Report Code: 12260 | Available Format: PDF | Pages: 106

U.S. CAD Software Market Research Report: By Technology (2D Software, 3D Software), Model (Solid, Surface, Wireframe), Deployment (On-Premises, Cloud), Level (Pro, Intermediate, Beginner), Application (Aerospace & Defense, Automotive, Manufacturing, Healthcare, Media & Entertainment, Arts) - Industry Analysis and Growth Forecast to 2030

- Report Code: 12260

- Available Format: PDF

- Pages: 106

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

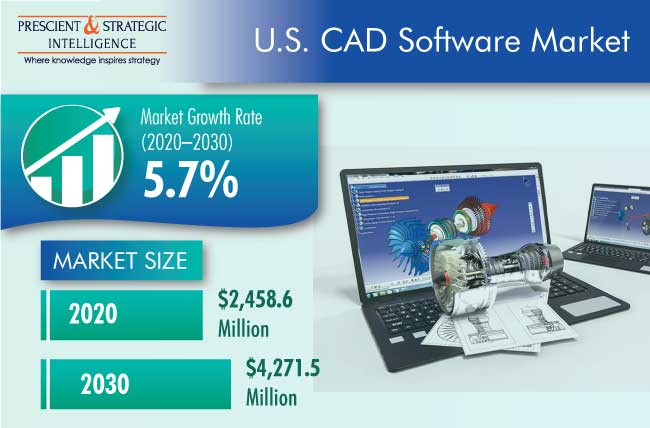

The U.S. CAD software market generated $2,458.6 million revenue in 2020, and it is expected to grow at a CAGR of 5.7% during 2020–2030. The key factors responsible for the growth of the market is the increasing use of the CAD software in the packaging industry, and the growing adoption of CAD software in automotive industry.

The market for CAD software in the U.S. is experiencing a significant growth in the sales, due to the recovery seen in the industries of automobiles and aerospace & defense. In 2021, vehicle production facilities have started to function properly, and the purchase of automobiles has also increased from last year, which is resulting in the growth of the automobile sector.

Furthermore, during the pandemic, most of the industries were working in the online by using different software and internet connections, in order to cope up with the losses, and to continue the minimal work for the industry to run. In addition, CAD software solutions have helped the many engineers, architects, and designers to work efficiently, which in turn showcases that the market haven’t faced a major impact.

3D Software Held Larger Share due to Its Higher Accuracy and More-Advanced Designs

The 3D software held the larger share in 2020 in the U.S. market for CAD software, based on technology. The market domination of this category was primarily due to the fact that 3D software helps to achieve higher accuracy in designs that are to be transformed into physical products or prototypes.

Cloud To Witness Faster Growth as It Offers Better Scalability and Anytime, Anywhere Access

The cloud category is expected to witness the faster growth in the U.S. CAD software market during the forecast period (2021–2030), based on deployment. This is primarily due to the fact that cloud delivers improved agility, being an on-demand self-service, better scalability, and access from any internet-connected device, anytime.

Solid-Model CAD Software Held the Largest Share due to Its Rising Usage in Professional Product Prototyping

The 3D software held the larger share in 2020 in the market for CAD software in the U.S., based on technology. The market domination of this category was primarily due to the rise in the focus on precise designing and professional product prototyping. In addition, solid-modeling CAD software enables the designer to see the designed object as it would look like when manufactured.

Pro Category to Witness Fastest Growth as It Delivers Higher-Quality Designs, and Its Design Documentation Ability

The pro category is expected to witness the fastest growth in the U.S. CAD software market during the forecast period. This can majorly be ascribed to the shift in the user preference toward pro-level CAD software offering advanced features, including higher-quality designs, simplified sharing, and design documentation ability.

Aerospace & Defense Category Dominated the Market, As the CAD Software Provides Higher Accuracy During Aerospace & Defense Production

The aerospace & defense category held the largest share in the U.S. market for CAD software, in 2020, and further, it is expected to retain its dominance during the forecast period as well. This can majorly be ascribed to the high focus on the development of state-of-the-art space shuttle, missile, and aircraft designs. Since aerospace & defense production demands high accuracy, especially in the development of critical components, such as wings and interbody sheets, CAD software has become an integral part of product designing in this industry.

Transition from 2D CAD to 3D CAD Is Major Trend in U.S.

The growing demand for speed and accuracy in product designing and development, without compromising the quality, is the key factor driving the consumer preference for 3D CAD software in the country. This in turn, is resulting the rising sales of the U.S. CAD software market. Industries such as automotive and aerospace & defense are becoming aware of the advantages of 3D CAD solutions and, therefore, increasingly focusing on it to digitally prototype their products before mass manufacturing.

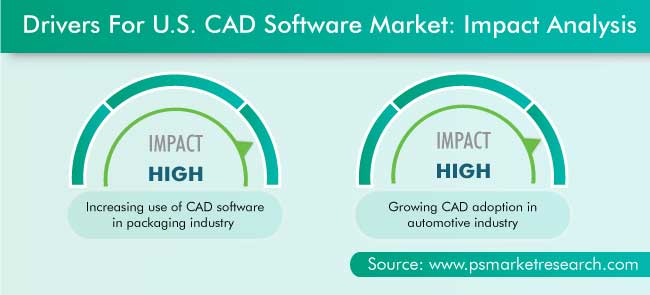

Increasing Use of CAD Software in Packaging Industry Propelling the Market Growth

Packaging machinery, which is widely used in several industries, carries out product filling, wrapping, strapping, and labeling, which in turn is resulting in the growing sales of the market for CAD software in the U.S. With packaging machines becoming increasingly complex, engineers and designers are adopting CAD software to meet mechatronic engineering challenges. CAD software enables unconventional modeling of these machines through simulation and communication control tools. These tools help in the selection of actuators and optimization of motors, to reduce the cost and energy consumption of machines.

Growing CAD Adoption in Automotive Industry Is Another Key Driver for Market

The automotive industry has witnessed a considerable increase in the demand for quality components and products in recent years, which leads to the significant growth in the U.S. CAD software market. While users are increasingly focusing on quality over brand value, manufacturers are striving to reduce the burden of product recalls. Moreover, with millions of connected cars expected to ply on the roads in the coming years, engineers are considering advanced solutions and tools supported by CAD software for the designing and development of vehicles.

| Report Attribute | Details |

Historical Years |

2015-2020 |

Forecast Years |

2021-2030 |

Base Year (2020) Market Size |

$2,458.6 Million |

Market Size Forecast in 2030 |

$4,271.5 Million |

Forecast Period CAGR |

5.7% |

Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Company Profiling |

Market Size by Segments |

By Technology; By Model; By Deployment; By Level; By Application |

Secondary Sources and References (Partial List) |

Aerospace Industries Association (AIA), Alliance for American Manufacturing, Alliance of Automobile Manufacturers, Architectural & Civil Drafters Association, Associated Builders and Contractors (ABC), Association of Architecture Organizations (AAO), European Cloud Alliance, Information Technology Association (ITA), IT Dashboard, Japan Automobile Manufacturers Association (JAMA), National Association of Manufacturers (NAM), National Association of Software and Service Companies (NASSCOM) Association of Architecture Organizations (AAO), European Cloud Alliance, Information Technology Association (ITA), IT Dashboard, Japan Automobile Manufacturers Association (JAMA), National Association of Manufacturers (NAM), National, Association of Software and Service Companies (NASSCOM) |

Explore more about this report - Request free sample

Market Players Involved in Mergers and Acquisitions to Gain Significant Position

The U.S. CAD software industry is fragmented in nature due to the presence of several key players. Some of the major players in the industry are Dassault Systèmes SE, Autodesk Inc., Bentley Systems Inc., Trimble Inc., PTC Inc., 3D Systems Corporation, AVEVA Group plc, Hexagon AB, IronCAD LLC, CNC Software Inc., and Siemens AG.

In recent years, players in the U.S. CAD software market have been involved in mergers and acquisitions in order to attain a significant position. For instance:

- In September 2021, 3D Systems Corporation signed an agreement to acquire Oqton Inc., a software company that provides cloud-based manufacturing operating system (MOS) platforms. This platform is tailored for flexible production environments that are increasingly utilizing a range of advanced manufacturing and automation technologies, including additive manufacturing. The cloud-based solution leverages the industrial internet of things (IIOT), artificial intelligence (AI), and machine learning technologies to deliver a new and more-efficient way for customers to automate their digital manufacturing workflows and scale their operations in the fields of healthcare (including dentistry), biotech, aerospace, and automotive.

- In June 2021, Autodesk Inc. submitted a non-binding proposal to acquire all the outstanding shares of the common stock of Altium Limited, which to is be implemented by way of a scheme of arrangement. The proposed combination would advance Autodesk's strategy to converge design and the make through a unified designing, engineering, and manufacturing cloud platform that enables greater productivity and sustainability for its customers. Autodesk believes Altium's solutions would be complementary to its portfolio, creating opportunities for customers, while delivering significant, certain, and immediate value to Altium's shareholders.

Key Players in U.S. CAD Software Market Include:

- Dassault Systèmes SE

- Autodesk Inc.

- Bentley Systems Inc.

- Trimble Inc.

- PTC Inc.

- 3D Systems Corporation

- AVEVA Group plc

- Hexagon AB

- IronCAD LLC

- CNC Software Inc.

- Siemens AG

Market Size Breakdown by Segments

The U.S. CAD software market report offers comprehensive market segmentation analysis along with market estimation for the period 2015-2030.

Based on Technology

- Two-Dimensional (2D) Software

- Three-Dimensional (3D) Software

Based on Model

- Solid

- Surface

- Wireframe

Based on Deployment

- On-Premises

- Cloud

Based on Level

- Pro

- Intermediate

- Beginner

Based on Application

- Aerospace & Defense

- Automotive

- Manufacturing

- Healthcare

- Media & Entertainment

- Arts

The 2030 value of the CAD software market in the U.S. will be $4,271.5 million.

End users in the U.S. CAD software industry are shifting to 3D CAD as it helps create more-accurate designs for prototyping and mass production.

The CAD software market in the U.S. will witness the higher CAGR in the cloud bifurcation, on the basis of deployment.

The U.S. CAD software industry is advancing primarily on account of the growing demand for this software in the automotive and packaging sectors.

Players in the CAD software market of the U.S. are engaging in mergers, acquisitions.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws