U.S. Mattress Market Analysis

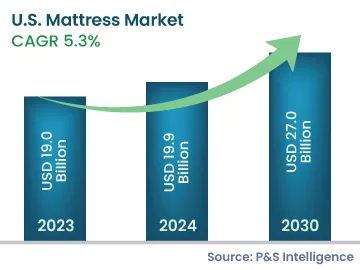

The U.S. mattress market size was USD 19.0 billion in 2023, which is expected to witness a CAGR of 5.3% during the forecast period 2024–2030, to reach USD 27.0 billion in 2030. The key factors responsible for the growth of the market include the advancing construction industry and booming hospitality and tourism sectors in the country.

The U.S. is one of the largest construction markets worldwide, majorly driven by the boom in residential construction. According to the U.S. Census Bureau, in January 2024, the U.S. construction spending amounted to USD 2,102 billion, which was 11.7% more than 2023's figure of USD 1,882.2 billion. The spending on private construction in November 2024 was 0.1% more in comparison to the previous year's figures. Similarly, in January 2024, residential construction spending was 0.9% greater than the previous year.

Other key drivers are the rise in the disposable income, availability of affordable mattresses through the bed-in-a-box concept, decrease in the replacement cycle from 9–12 years to 6–8 years. Further, the growing awareness pertaining to the importance of sleep among the populace is projected to drive the demand for mattresses in the coming years.

According to the National Centre for Biotechnology Information (NCBI), around 50–70 million Americans suffer from chronic, long-term sleep disorders, affecting day-to-day work and adversely impacting health. In order to overcome these, mattress manufacturers are focusing on product innovation, such as heating/cooling technology via gel foam, breathable mattress borders, and improvised memory foam for firm back support.

Traditionally, specialty stores and furniture stores were the popular distribution channels for these products; however, the introduction of the direct-to-customer (DTC) model has resulted in an increase in sales through the online channel. The DTC model offers quality mattresses at an affordable price to customers. Presently, over 200 DTC mattress providers are present in the country, among which Casper, Tuft & Needle, Leesa, Saatva, and Purple are some of the popular ones. Therefore, the growing importance of sleep and increasing sales through the online channel are projected to accelerate the U.S. mattress market growth during the forecast period.