Key Highlights

| Study Period | 2019 - 2032 |

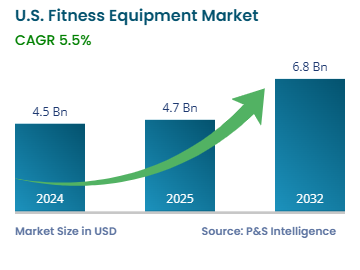

| Market Size in 2024 | USD 4.5 Billion |

| Market Size in 2025 | USD 4.7 Billion |

| Market Size by 2032 | USD 6.8 Billion |

| Projected CAGR | 5.5% |

| Largest Region | West |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

Report Code: 13579

This Report Provides In-Depth Analysis of the U.S. Fitness Equipment Market Report Prepared by P&S Intelligence, Segmented by Type (Cardiovascular Equipment, Strength Training Equipment, Body Composition Analyzers, Fitness Monitoring Equipment), Distribution Channel (Online Retail, Offline Retail, Third-Party Retail), End User (Home Consumer, Commercial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 4.5 Billion |

| Market Size in 2025 | USD 4.7 Billion |

| Market Size by 2032 | USD 6.8 Billion |

| Projected CAGR | 5.5% |

| Largest Region | West |

| Fastest Growing Region | West |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. fitness equipment market was valued at USD 4.5 billion in 2024, and this number is expected to increase to USD 6.8 billion by 2032, advancing at a CAGR of 5.5% during 2025–2032. This is due to because people focusing on more health and wellness and having growing incomes and improved technology. The U.S. fitness equipment market contains a diverse set of products between cardiovascular equipment (treadmills, ellipticals, stationary bikes) and strength training equipment (weight machines, free weights) and fitness accessories. Recent lifestyle changes together with the growth of home-based workouts produced substantial growth in the demand for fitness equipment used in residential settings.

The industry is undergoing transformation due to digital technology integrating with the equipment, which brings interactive display and virtual training applications. The market demonstrates an increased requirement for multifunctional fitness equipment that minimizes space requirements above all other things, especially within city environments. Market expansion happens because consumers increasingly want personalized fitness services combined with the rising availability of fitness content online. Growth prospects for the U.S. fitness equipment market remain strong because consumers choose different kinds of equipment and technological advances and people increasingly value physical fitness.

The cardiovascular equipment category dominates the fitness equipment market with a revenue share of 65% in 2024, because of the two leading subcategories which are namely treadmills and stationary bikes. People require these machines as essential tools for performing aerobic exercise thus they dominate home workout spaces and commercial fitness facilities. Treadmills continue to be highly popular since they work for every fitness level while delivering effective workouts that burn calories. Portable cycling machines have become more successful during the COVID-19 era when people needed simple cardiovascular exercise equipment to use at home.

The types covered in the report are:

The online retail category accounted for the largest and fastest-growing category with a revenue share, of around 60%, in 2024, and this category is further expected to maintain its position during the forecast period. This is because of the e-commerce boom brought by improved convenience, affordable prices, and increased product selection made online retail the key distribution method for fitness equipment. Customers pick fitness products from online stores more often due to the combination of home delivery services with user reviews and member-only deals.

The COVID-19 plays a very crucial role in the expansion of this category due to the closures led people to invest in the home fitness equipment. Even after post-pandemic the people continue purchasing from online shopping as it provides brands leveraging direct-to-consumer (DTC) models, subscription-based fitness programs, and AI-powered recommendations to enhance customer experience.

Here are the distribution channels studied in the report:

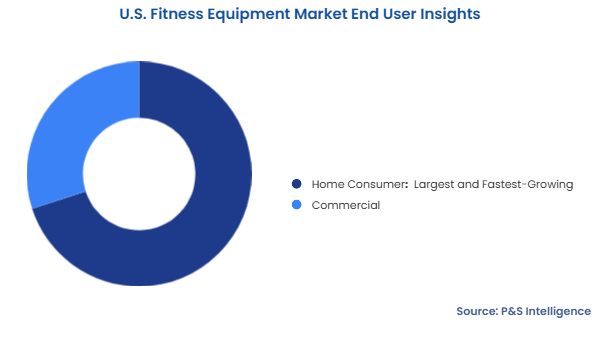

The home consumer category leads the fitness equipment market with a revenue share of 70% in 2024. This is due to the rising public health consciousness combined with rising trends toward easy shopping has driven people to buy fitness equipment for their homes. Customers purchase premium-quality treadmill equipment, stationary bikes, and strength training machines as well as intelligent fitness devices to establish personal workout setups within their homes.

The pandemic lockdowns which closed gyms accelerated the trend toward home fitness because people needed to exercise at home. People continue to purchase fitness equipment after the pandemic due to their interest in combining digital training with physical exercises and smart devices that connect to fitness applications and virtual coaching services.

The following are the end users studied in the report:

Drive strategic growth with comprehensive market analysis

The West region has the largest revenue share, of around 40%, in 2024, and it is expected to maintain its place in the market during the forecast period. This is due to the highly health-conscious residents along with their active lifestyle have resulted in this region placing strong importance on wellness and fitness. Advanced fitness equipment remains in high demand among residents of the major cities comprising Los Angeles, San Francisco, and Seattle. The market's expansion in this region receives additional support from the many fitness centers, gyms, and health clubs operating within it.

These regions are covered:

The U.S. fitness equipment market is fragmented with a mix of well-established global brands and emerging players competing in the market. The market shows significant fragmentation due to the major key players like Nautilus Inc., Johnson Health Tech Co., Peloton Interactive Inc., iFIT Health & Fitness Inc., and Life Fitness, and other firms comprising multiple market players. An evolving and competitive business environment consists of veteran and rising brands that create advanced fitness products to meet multiple consumer requirements.

The market has experiencing segmentation because consumers are buying residential along with commercial gym equipment because people are starting to prioritize their fitness awareness and new technology enables connected fitness systems in the market. Small businesses as well as specialty players in the fitness equipment market are experiencing growth by developing ecological and connected fitness solutions. The competitive atmosphere within this environment stimulates both innovative approaches and drives a number of choices available to consumers.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages