U.S. Electric Truck Market Analysis

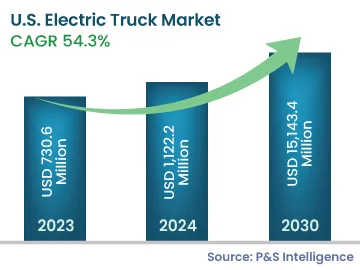

The U.S. electric truck market generated revenue of USD 730.6 million in 2023, which is expected to witness a CAGR of 54.3% during 2024–2030, to reach USD 15,143.4 million by 2030. This is primarily due to the increasing number of government measures to promote e-mobility and strict emission standards placed on fossil-fuel-powered commercial vehicles.

The initiatives taken by the government for the promotion of e-mobility, such as emission regulations and financial incentives on the purchase of electric vehicles, are essentially expected to drive the growth of the industry. Furthermore, the rise in the demand for electric trucks from the logistics industry, as well as the development of the self-driving technology, is expected to present significant growth opportunities for electric truck manufacturers.

As more governments in the country follow the trend and set clear targets to phase out fossil fuels, the uncertainty in the market will reduce, and the adoption of more trucks in businesses will support the transition.

For instance, New York City relaunched its Clean Trucks Program in June 2020, which provides funding to incentivize the transition from diesel to electric models. The goal is to reach 4,000 EVs by 2025 from 2,100 EVs in 2020. This program will be instrumental in helping the city achieve its goal of carbon neutrality by 2050.

Furthermore, as the cost of fuel continues to rise, the EV sector is expected to boom in the future. The EPA and NHTSA have implemented the Safer Affordable Fuel-Efficient (SAFE) Vehicles rule from 2021 to 2026 in the U.S. The proposal has set corporate average fuel economy and greenhouse gas emission standards for passenger and light vehicles. However, over the projection period, the electric truck market growth is likely to be hampered by the high cost and lack of charging infrastructure.