing Region | West |

| Market Structure | Consolidated |

|

Explore the market potential with our data-driven report

The size of the U.S. oil & gas pipeline construction market in 2024 was USD 52.5 billion, and it will reach USD 99 billion by 2032 at a CAGR of 8.4% during 2025–2032.

The market is growing due to the increasing demand for oil and gas for electricity generation, space heating, transportation, cooking, and industrial purposes. This is leading to the construction of new pipelines and the overhauling of the existing ones. As per the Energy Information Administration, the country has more than 3 million miles of oil & gas pipelines, while five more completed in 2024.

The demand for oil and gas is increasing in the country due to its huge and rising population, which needs more electricity and vehicles. Similarly, the rampant industrialization creates the requirement for these commodities as a heating fuel for several machines and processes. The rising import and export are another factor that propels the need for pipeline construction overground, underground, and under the seabed.

Natural gas transmission pipelines are the leading sector, due to the country’s strong dependence on natural gas to run power plants, heat buildings, and drive industrial machines. The expanding LNG export industry and increasing interstate transmission network are due to the rising investments in major pipeline projects. The Permian Basin-to-Gulf Coast pipeline has received over USD 2.5 trillion in investment till now.

The pipeline types analyzed here are:

Midstream oil pipelines lead the market with a share of 50%, due to the rising need to transport crude oil from production areas to refining facilities and export ports. The U.S. Energy Information Administration (EIA) shows that daily production exceeds 12 million barrels of oil. The Permian Basin-to-Gulf Coast pipeline network and related infrastructure expansion projects serve as critical solutions to the rising oil requirement.

The applications analyzed here are:

Trenching & open-cut dominates the market with a share of 55% because it is the most-economical solution for rural areas. This standard approach is applied to pipelines in the midstream and downstream sections because it provides dependable construction methods for long-distance projects. The Pipeline & Hazardous Materials Safety Administration (PHMSA) allocated over USD 200 million in 2023–2024 to pipeline safety improvement, modernization, leak detection, and integrity upgrades. The reliability and lower CAPEX requirements for trenching methods make it preferred in crude oil and natural gas pipeline projects.

The technology analyzed here are:

Steel leads the market with a share of 75% because of its strength and endurance under high pressure, temperature, and moisture. Due to these factors, high-strength steel constitutes more than 90% of the petroleum pipelines in the country. New developments in corrosion protection coatings and alloys of steel have improved steel pipeline durability.

The materials analyzed here are:

Replacement and expansion projects dominate the market with a share of 60% due to the deterioration of pipelines, stringent regulations, and rising transportation needs. The PHMSA reports that more than 50% of the domestic pipeline infrastructure is over 50 years old; hence, replacement is essential to manage leaks and enhance safety. The Permian Basin and Appalachian shale formations need expansion projects to increase transportation capacity amidst the rising production.

The construction types analyzed here are:

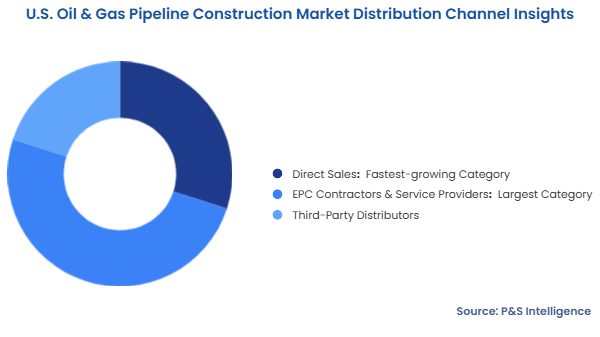

EPC dominates the market with a share of 50% because they take care of the entire project, including planning, designing, material procurement, construction, and maintenance. Specialized knowledge is necessary to handle large pipeline projects since they must overcome complex engineering specifications, environmental regulations, and state and federal requirements.

The distribution channels analyzed here are:

Drive strategic growth with comprehensive market analysis

South dominates the market with a share of 40% because this region leads the nation in oil & gas production, refining, and exports. Texas, Louisiana, and Oklahoma are the biggest oil & natural gas hubs in the country because they host extensive manufacturing infrastructure and fuel reserves. This is why they have a massive network of pipelines to connect oil wells to refining sites, storage terminals, and export and import centers. Pipeline construction is expanding across the Permian Basin due to the high quality of the oil reserves present here. Liquefied natural gas export facilities in the Gulf Coast create am additional demand for pipeline construction. Pipelines from the South also travel to Mexico, a key export hub for the U.S.

The regions analyzed here are:

The industry is moderately consolidated due to the presence of few leading EPC firms, pipeline operators, and material suppliers. The major players include Bechtel, Fluor, Kinder Morgan, and Enbridge, who have deep expertise in large-scale crude oil, natural gas transmission and LNG pipelines. Apart from this, they have high funding capabilities and the ability to meet complex multi-billion-dollar development requirements. The market also includes minor regional firms and specialized service enterprises that handle local distribution maintenance tasks and small pipeline extensions.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages