Key Highlights

| Study Period | 2019 - 2032 |

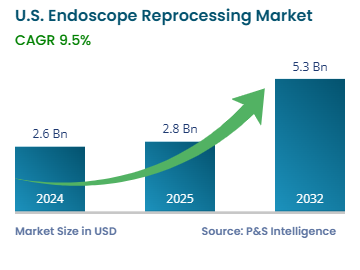

| Market Size in 2024 | USD 2.6 Billion |

| Market Size in 2025 | USD 2.8 Billion |

| Market Size by 2032 | USD 5.3 Billion |

| Projected CAGR | 9.5% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Report Code: 13516

This Report Provides In-Depth Analysis of the U.S. Endoscope Reprocessing Market Report Prepared by P&S Intelligence, Segmented by Product (High-Level Disinfectants & Test Strips, Detergents & Wipes, Automated Endoscope Reprocessors, Endoscope Drying, Storage, & Transport Systems, Endoscope Tracking Solutions), Neuroendoscopes (Flexible, Rigid), End User (Hospitals, Ambulatory Surgical Centers and Clinics), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| Market Size in 2024 | USD 2.6 Billion |

| Market Size in 2025 | USD 2.8 Billion |

| Market Size by 2032 | USD 5.3 Billion |

| Projected CAGR | 9.5% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. endoscope reprocessing market size was USD 2.6 billion in 2024, and it will grow by 9.5% during 2025–2032, reaching USD 5.3 billion by 2032.

The market is driven by the rising of endoscopic procedures due to an aging population and increasing chronic disease incidence. According to the American Cancer Society's 2023–2025 report, approximately 153,020 individuals were diagnosed with colorectal cancer in the country in 2023. Of these, about 19,550 cases occurred in individuals under the age of 50. The increasing volume of diagnostic and therapeutic endoscopic procedures increases the necessity of safe instrument reprocessing systems.

Healthcare facilities are under regulatory pressure for the institutions to meet the standards established by the FDA and CDC. Medical instruments, especially endoscopes, must undergo efficient reprocessing according to established healthcare regulations to keep up safety levels and stop infections from appearing in healthcare settings.

In August 2024, PENTAX Medical, a division of HOYA Group, achieved the FDA clearance for the DEC Duodenoscope (ED34-i10T2s) to work with the STERRAD 100NX Sterilizer from Advanced Sterilization Products (ASP), a division of Fortive.

The automated endoscope reprocessors category held the larger market share, of 30%, in 2024. This is because AERs are essential for the cleaning and reprocessing process, which is a standard procedure in healthcare facilities. Using automated endoscope reprocessors helps improve patient safety and make the workflow more efficient.

The endoscope tracking solutions category will grow at the highest CAGR, of 9.8%, during the forecast period. This is because of the wide use of tracking solutions to monitor endoscopes from the cleaning process through disinfection until storage and procedural use. The implementation of endoscope tracking systems enables hospitals and clinics to create precise inventory records, track equipment maintenance requirements, and reduce the possibility of equipment mishandling and cross-contamination.

The products analyzed in this report are:

The flexible category held the larger market share, of 70%, in 2024. This is because flexible endoscopes are used for diagnosing and treating various conditions, including gastrointestinal issues, bronchial problems, and ear, nose, and throat conditions.

The rigid category will grow at the higher CAGR, of 9.7%, during the forecast period. This is because of the increasing demand for minimally invasive surgical instruments in orthopedics, urology, and gynecology. These instruments enable the exact identification of targets, for doctors to monitor and treat patients with minimally invasive surgical procedures. The improvement in rigid endoscopes with advanced imaging systems and better maneuverability is driving their use in specialized surgeries.

The types analyzed in this report are:

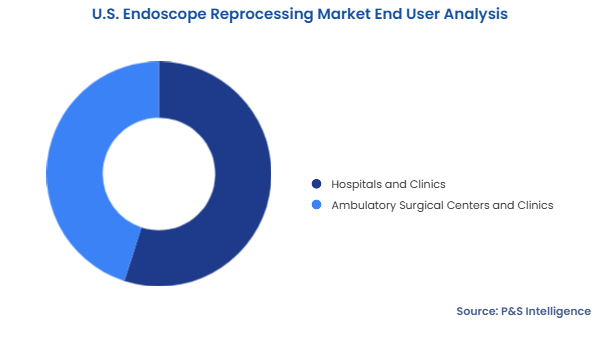

The hospitals and clinics category held the larger market share, of 55%, in 2024. This is because hospitals serve as the leading facilities for performing complicated medical procedures, including diagnostic and therapeutic endoscopies. Healthcare facilities perform many endoscopic procedures, such as colonoscopies, gastrointestinal exams, and bronchoscopies, which creates the need for efficient endoscope reprocessing. Furthermore, advanced reprocessing systems are widely deployed in hospitals as they tend to large numbers of patients.

The ambulatory surgical centers and clinics category will grow at the higher CAGR, of 10%, during the forecast period. The rising demand for outpatient care and minimally invasive treatments drives outpatient clinics and ASCs to enhance the performance of endoscopes. They are focusing on providing low-cost, high-quality procedures that do not require patients to be admitted to the hospital. Moreover, they invest in cost-effective automated reprocessing systems to improve operational efficiency and increase their ability to handle more patients.

The end users analyzed in this report are:

Drive strategic growth with comprehensive market analysis

The Western region of the U.S. held the largest market share, of 35%, in 2024. This is because Western U.S. is home to several major metropolitan areas and healthcare facilities, with California, Washington, and Arizona standing out as key medical centers. The large number of hospitals, outpatient clinics, and specialized surgical centers (ASCs) here offer a variety of endoscopic procedures. This wide network of healthcare providers increases the overall need for endoscope reprocessing systems to maintain cleanliness, safety, and infection control.

The Southern region of the U.S. will grow at the highest CAGR, of 10.2%, during the forecast period. This is because the Southern region has experienced robust population growth, particularly in Texas, Florida, and Georgia. This population increase includes a growing aging population, leading to a rise in healthcare needs, including diagnostic and therapeutic endoscopic procedures. Moreover, the region is quickly adopting newer medical technologies, including advanced automated reprocessing systems, to improve operational efficiency, reduce human error, and enhance patient safety.

The regions analyzed in this report are:

The market is fragmented in nature because it includes various products that perform different tasks in the reprocessing process. Hospitals and medical facilities use different technologies, such as automated endoscope reprocessors and manual cleaning solutions, which creates many options and competition in the market. Moreover, many companies, both big and small, offer different solutions, from traditional manual systems to advanced automated ones. This competition, and the variety of products available, leads to fragmentation, as no single solution is dominant in the market.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages