Mattress Market Analysis

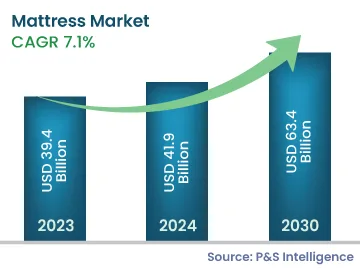

The mattress market generated revenue of USD 39.4 billion in 2023, which is expected to witness a CAGR of 7.1% during 2024–2030, to reach USD 63.4 billion by 2030. This is attributed to the growth of the tourism industry, which is resulting in the escalating number of hotels and, in turn, increasing the sales of these essential products.

Moreover, the rising health concerns and increasing disposable income have fueled the mattress demand, as consumers are spending more on health-improving products. Their willingness to pay for sleeping aids has risen substantially throughout the world; not just in large cities, but also in smaller towns and cities. The majority of the consumers perform extensive research, compare prices, and make informed decisions when buying bedding.

Furthermore, the growing number of luxury hotels in emerging economies around the world is predicted to contribute significantly to the revenue growth, because such hotels use luxury bedding. These products are more expensive compared to standard bedding products, which is expected to have a favorable influence on the market.

Additionally, consumers’ buying habits are changing owing to an increase in their awareness of environmental issues, such as pollution due to the emission of volatile organic compounds (VOCs) from polyurethane-foam mattresses. As a result, they are now choosing natural and eco-friendly mattresses made of organic cotton, natural latex, organic wool, hemp, animal hair, and coconut fiber, which have a weaker chemical and ecological impact than those made from conventional materials.

Such materials used to make eco-friendly mattresses are, additionally, renewable and biodegradable. Such products do not have flame retardants, off-gassing, adhesives, and other chemicals that are used in the manufacturing of conventional mattresses and impact the environment negatively.

The eco-friendly mattresses available in the market include natural memory foam, natural latex, and natural innerspring variants. Some of the brands offering eco-friendly bedding options are Astrabeds LLC and Amerisleep.